Telus 2011 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 147

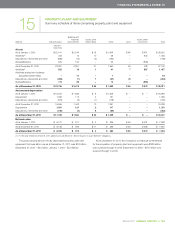

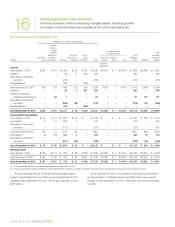

FINANCIAL STATEMENTS & NOTES: 16

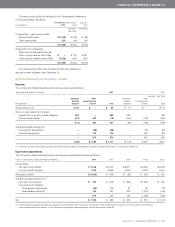

(b) Intangible assets subject to amortization

Estimated aggregate amortization expense for intangible assets subject

to amortization, calculated for such assets held as at December 31, 2011,

for each of the next five fiscal years is as follows:

Years ending December 31 (millions)

2012 $ß406

2013 248

2014 104

2015 44

2016 32

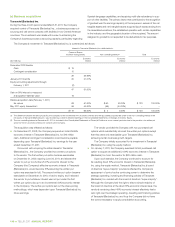

(c) Intangible assets with indefinite lives –

spectrum licences

The Company’s intangible assets with indefinite lives include spectrum

licences granted by Industry Canada. Industry Canada’s spectrum

licence policy terms indicate that the spectrum licences will likely be

renewed. The Company’s spectrum licences are expected to be renewed

every 20 years (December 31, 2010 – every 5 years or every 10 years;

January 1, 2010 – every 5 years or every 10 years) following a review

by

Industry Canada of the Company’s compliance with licence terms.

In addition to current usage, the Company’s licensed spectrum can be

used for planned and new technologies. As a result of the combination

of these significant factors, the Company’s spectrum licences are

currently considered to have indefinite lives.

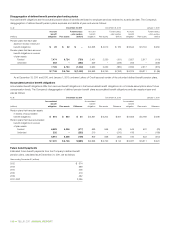

(d) Impairment testing of intangible assets with indefinite lives and goodwill

As referred to in Note 1(j), the carrying values of intangible assets with indefinite lives and goodwill are periodically tested for impairment and this test

represents a significant estimate for the Company.

The carrying amounts of intangible assets with indefinite lives and goodwill allocated to each cash-generating unit are as set out in the following table.

Intangible assets with indefinite lives Goodwill Total

Dec. 31, Dec. 31, Jan. 1, Dec. 31, Dec. 31, Jan. 1, Dec. 31, Dec. 31, Jan. 1,

As at (millions) 2 0 11 2010 2010 2 0 11 2010 2010 2 0 11 2010 2010

(adjusted – (Note 25(d))

Note 25(d))

Wireless $ß4,874 $ß4,874 $ß4,874 $ß2,644 $ß2,606 $ß2,606 $ß7,518 $ß7,480 $ß7,480

Wireline – – – 1,017 966 966 1,017 966 966

$ß4,874 $ß4,874 $ß4,874 $ß3,661 $ß3,572 $ß3,572 $ß8,535 $ß8,446 $ß8,446

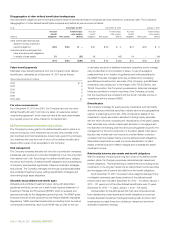

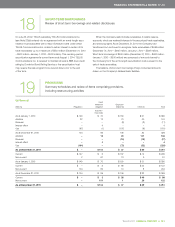

The recoverable amounts of the cash-generating units’ assets have

been determined based on a value in use calculation. There is a material

degree of uncertainty with respect to the estimates of the recoverable

amounts of the cash-generating units’ assets given the necessity of

making key economic assumptions about the future. The value in use

calculation uses discounted cash flow projections which employ the

following key assumptions: future cash flows and growth projections,

including economic risk assumptions and estimates of achieving key

operating metrics and drivers; the future weighted average cost of capital;

and earnings multiples. The Company considers a range of reasonably

possible amounts to use for key assumptions and decides upon amounts

that represent management’s best estimates. In the normal course,

changes are made to key assumptions to reflect current (at time of test)

economic conditions, updating of historical information used to develop

the key assumptions and changes in the Company’s debt ratings.

The cash flow projection key assumptions are based upon the

Company’s approved financial forecasts which span a period of three

years and are discounted, for December 2011 annual test purposes,

at a consolidated pre-tax notional rate of 9.39% (December 2010 – 9.49%;

January 1, 2010 – 8.89%). For impairment testing valuation purposes,

the cash flows subsequent to the three-year projection period are

extrapolated, for December 2011 annual test purposes, using perpetual

growth rates of 1.75% (December 2010 – 1.75%; January 1, 2010 – 1.75%)

for the wireless cash-generating unit and zero (December 2010 – zero;

January 1, 2010 – zero) for the wireline cash-generating unit; these

growth rates do not exceed the observed long-term average growth

rates for the markets in which the Company operates.

The Company validates its value in use results through the use

of the market-comparable approach and analytical review of industry

and Company-specific facts. The market-comparable approach uses

current (at the time of test) market consensus estimates and equity

trading prices for U.S. and Canadian firms in the same industry. In

addition, the Company ensures that the combination of the valuations

of the cash-generating units is reasonable based on current market

values of the Company.

The Company believes that any reasonably possible change in the

key assumptions on which its cash-generating units recoverable amounts

are based would not cause the cash-generating units’ carrying amounts

(including the intangible assets with indefinite lives and the goodwill

allocated to the cash-generating unit) to exceed their recoverable

amounts. If the future were to adversely differ from management’s best

estimate of key assumptions and associated cash flows were to be

materially adversely affected, the Company could potentially experience

future material impairment charges in respect of its intangible assets

with indefinite lives and goodwill.

Sensitivity testing was conducted as a part of the December 2011

annual test. A component of the sensitivity testing was a break-even

analysis. Stress testing included moderate declines in annual cash

flows with all other assumptions being held constant; this too resulted

in the Company continuing to be able to recover the carrying value

of its intan gible assets with indefinite lives and goodwill for the fore-

seeable future.