Telus 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 0 . TELUS 2011 ANNUAL REPORT

Risk mitigation: Although the Company cannot completely mitigate

economic risks, TELUS introduced the Customers First initiatives as

the number one corporate priority to enhance customer experiences.

TELUS

also continues to pursue cost reduction and efficiency initiatives.

Although Canadian economic growth in 2012 is expected to be lower

than in 2011, TELUS expects its revenue growth to be 3 to 6% in 2012

(see Section 1.5). The Company also expects its 2012 capital expen-

ditures to be at a level similar to 2011 (excluding any potential spectrum

purchases). If necessary, the Company may also consider additional

cost and efficiency initiatives in future years.

Pension funding

Economic and capital market fluctuations could also adversely impact

the funding and expense associated with the defined benefit pension

plans that TELUS sponsors. There can be no assurance that TELUS’

pension expense and funding of its defined benefit pension plans will

not increase in the future and thereby negatively impact earnings and/or

cash flow. Defined benefit funding risks may occur if total pension

liabilities exceed the total value of the respective trust funds. Unfunded

differences may arise from lower than expected investment returns,

reductions in the discount rate used to value pension liabilities, and

actuarial loss experiences. After-tax actuarial gains and losses on defined

benefit pension plans will cause fluctuations in Other comprehensive

income, which will never be subsequently reclassified to income.

Risk mitigation: TELUS seeks to mitigate this risk through the application

of policies and procedures designed to control investment risk and

ongoing monitoring of its funding position. Pension expense and funding

for 2012 have been largely determined by the rates of return on the plans’

assets for 2011 and interest rates at year-end 2011. The estimated pension

recovery is approximately $12 million for 2012 (a pension recovery of

$34 million in 2011). The Company’s best estimate of cash contribu tions

to its defined benefit pension plans in 2012 is $172 million including a

$100 million discretionary special contribution in January 2012 ($298 mil-

lion in 2011 including a $200 million discretionary special contribution in

January 2011).

11.1 EBITDA (earnings before interest, taxes,

depreciation and amortization)

EBITDA does not have any standardized meaning prescribed by

IFRS-IASB and is therefore unlikely to be comparable to similar measures

presented by other issuers. EBITDA should not be considered an

alterna tive to Net income in measuring the Company’s performance,

nor should it be used as an exclusive measure of cash flow. TELUS

has issued guidance on and reports EBITDA because it is a key measure

that management uses to evaluate performance of segments and

the Company. EBITDA – excluding restructuring costs is also utilized

in measuring compliance with debt covenants (see description in

Section 11.4). EBITDA is a measure commonly reported and widely used

by investors and lending institutions as an indicator of a company’s

operating performance and ability to incur and service debt, and as a

valuation metric.

The CICA’s Canadian Performance Reporting Board defined

standardized EBITDA to foster comparability of the measure between

entities. Standardized EBITDA is an indication of an entity’s capacity

to generate income from operations before taking into account

management’s financing decisions and costs of consuming tangible

and intangible capital assets, which vary according to their vintage,

technological currency and management’s estimate of their useful life.

Accordingly, standardized EBITDA comprises revenue less operating

costs before interest expense, capital asset amortization and impairment

charges, and income taxes.

As in 2011, an adjusted EBITDA may also be calculated periodically

to exclude items of an unusual nature that do not reflect normal or

ongoing telecommunications operations, that should not be considered

in a valuation metric or should not be included in assessment of ability

to service or incur debt.

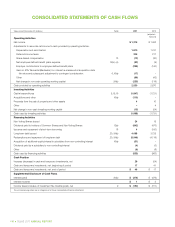

EBITDA reconciliation

Years ended December 31 ($ millions) 2 0 11 2010

Net income 1,215 1,052

Financing costs 377 522

Income taxes 376 335

Depreciation 1,331 1,339

Amortization of intangible assets 479 402

Impairment losses (reversals) for capital assets – –

EBITDA (standardized EBITDA

in CICA guideline) 3,778 3,650

Deduct Transactel gain (17) –

Adjusted EBITDA 3,761 3,650

Management also calculates EBITDA less capital expenditures

as a simple proxy for cash flow at a consolidated level and in its two

reportable segments. EBITDA less capital expenditures may be used

for compa rison to the reported results for other telecommunications

companies over time and is subject to the potential comparability issues

of EBITDA described above.

Calculation of EBITDA less capital expenditures

Years ended December 31 ($ millions) 2 0 11 2010

EBITDA 3,778 3,650

Capital expenditures (1,847) (1,721)

EBITDA less capital expenditures 1,931 1,929

Deduct Transactel gain (17) –

Adjusted EBITDA less capital expenditures 1,914 1,929

11 DEFINITIONS AND RECONCILIATIONS

Definitions of operating, liquidity and capital resource measures, including calculation

and reconciliation of certain non-GAAP measures used by management