Telus 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 . TELUS 2011 ANNUAL REPORT

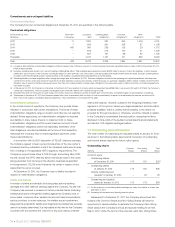

Commitments and contingent liabilities

Contractual obligations

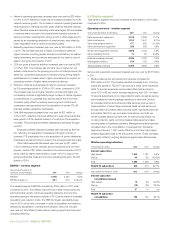

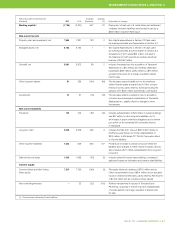

The Company’s known contractual obligations at December 31, 2011, are quantified in the following table.

Contractual obligations

At December 31, 2011 Short-term Long-term Operating lease Purchase Other

($ millions) borrowings debt(1) obligations(2) obligations(3)(4) obligations(5) To t a l (6)

2012 11 1,387 287 940 1,476 4,101

2013 7 605 261 228 57 1,158

2014 405 980 235 129 23 1,772

2015 – 873 215 100 21 1,209

2016 – 807 197 96 32 1,132

Thereafter – 4,070 1,131 471 328 6,000

Total 423 8,722 2,326 1,964 1,937 15,372

(1)

Long-term debt maturities include interest obligations. Interest payment cash outflows in respect of commercial paper have been calculated based on rates in effect at December 31, 2011.

Finance leases are $nil.

(2)

Excludes operating lease receipts from sub-let buildings totalling $166 million. Total operating lease payments include $2,294 million in respect of land and buildings, of which approxi-

mately 56% was in respect of the Company’s five largest leases for office premises over various terms, with expiry dates that range between 2016 and 2026. Excludes operating leases

in respect of the TELUS Garden project. See Note 22(a) of the Audited consolidated financial statements for further details.

(3) Where applicable, purchase obligations reflect foreign exchange rates at December 31, 2011. Purchase obligations include future operating and capital expenditures that have been

contracted for at the current year-end and include the most likely estimates of prices and volumes, where necessary. As purchase obligations reflect market conditions at the time the

obligation was incurred for the items being purchased, they may not be representative of future years. Obligations from personnel supply contracts and other such labour agreements

have been excluded.

(4)

At December 31, 2011, the Company’s contractual commitments for the acquisition of property, plant and equipment were $188 million over a period through to 2013 and the Company’s

contractual commitments for the acquisition of intangible assets were $142 million over a period through to 2018.

(5) Excludes items that do not result in a future outlay of economic resources: deferred customer activation and connection fees, and deferred gain on sale-leaseback of buildings.

(6) Subsequent to December 31, 2011, the Company entered into a loan commitment (that is subject to final documentation) in respect of a real estate joint venture, as discussed in

Note 17(b) of the Audited consolidated financial statements. That commitment is not included in this table.

Indemnification obligations

In the normal course of operations, the Company may provide indem-

nification in conjunction with certain transactions. The terms of these

indemnification obligations range in duration and often are not explicitly

defined. Where appropriate, an indemnification obligation is recorded

as a liability. In many cases, there is no maximum limit on these

indemnification obligations and the overall maximum amount of such

indemnification obligations cannot be reasonably estimated. Other

than obligations recorded as liabilities at the time of the transaction,

historically the Company has not made significant payments under

these indemnifications.

In connection with its 2001 disposition of TELUS’ directory business,

the Company agreed to bear a proportionate share of the new owner’s

increased directory publication costs if the increased costs were to arise

from a change in the applicable CRTC regulatory requirements. The

Company’s proportionate share is 15% through, and ending, May 2016.

As well, should the CRTC take any action that would result in the owner

being prevented from carrying on the directory business as specified

in the agreement, TELUS would indemnify the owner in respect of any

losses that the owner incurred.

At December 31, 2011, the Company has no liability recorded in

respect of indemnification obligations.

Claims and lawsuits

A number of claims and lawsuits (including class actions) seeking

damages and other relief are pending against the Company. As well, the

Company has received or is aware of certain potential claims (including

intellectual property infringement claims) against the Company and, in

some cases, numerous other wireless carriers and telecommunications

service providers. In some instances, the matters are at a preliminary

stage and the potential for liability and magnitude of potential loss currently

cannot be readily determined. It is impossible at this time for the Company

to predict with any certainty the outcome of any such claims, potential

claims and lawsuits. However, subject to the foregoing limitations, man-

agement is of the opinion, based upon legal assessment and information

presently available, that it is unlikely that any liability, to the extent not

provided for through insurance or otherwise, would be material in relation

to the Company’s consolidated financial position, excepting the items

disclosed in Note 22(d) of the Audited consolidated financial statements

and Section 10.9 Litigation and legal matters.

