Telus 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128 . TELUS 2011 ANNUAL REPORT

Non-derivative

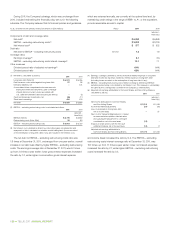

The Company’s long-term debt, which is measured at amortized cost, and the fair value thereof, are as set out in the following table.

As at (millions) December 31, 2011 December 31, 2010 January 1, 2010

Carrying Fair Carrying Fair Carrying Fair

amount value amount value amount value

Long-term debt $ß6,574 $ß7,359 $ß6,056 $ß6,590 $ß6,172 $ß6,656

(i) Recognition of derivative gains and losses

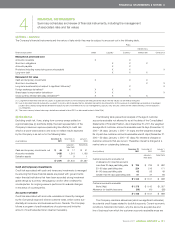

The following table sets out the gains and losses, excluding tax effects, on derivative instruments classified as cash flow hedging items and their

location within the Consolidated Statements of Income and Other Comprehensive Income; there was no ineffective portion of derivative instruments

classified as cash flow hedging items for the periods presented.

Amount of gain (loss) recognized Gain (loss) reclassified from other comprehensive

in other comprehensive income income into income (effective portion) (Note 10)

(effective portion) (Note 10) Amount

Years ended December 31 (millions) 2 0 11 2010 Location 2 0 11 2010

Derivatives used to manage currency risks

– Associated with U.S. dollar denominated debt $ (6) $ß 9 Financing costs $ß(8) $ß(59)

– Arising from U.S. dollar denominated purchases 8 (1) Goods and services purchased 3 –

Derivatives used to manage changes in share-based

compensation costs (Note 13(c)) 13 7 Employee benefits expense 12 –

$ß15 $ß15 $ 7 $ß(59)

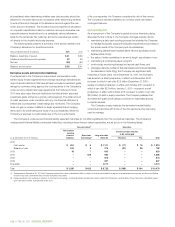

The following table sets out gains and losses arising from derivative instruments that are classified as held for trading items and that are not designated

as being in a hedging relationship, and their location within the Consolidated Statements of Income and Other Comprehensive Income.

Gain (loss) recognized in income on derivatives

Years ended December 31 (millions) Location 2 0 11 2010

Derivatives used to manage currency risks Financing costs $ß 7 $ß –

Derivatives used to manage changes in share-based compensation costs (Note 13(b)) Employee benefits expense 6 24

$ß13 $ß24