Telus 2011 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.152 . TELUS 2011 ANNUAL REPORT

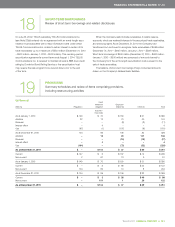

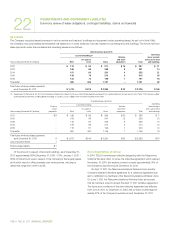

Regulatory

In 2002, the CRTC issued Decision 2002-34 and Decision 2002-43, which

resulted in the creation of non-high cost serving area deferral accounts.

The deferral account arises from the CRTC requiring the Company to defer

the statement of income and other comprehensive income recognition

of a portion of the monies received in respect of residential basic services

provided to non-high cost serving areas. In order to extinguish the deferral

account liability, the Company will be: expanding broadband services

in its incumbent local exchange carrier territories to rural and remote

communities; enhancing accessibility to telecommunications services

for individuals with disabilities; and rebating the balance of the deferral

account to local residential customers in non-high cost serving areas.

The CRTC rendered its final decision on the use of the deferral account

in August 2010. The decision required $54 million in customer rebates

to be effected by February 2011, and the remaining $111 million is to be

applied to providing broadband services and initiatives for the disabled,

both of which are to be completed by 2014. The amounts used, rebated,

to be applied in the next twelve months or for which the timing or amount

are no longer uncertain are reflected in the table above as a use.

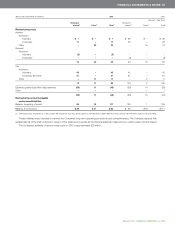

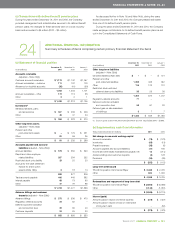

Asset retirement obligation

As discussed further in Note 1(r), the Company recognizes liabilities

associated with the retirement of property, plant and equipment when

those obligations result from the acquisition, construction, development

and/or normal operation of the assets. The Company expects that

the cash outflows in respect of the balance accrued as at the financial

statement date will occur proximate to the dates these long-term

assets are retired.

Employee related

The employee related provisions are largely in respect of restructuring

activities (as discussed further in (b) following). The timing of the cash

outflows in respect of the balance accrued as at the financial statement

date is substantially short-term in nature.

Other

The provision for other includes disputes and non-employee related

restructuring activities (as discussed further in (b) following), as well as a

written put option related to a business acquisition. As discussed further

in Note 22(d), the Company is involved in a number of legal disputes

and is aware of certain possible legal disputes. In respect of legal dis-

putes, the Company has established provisions, when warranted, after

taking into account legal assessment, information presently available,

and the expected availability of insurance or other recourse. The timing

of cash outflows associated with legal claims cannot be reasonably

determined. As discussed further in Note 16(e), the Company incurred

a liability for contingent consideration in connection with acquiring

an initial 29.99% economic interest in Transactel (Barbados) Inc.

in December 2008; as at December 31, 2011, the timing and amount

of the contingent consideration are no longer uncertain and thus

the amount to be paid is reflected in the table above as a use and the

difference of $1 million is reflected as a reversal. Also as discussed

further in Note 16(e), the Company provided a written put option

in respect of the remaining 5% non-controlling interest in Transactel

(Barbados) Inc.; cash outflows are not expected to occur prior to

initial exercisability of the written put option on December 22, 2015.

The Company expects that the cash outflows in respect of the

balance accrued as at the financial statement date will occur over

an indeterminate, multi-year period.

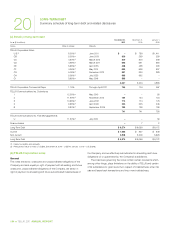

(b) Restructuring

Employee related provisions and other provisions, in (a) preceding,

include amounts in respect of restructuring activities. In 2011, restructuring

activities included ongoing efficiency initiatives such as:

.simplifying or automating processes to achieve operating efficiencies,

which includes workforce reductions;

.simplifying organizational structures through consolidation of functions

and reducing organizational layers;

.consolidating administrative real estate to create a smaller environ-

mental footprint through mobile working, encouraging less inter-city

travel, reduced daily commutes, and lower use of real estate space,

which includes vacating premises;

.decommissioning uneconomic services and products; and

.leveraging business process outsourcing and off-shoring to the

Company’s own international call centres.