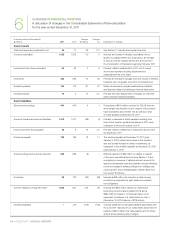

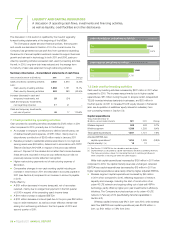

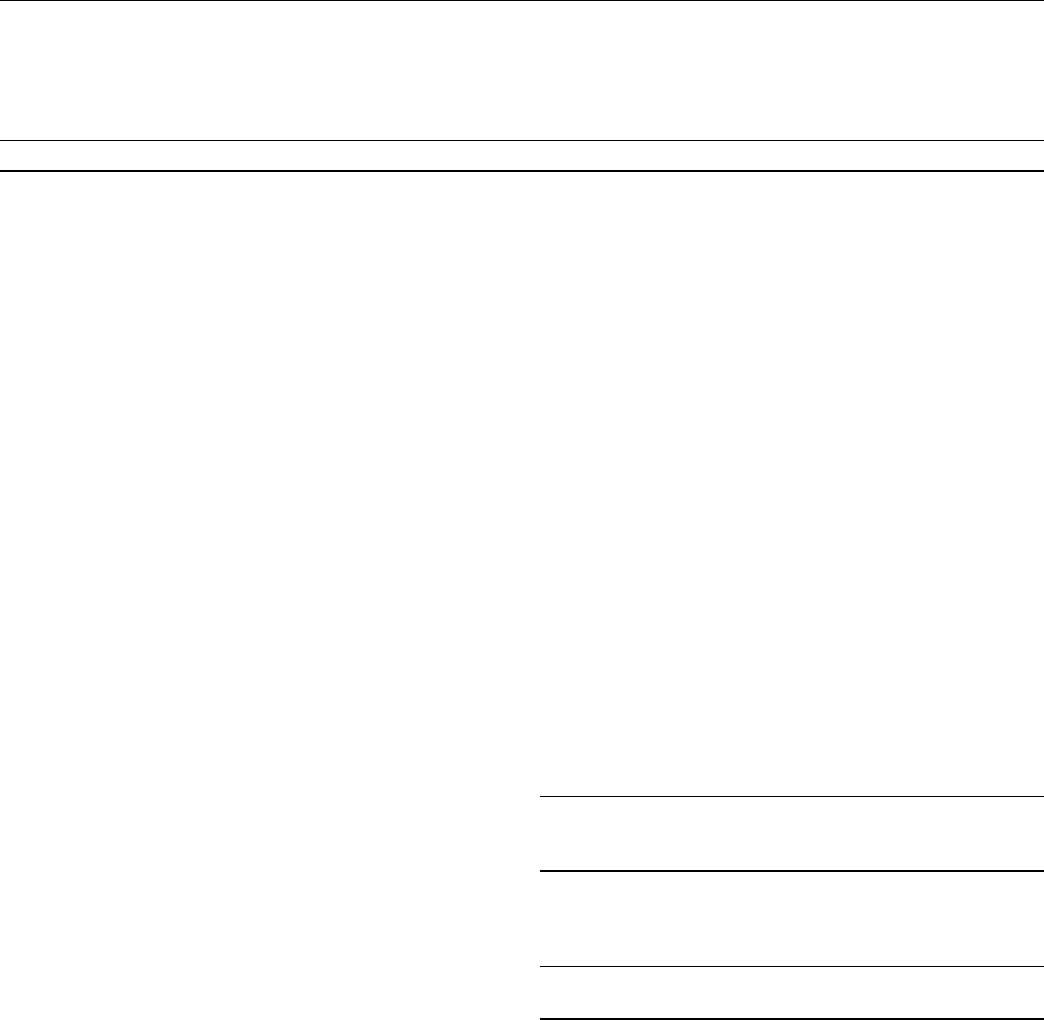

7.9 Outstanding share information

The total number of outstanding and issuable shares at January 31, 2012,

as shown in the following table, assumes full conversion of outstanding

options and shares reserved for future option grants.

Outstanding shares

Common Non-Voting Total

(millions) Shares Shares shares

Common equity

Outstanding shares

at December 31, 2011 175 150 325(1)

Outstanding shares

at January 31, 2012 175 150 325

Options outstanding and

issuable(2) at January 31, 2012 – 28 28

Outstanding and issuable

shares at January 31, 2012 175 178 353

(1) For the purposes of calculating diluted earnings per share, the number of shares was

326 million in 2011.

(2) Assuming full conversion and ignoring exercise prices.

Subsequent to December 31, 2011, the Company announced that

holders of its Common Shares and Non-Voting Shares will have the

opportunity to decide whether to eliminate the Company’s Non-Voting

Share class at the Company’s annual and special meeting to be held

May 9, 2012. Under the terms of the proposal, each Non-Voting Share