Telus 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

164 . TELUS 2011 ANNUAL REPORT

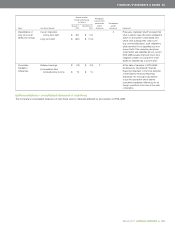

The effects of the transition to IFRS-IASB on the line items in the preceding table can be classified into two categories: those that have recognition,

measurement, presentation and/or disclosure effects for the Company, or those that have only presentation and/or disclosure effects for the Company.

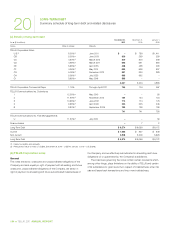

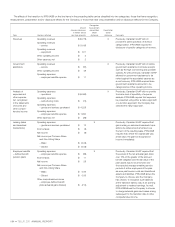

Topic

Recognition,

Amount measurement,

(increase (decrease), presentation Presentation

in millions except and/or and/or

Line items affected per share amounts) disclosure disclosure

Comments

Revenues Operating revenues $ß(9,779) X

Operating revenues

– service $ 9,168

Operating revenues

– equipment $ß 611

Other operating income $ß 2

Other expense, net $ß 2

Previously, Canadian GAAP did not

provide the same specificity of revenue

categorization. IFRS-IASB requires the

disclosure of specific categories of revenue.

Government

assistance

Operating revenues X

– service $ (37)

Other operating income $ß 48

Operating expenses

– employee benefits expense $ß 11

Previously, Canadian GAAP did not define

government assistance to include receipts

such as the high cost serving area portable

subsidy. As well, previously, Canadian GAAP

allowed for government assistance to be

netted against the associated expense as

a cost recovery. IFRS-IASB requires these

government assistance amounts to be

categorized as Other operating income.

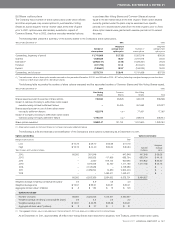

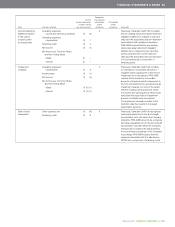

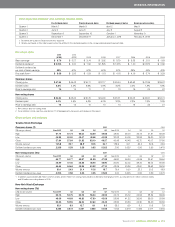

Analysis of

expenses and

other expense,

net, recognized

in the statements

of income and

other compre-

hensive income

Operating expenses X

– operations $ß(6,062)

Operating expenses

– restructuring costs $ (74)

Operating expenses

– goods and services purchased $ 4,228

Operating expenses

– employee benefits expense $ 1,934

Other expense, net $ (26)

Previously, Canadian GAAP did not provide

the same level of specificity of expense

analysis. IFRS-IASB requires that expenses

be presented using either a nature approach

or a function approach; the Company has

selected the nature approach.

Leasing (sales

and leaseback

transactions)

Operating expenses X

– goods and services purchased $ß 12

Income taxes $ (3)

Net income $ (9)

Net income per Common Share

and Non-Voting Share

– Basic $ß (0.03)

– Diluted $ß (0.03)

Previously, Canadian GAAP required that

gains arising on sales and leaseback trans-

actions be deferred and amortized over

the term of the resulting lease. IFRS-IASB

requires that, where the original sale was

at fair value, the gain be recognized in

income immediately.

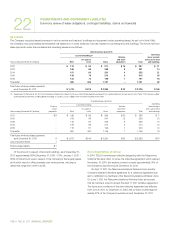

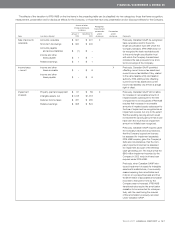

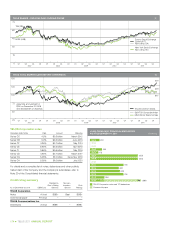

Employee benefits

– defined benefit

pension plans

Operating expenses X

– employee benefits expense $ (39)

Income taxes $ß 11

Net income $ß 28

Net income per Common Share

and Non-Voting Share

– Basic $ 0.09

– Diluted $ 0.09

Other comprehensive income

– employee defined benefit

plans actuarial gains (losses) $ (214)

Previously, Canadian GAAP required that

the excess of the net actuarial gain (loss)

over 10% of the greater of the accrued

benefit obligation and the fair value of the

plan assets was to be amortized over

the expected average remaining service

periods of active employees of the plan,

as were past service costs and transitional

assets and liabilities. IFRS-IASB allows the

Company to choose, and the Company

has chosen, to recognize such balances

at the transition date by way of an opening

adjustment to retained earnings. As well,

IFRS-IASB allows the Company to choose

to charge actuarial gains and losses arising

subsequent to the transition date to other

comprehensive income.