Telus 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 . TELUS 2011 ANNUAL REPORT

The discussion in this section is qualified in its entirety by the Caution

regarding forward-looking statements at the beginning of the MD&A.

Risk and control assessment process

TELUS uses a three-level enterprise risk and control assessment

process that solicits and incorporates the expertise and insight of team

members from all areas of the Company. TELUS implemented this

process in 2002 and tracks multi-year trends for various key risks and

control environment perceptions across the organization.

Definition of business risk

TELUS defines business risk as the degree of exposure associated

with the achievement of key strategic, financial, organizational and process

objectives in relation to the effectiveness and efficiency of operations,

reliability of financial reporting, compliance with laws and regulations and

safeguarding of assets within an ethical organizational culture.

TELUS’ enterprise risks are largely derived from the Company’s

business environment and are fundamentally linked to TELUS’ strategies

and business objectives. TELUS strives to proactively mitigate its risk

exposures through rigorous performance planning, effective and efficient

business operational management, and risk response strategies which

can include mitigating, transferring, retaining and/or avoiding risks.

For example, residual exposure for certain risks is mitigated through

appropriate insurance coverage, including for domestic and international

operations, where this is judged to be efficient and commercially viable.

Risks are also mitigated through contractual terms and conditions,

contingency planning and other risk response strategies as appropriate.

TELUS strives to avoid taking on undue risk exposures whenever

possible and strives to ensure alignment of these exposures with business

strategies, objectives, values and risk tolerances.

10 RISKS AND RISK MANAGEMENT

Risks and uncertainties facing TELUS and how the Company manages these risks

Enterprise risk and control assessment process

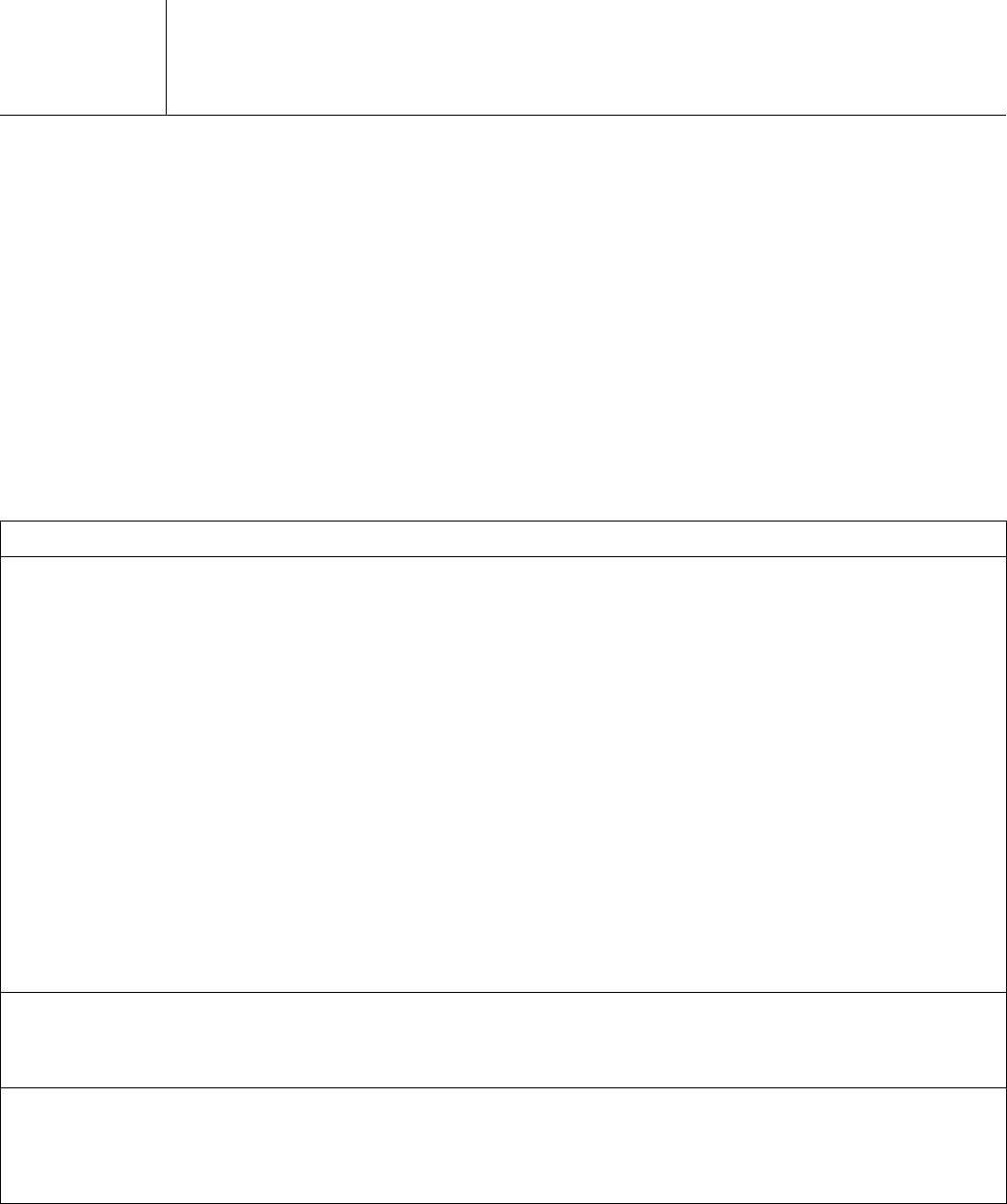

Level one Annual risk and control assessment

Key inputs into this process include interviews with senior managers, data and updates from TELUS’ ongoing strategic

planning process, and the results of an annual web-enabled risk and control assessment survey. The survey is based on

the COSO (Committee of Sponsoring Organizations of the Treadway Commission) enterprise risk management and internal

control frameworks. The survey is widely distributed to TELUS’ management leadership team (all executive vice-president,

vice-president and director level team members and a random sample of management). Survey responses were received

from 1,774 individuals in 2011.

The members of TELUS’ Board of Directors are also surveyed to solicit their perspective of the Company’s key risks and

approach to enterprise risk management, and to gauge the Company’s risk appetite and tolerance by key risk category.

TELUS’ assessment process incorporates input from recent internal and external audits, results of various risk management

activities, and management’s SOX 404 (Sarbanes Oxley Act of 2002) internal control over financial reporting compliance

activities. Key enterprise risks are identified, defined and prioritized, and classified into one of nine risk categories. Perceived

risk resiliency (or readiness) is assessed by key risk and risk tolerance/appetite is evaluated by risk category.

Results of the annual risk and control assessment are shared with senior management and the Board (including the Audit

Committee). Executive-level risk owners and Board oversight committees are assigned. The annual risk assessment results

guide the development of the Company’s annual internal audit program, which has an emphasis on assurance coverage

of higher-rated risks and is approved by the Audit Committee. Risk assessments are also incorporated back into the

Company’s strategic planning, operational risk management and performance management processes, and are shared

with the Board.

Level two Quarterly risk assessment review

TELUS conducts quarterly risk assessment reviews with executive level risk owners and designated risk primes across all

business units to capture and communicate the dynamically changing business risks, identify key risk mitigation activities

and provide quarterly updates and assurance to the applicable Board committee.

Level three Granular risk assessments

TELUS conducts granular risk assessments for specific audit engagements and various risk management, strategic and

operational initiatives (e.g. strategic planning, project, environmental management, safety, business continuity planning,

network and IT vulnerability, and fraud and ethics risk assessments). The results of the multiple risk assessments are

evaluated, prioritized, updated and integrated into the key risk profile throughout the year.