Telus 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 71

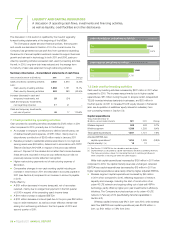

MANAGEMENT’S DISCUSSION & ANALYSIS: 7

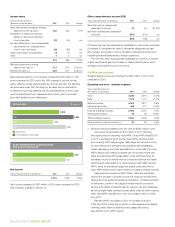

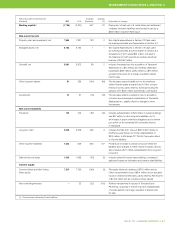

TELUS credit facilities

Outstanding Backstop

At December 31, 2011 undrawn letters for commercial Available

($ in millions) Expiry Size Drawn of credit paper program liquidity

Five-year revolving facility(1) November 3, 2016 2,000 – – (766) 1,234

Other bank facilities – 165 (4) (115) – 46

Total – 2,165 (4) (115) (766) 1,280

(1) Canadian dollars or U.S. dollar equivalent.

TELUS’ revolving credit facility contains customary covenants, including

a requirement that TELUS not permit its consolidated Leverage Ratio

(debt to trailing 12-month EBITDA) to exceed 4 to 1 (approximately 1.8 to 1

at December 31, 2011) and not permit its consolidated Coverage Ratio

(EBITDA to interest expense on a trailing 12-month basis) to be less than

2 to 1 (approximately 10.1 to 1 at December 31, 2011) at the end of any

financial quarter. There are certain minor differences in the calculation

of the Leverage Ratio and Coverage Ratio under the credit agreements

as compared with the calculation of Net debt to EBITDA – excluding

restructuring costs and EBITDA – excluding restructuring costs interest

coverage. Historically, the calculations have not been materially different.

The covenants are not impacted by revaluation of property, plant and

equipment, intangible assets or goodwill for accounting purposes.

Continued access to TELUS’ credit facilities is not contingent on the

maintenance by TELUS of a specific credit rating.

Subsequent to December 31, 2011, the Company received financing

commitments from two Canadian financial institutions in connection

with the TELUS Garden project. TELUS Corporation plans to participate

as a 50% lender in the construction credit facilities which, once fully

documented, will provide a combined total of $413 million of liquidity

to the real estate joint venture. The facilities contain customary repre-

sentations, warranties and covenants and are secured by demand

debentures constituting first fixed and floating charge mortgages over

the two under lying real estate projects. The facilities bear interest at

bankers’ acceptance rate or prime rate, plus applicable margins. As at

February 23, 2012, no amounts had been advanced under the facilities.

7.6 Sale of trade receivables

Effective August 1, 2011, TELUS Communications Inc. (TCI), a wholly

owned subsidiary of TELUS, amended an agreement with an arm’s-

length securitization trust associated with a major Schedule I Canadian

bank, under which TCI is able to sell an interest in certain of its trade

receivables, for an amount up to a maximum of $500 million. The

amendment resulted in the term of the revolving period securitization

agreement being extended to August 1, 2014. The agreement prior

to this amendment was set to expire in May 2012.

TCI is required to maintain at least a BBB (low) credit rating by

DBRS Ltd. or the securitization trust may require the sale program

to be wound down. The necessary credit rating was exceeded as

of February 23, 2012.

7.7 Credit ratings

There were no changes to the Company’s investment grade credit ratings

during 2011, or as of February 23, 2012. TELUS believes its adherence

to its stated financial policies and the resulting investment grade credit

ratings, coupled with its efforts to maintain a constructive relationship

with banks, investors and credit rating agencies, continue to provide

reasonable access to capital markets. (See Section 10.6 Financing and

debt requirements.)

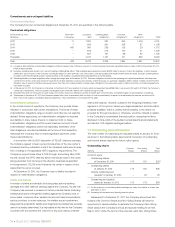

7.5 Credit facilities

In 2011, TELUS Corporation entered into a new bank credit facility with

a syndi cate of 15 financial institutions. The new credit facility consists

of a $2 billion (or U.S. dollar equivalent) revolving credit facility expiring

November 3, 2016, to be used for general corporate purposes including

the backstop of commercial paper. This new facility replaced the

Company’s pre-existing $2 billion committed credit facility prior to its

expiry in May 2012. The new facility has no substantial changes in terms

and conditions other than pricing.

At December 31, 2011, TELUS had available liquidity of $1.28 billion

from unutilized credit facilities, as well as availability of $100 million under

its trade receivables securitization program (see Section 7.6), consistent

with the Company’s objective of generally maintaining at least $1 billion

of available liquidity.