Telus 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 115

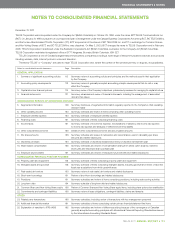

FINANCIAL STATEMENTS & NOTES: 1

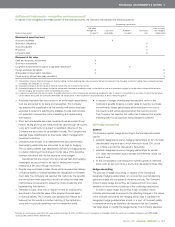

The deferral account arises from the CRTC requiring the Company

to defer the statement of income recognition of a portion of the monies

received in respect of residential basic services provided to non-high

cost serving areas. The Company has adopted the liability method

of accounting for the deferral account. This resulted in the Company

recording incremental liability amounts, subject to reductions for the

mitigating activities, during the Decisions’ initial four-year periods. The

deferral account balance also reflects an interest expense component

based on the Company’s applicable short-term cost of borrowing,

such expense being included in the Consolidated Statements of Income

and Other Comprehensive Income as Financing costs.

The Company discharges the deferral account liability by undertaking

qualifying actions including providing broadband services to rural and

remote communities, enhancing the accessibility to telecommunications

services for individuals with disabilities and providing customer rebates for

the balance. The Company recognizes the drawdown and amor

tiza tion

(over a period no longer than three years) of a proportionate share

of the

deferral account as qualifying actions are completed; such amortization

is included in Other operating income.

(f) Government assistance*

The Company recognizes government assistance on an accrual basis

as the subsidized services are provided or as the subsidized costs

are incurred. As set out in Note 6, government assistance is included

in the Consolidated Statements of Income and Other Comprehensive

Income as Other operating income.

(g) Cost of acquisition and advertising costs

Costs of acquiring customers, that are expensed as incurred, include

the total cost of hardware sold to customers, commissions, advertising

and promotion related to the initial customer acquisition. Costs of

acquiring customers, that are capitalized as incurred, include Company-

owned hardware situated at customers’ premises and associated

installation costs. Costs of acquisition that are expensed are included

in the Consolidated Statements of Income and Other Comprehensive

Income as a component of Goods and services purchased except

for commissions paid to Company employees, which are included as

Employee benefits expense. Costs of advertising production, advertising

airtime and advertising space are expensed as incurred.

(h) Research and development

Research and development costs are expensed except in cases

where development costs meet certain identifiable criteria for capitaliza-

tion. Capitalized development costs are amortized over the life of the

commercial production, or in the case of serviceable property, plant and

equipment, are included in the appropriate property group and are

depreciated over its estimated useful life.

(i) Leases

Leases are classified as finance or operating depending upon the terms

and conditions of the contracts.

Where the Company is the lessee, asset values recorded under

finance leases are amortized on a straight-line basis over the period of

expected use. Obligations recorded under finance leases are reduced

by lease payments net of imputed interest.

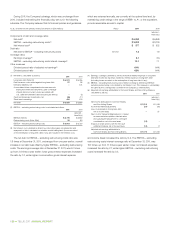

For the year ended December 31, 2011, real estate and vehicle

operating lease expenses, which are net of the amortization of the

deferred gain on the sale-leaseback of buildings, were $250 million

(2010 – $266 million (adjusted – Note 25(c))); of these amounts, less than

$1 million (2010 – less than $1 million) was in respect of real estate leased

from the Company’s pension plans, as discussed further in Note 14(b).

The unamortized balances of the deferred gains on the sale-leaseback

of buildings are set out in Note 24(a).

(j) Depreciation, amortization and impairment*

Depreciation and amortization

Assets are depreciated on a straight-line basis over their estimated

useful lives as determined by a continuing program of asset life studies.

Depreciation includes amortization of assets under finance leases and

amortization of leasehold improvements. Leasehold improvements are

normally amortized over the lesser of their expected average service

life or the term of the lease. Intangible assets with finite lives (intangible

assets subject to amortization) are amortized on a straight-line basis

over their estimated lives; estimated lives are reviewed at least annually

and are adjusted as appropriate.

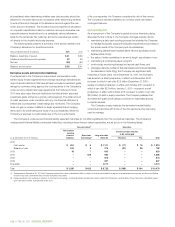

Estimated useful lives for the majority of the Company’s property,

plant and equipment subject to depreciation are as follows:

Estimated

useful lives(1)

Network assets

Outside plant 17 to 40 years

Inside plant 4 to 16 years

Wireless site equipment 6.5 to 8 years

Balance of depreciable property, plant and equipment 3 to 40 years

(1) The composite depreciation rate for the year ended December 31, 2011, was 5.0%

(2010 – 5.1%). The rate is calculated by dividing depreciation expense by an average

gross book value of depreciable assets for the reporting period. One result of this

methodology is that the composite depreciation rate will be lower in a period that has

a higher proportion of fully depreciated assets remaining in use (Note 15).

Estimated useful lives for the majority of the Company’s intangible

assets subject to amortization are as follows:

Estimated

useful lives

Wireline subscriber base 40 years

Customer contracts, related customer relationships

and leasehold interests 6 to 10 years

Software 3 to 5 years

Access to rights-of-way and other 8 to 30 years

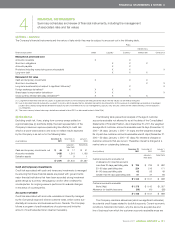

Impairment – general

Impairment testing compares the carrying values of the assets or cash-

generating units being tested with their recoverable amounts (recoverable

amounts being the greater of the assets’ or cash-generating units’

values in use or their fair values less costs to sell). Impairment losses are

immediately recognized to the extent that the asset or cash-generating

unit carrying values exceed their recoverable amounts. Should the

recoverable amounts for previously impaired assets or cash-generating

units subsequently increase, the impairment losses previously recognized

(other than in respect of goodwill) may be reversed to the extent that the

reversal is not a result of “unwinding of the discount” and that the resulting

carrying value does not exceed the carrying value that would have

been the result if no impairment losses had been previously recognized.

*Denotes accounting policy affected in the years ended December 31, 2011 and 2010, by the convergence of Canadian GAAP for publicly accountable enterprises with IFRS-IASB,

as discussed further in Note 2 and Note 25.