Telus 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 . TELUS 2011 ANNUAL REPORT

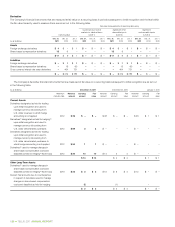

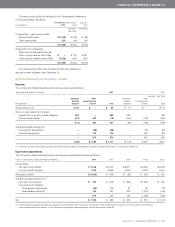

12 DIVIDENDS PER SHARE

Summary schedule of dividends declared and review of dividend reinvestment plan

(a) Dividends declared

Years ended December 31

(millions except per share amounts) 2 0 11 2010

Common Share and Declared Paid to Declared Paid to

Non-Voting Share dividends Effective Per share shareholders Total Effective Per share shareholders Total

Mar. 11, 2011 $ß0.525 Apr. 1, 2011 $ß170 Mar. 11, 2010 $ß0.475 Apr. 1, 2010 $ß152

June 10, 2011 0.550 July 4, 2011 178 June 10, 2010 0.500 July 2, 2010 161

Sep. 9, 2011 0.550 Oct. 3, 2011 179 Sep. 10, 2010 0.500 Oct. 1, 2010 160

Dec. 9, 2011 0.580 Jan. 3, 2012 188 Dec. 10, 2010 0.525 Jan. 4, 2011 169

$ß2.205 $ß715 $ß2.000 $ß642

Years ended December 31 (millions) 2 0 11 2010

Dividends declared in Dividends declared in

Prior Current Prior Current

fiscal year fiscal year Total fiscal year fiscal year Total

Common Share and Non-Voting Share dividends

Payable, beginning of period $ß169 $ß – $ß169 $ß150 $ß – $ß150

Declared n.a. 715 715 n.a. 642 642

Paid in cash (115) (527) (642) (129) (344) (473)

Reinvested in Non-Voting Shares

issued from Treasury (54) – (54) (21) (129) (150)

Payable, end of period $ß – $ß188 $ß188 $ß – $ß169 $ß169

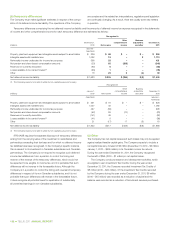

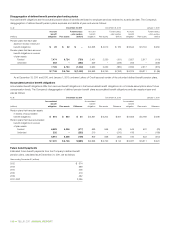

On February 8, 2012, the Board of Directors declared a quarterly

dividend of $0.58 per share on the issued and outstanding Common

Shares and Non-Voting Shares of the Company payable on April 2, 2012,

to holders of record at the close of business on March 9, 2012. The final

amount of the dividend payment depends upon the number of Common

Shares and Non-Voting Shares issued and outstanding at the close of

business on March 9, 2012.

On February 21, 2012, the Board of Directors declared a quarterly

dividend of $0.61 per share on the issued and outstanding Common

Shares and Non-Voting Shares of the Company, payable on July 3, 2012,

to holders of record at the close of business on June 8, 2012. In the

event

that the proposed share conversion of Non-Voting Shares to

Common Shares on a one-for-one basis receives all requisite approvals

(see Note 21(a)) and is effective prior to the dividend record date of

June 8, 2012, holders of record on such date who previously held Non-

Voting Shares would hold Common Shares and would therefore receive

the same dividend as all other holders of Common Shares.

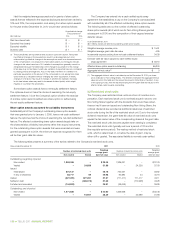

(b) Dividend Reinvestment and Share Purchase Plan

General

The Company has a Dividend Reinvestment and Share Purchase Plan

under which eligible holders of Common Shares and Non-Voting Shares

may acquire Non-Voting Shares through the reinvestment of dividends

and by making additional optional cash payments to the trustee. Under

this Plan, the Company has the option of offering shares from Treasury

or having the trustee acquire shares in the stock market.

Reinvestment of dividends

The Company, at its discretion, may offer the Non-Voting Shares at up to

a 5% discount from the market price. In respect of dividends reinvested

during the three-month period ended March 31, 2011, the Company issued

Non-Voting Shares from Treasury at a discount of 3%. The Company

opted to have the trustee acquire the Non-Voting Shares in the stock

market commencing March 1, 2011, with no discount. In respect of

Common Share and Non-Voting Share dividends declared during the

year ended December 31, 2011, $34 million (2010 – $183 million) was

to be reinvested in Non-Voting Shares.

Optional cash payments

Shares purchased through optional cash payments are subject to a

minimum investment of $100 per transaction and a maximum investment

of $20,000 per calendar year.