Telus 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

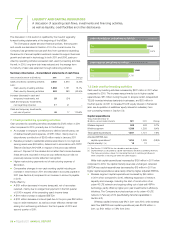

TELUS 2011 ANNUAL REPORT . 65

MANAGEMENT’S DISCUSSION & ANALYSIS: 5

Net additions of high-speed Internet subscribers and TELUS TV

sub scribers improved in 2011 when compared to 2010, due to the

positive effects of the launch of the new Optik service brands in

June 2010. The enhanced bundling capabilities and retention offers,

combined with ongoing service enhancements, have contributed

to increased customer demand and reduced customer churn across

all major product lines. TELUS largely completed the conversion

of IP TV residential subscribers on older technology platforms to

Microsoft Mediaroom technology in the first half of 2011.

.Voice local service revenue decreased by $133 million in 2011.

The decrease reflects reductions in basic access and enhanced voice

service revenues caused by competition for residential subscribers,

the con se quent decline in local residential access lines and matching

of competitive offers, bundled offers in deregulated urban markets,

and technological substitution to wireless and Internet-based

services. The decrease also reflects the decline in business voice

lines resulting from technological substitution to data services

and competitor activity including price competition. These factors

were partly offset by varying increases in monthly local rates.

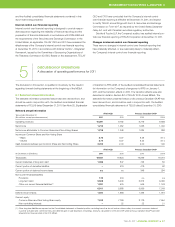

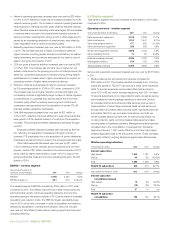

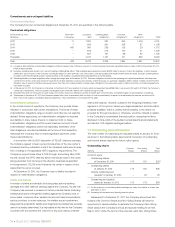

Wireline operating indicators

At December 31 (000s) 2 0 11 2010 Change

Network access lines (NALs)

Residential 1,915 2,046 (6.4)%

Business 1,678 1,693 (0.9)%

Total 3,593 3,739 (3.9)%

Years ended December 31 (000s) 2 0 11 2010 Change

Net (losses) additions in NALs

Residential (131) (177) 26.0%

Business (15) (50) 70.0%

Total (146) (227) 35.7%

Residential NALs continue to be affected by wireless and Internet-

based technological substitution for local services, as well as

promotional activity by primary cable-TV competitors in the Company’s

incumbent areas of B.C., Alberta and Eastern Quebec. Residential

NAL losses improved by 46,000 in 2011 when compared to 2010,

largely due to the sustained positive pull-through effect of bundled

offers, including Optik TV and Optik High Speed Internet services,

which gained traction since being launched in June 2010.

Business NAL losses in 2011 reflect the continuing trend of

increased competition in the SMB market and conversion of voice

lines to more efficient IP-based services, partly offset by the imple-

mentation of voice and data services for a wholesale customer in the

first half of 2011. Growth in certain data services such as private IP

networks is not measured by business NAL counts, and conversion

of legacy voice services to IP-based services results in a decrease

in business NALs.

.Voice long distance service revenue decreased by $53 million in

2011. The decrease reflects ongoing industry-wide price and bundling

competition, losses of local subscribers, and technological substitu-

tion to wireless and Internet-based services.

.Other service and equipment revenues increased by $13 million

in 2011, due to increased voice equipment sales and rent on jointly

used distribution facilities.

.Other operating income increased year over year by $18 million in

2011. The increase reflects higher recoveries of employee costs under

eligible government-sponsored employment programs, a drawdown

of the price cap deferral account to recognize the provisioning of

broadband Internet service to a number of qualifying rural communi-

ties, and the $17 million non-cash gain on Transactel recorded in 2011

(see Section 2.2 Partnering and acquiring), partly offset by lower

portable subsidy revenue.

.Intersegment revenue represents services provided by the wireline

segment to the wireless segment and is eliminated upon consolida tion

together with the associated expense in the wireless segment.

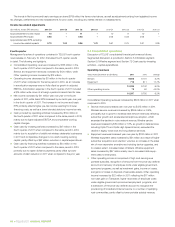

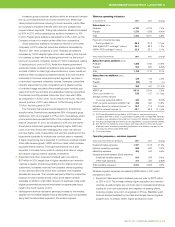

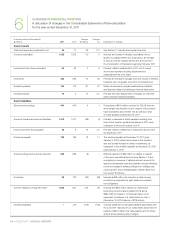

Operating expenses – wireline segment

Years ended December 31 ($ millions) 2 0 11 2010 Change

Goods and services purchased 2,154 1,907 13.0%

Employee benefits expense 1,353 1,398 (3.2)%

3,507 3,305 6.1%

Wireline operating expenses increased year over year by $202 million

in 2011.

.Goods and services expenses increased by $247 million in 2011.

The increase reflects higher content and support costs for TELUS TV

growth (62% year-over-year increase in the subscriber base), higher

cost of goods sold to support increased equipment sales, higher

external labour costs to support a larger customer base, restruc

turing

costs in 2011 associated with real estate consolidation, one-time

supplier credits in the third quarter of 2010 and higher network

transit and termination costs due to increased volumes and higher

blended rates, as well as higher advertising and promotions costs

primarily sup porting Optik TV and Optik High Speed Internet

marketing campaigns.

.Employee benefits expense decreased by $45 million in 2011.

The decrease includes lower employee-related restructuring costs,

higher defined benefit pension plan recoveries, lower share-based

compensation expenses and a one-time benefit liability recovery

in the second quarter of 2011. These decreases were partly offset

by the inclusion of Transactel operations since February 1, 2011,

compensation increases, and a higher number of domestic FTE

employees to support the growing subscriber base.

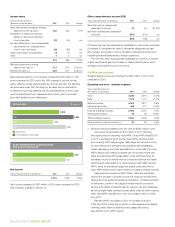

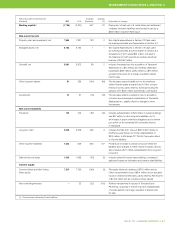

EBITDA – wireline segment

Years ended December 31

($ millions, except margins) 2 0 11 2010 Change

EBITDA 1,592 1,630 (2.3)%

Deduct Transactel gain (17) – n/m

Adjusted EBITDA 1,575 1,630 (3.4)%

Adjusted EBITDA margin (%) 31.0 33.0 (2.0) pts.

The wireline segment EBITDA decreased by $38 million in 2011 when

compared to 2010. Adjusted EBITDA, which excludes the non-cash

Transactel gain, decreased by $55 million in 2011. Decreases in adjusted

EBITDA and adjusted EBITDA margins primarily reflect ongoing declines

in higher-margin legacy voice services that were not fully offset by

growth in lower-margin data services.