Telus 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 131

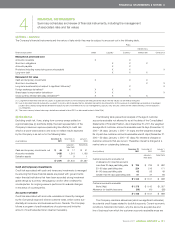

FINANCIAL STATEMENTS & NOTES: 6 – 9

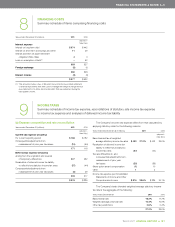

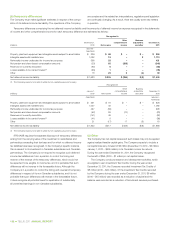

8FINANCING COSTS

Summary schedule of items comprising financing costs

Years ended December 31 (millions) 2 0 11 2010

(adjusted –

Note 25(c))

Interest expense

Interest on long-term debt $ß374 $ß442

Interest on short-term borrowings and other 11 29

Interest accretion on asset retirement

obligation (Note 19(a)) 4 4

Loss on redemption of debt(1) – 52

389 527

Foreign exchange (9) (1)

380 526

Interest income (3) (4)

$ß377 $ß522

(1) This amount includes a loss of $16 which arose from the associated settlement

of financial instruments that were used to manage the foreign exchange rate risk

associated with U.S. dollar denominated debt that was redeemed during the

third quarter of 2010.

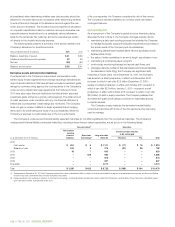

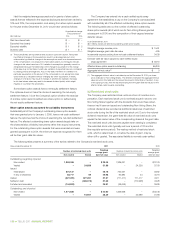

9INCOME TAXES

Summary schedule of income tax expense, reconciliations of statutory rate income tax expense

to income tax expense and analyses of deferred income tax liability

(a) Expense composition and rate reconciliation

Years ended December 31 (millions) 2 0 11 2010

(adjusted –

Note 25(c))

Current tax expense (recovery)

For current reporting period $ß186 $ß182

Consequential adjustments from

reassessment of prior year tax issues (15) (64)

171 118

Deferred tax expense (recovery)

Arising from the origination and reversal

of temporary differences 247 232

Revaluation of deferred income tax liability

to reflect future statutory income tax rates (37) (44)

Consequential adjustments from

reassessment of prior year tax issues (5) 29

205 217

$ß376 $ß335

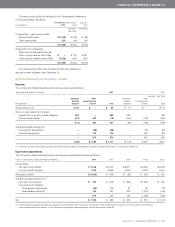

The Company’s income tax expense differs from that calculated by

applying statutory rates for the following reasons:

Years ended December 31 ($ in millions) 2 0 11 2010

(adjusted –

Note 25(c))

Basic blended tax at weighted

average statutory income tax rates $ß433 27.2% $ß402 29.0%

Revaluation of deferred income tax

liability to reflect future statutory

income tax rates (37) (44)

Tax rate differential on, and

consequential adjustments from,

reassessment of prior year

tax issues (20) (35)

Share option award compensation (1) 10

Other 1 2

Income tax expense per Consolidated

Statements of Income and Other

Comprehensive Income $ß376 23.6% $ß335 24.1%

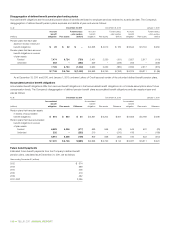

The Company’s basic blended weighted average statutory income

tax rate is the aggregate of the following:

Years ended December 31 2 0 11 2010

Basic federal rate 16.2% 17.7%

Weighted average provincial rate 10.4% 10.9%

Other tax jurisdictions 0.6% 0.4%

27.2% 29.0%