Telus 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.116 . TELUS 2011 ANNUAL REPORT

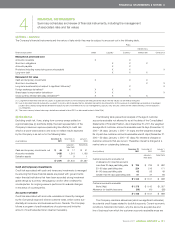

Impairment – property, plant and equipment; intangible assets

subject to amortization

The continuing program of asset life studies considers such items as

timing of technological obsolescence, competitive pressures and future

infrastructure utilization plans; such considerations could also indicate

that carrying values of assets may not be recoverable. If the carrying

values of assets were not considered recoverable, an impairment loss

would be recorded.

Impairment – intangible assets with indefinite lives; goodwill

The carrying values of intangible assets with indefinite lives and goodwill

are periodically tested for impairment. The frequency of the impairment

tests generally is the reciprocal of the stability of the relevant events and

circumstances, but intangible assets with indefinite lives and goodwill

must, at a minimum, be tested annually; the Company has selected

December as its annual test time.

The Company assesses its intangible assets with indefinite lives

by comparing the recoverable amounts of the cash-generating units

to the carrying amounts of its cash-generating units (including the

intangible assets with indefinite lives allocated to the cash-generating

unit, but excluding any goodwill allocated to the cash-generating unit).

To the extent that the carrying values of the cash-generating units

(including the intangible assets with indefinite lives allocated to the

cash-generating unit, but excluding any goodwill allocated to the cash-

generating unit) exceed their recoverable amounts, the excess would

reduce the carrying value of intangible assets with indefinite lives.

Subsequent to assessing its intangible assets with indefinite lives,

the Company then assesses its goodwill by comparing the recoverable

amounts of the cash-generating units to the carrying amounts of

its cash-generating units (including the intangible assets with indefinite

lives and the goodwill allocated to the cash-generating unit). To the

extent that the carrying values of the cash-generating units (including

the intangible assets with indefinite lives and the goodwill allocated to

the cash-generating unit) exceed their recoverable amounts, the excess

would first reduce the carrying value of goodwill and any remainder

would reduce the carrying value of the assets of the cash-generating

unit on a pro-rated basis.

The Company has determined that its current cash-generating units

are its reportable segments, Wireless and Wireline, as the reportable

segments are the smallest identifiable groups of assets that generate

net cash inflows that are largely independent of each other.

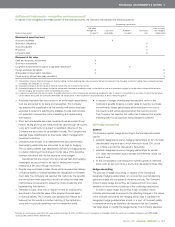

(k) Translation of foreign currencies

Trade transactions completed in foreign currencies are translated into

Canadian dollars at the rates prevailing at the time of the transactions.

Monetary assets and liabilities denominated in foreign currencies are

translated into Canadian dollars at the rate of exchange in effect at

the statement of financial position date with any resulting gain or loss

being included in the Consolidated Statements of Income and Other

Comprehensive Income as a component of Financing costs, as set out

in Note 8. Hedge accounting is applied in specific instances as further

discussed in Note 1(d).

The Company has minor foreign subsidiaries that do not have

the Canadian dollar as their functional currency. Accordingly, foreign

exchange gains and losses arising from the translation of the minor

foreign subsidiaries’ accounts into Canadian dollars are reported as a

component of other comprehensive income, as set out in Note 10.

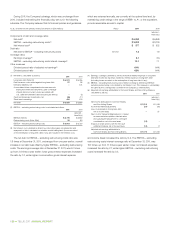

(l) Income taxes*

The Company follows the liability method of accounting for income taxes.

Under this method, current income taxes are recognized for the estimated

income taxes payable for the current year. Deferred income tax assets

and liabilities are recognized for temporary differences between the tax

and accounting bases of assets and liabilities, as well as for the benefit

of losses and Investment Tax Credits available to be carried forward to

future years for tax purposes that are more likely than not to be realized.

The amounts recognized in respect of deferred income tax assets and

liabilities are based upon the expected timing of the reversal of temporary

differences or usage of tax losses and application of the substantively

enacted tax rates at the time of reversal or usage.

The Company accounts for changes in substantively enacted tax

rates affecting deferred income tax assets and liabilities in full in the

period in which the changes were substantively enacted; the Company

has selected this method as its emphasis on the statement of financial

position is more consistent with the liability method of accounting for

income taxes. The Company accounts for changes in the estimates of

prior year(s) tax balances as estimate revisions in the period in which

the changes in estimate arose; the Company has selected this method

as its emphasis on the statement of financial position is more consistent

with the liability method of accounting for income taxes.

The operations of the Company are complex and the related tax

interpretations, regulations and legislation are continually changing.

As a result, there are usually some tax matters in question that result in

uncertain tax positions. The Company only recognizes the income tax

benefit of an uncertain tax position when it is more likely than not that the

ultimate determination of the tax treatment of the position will result in

that benefit being realized. The Company accrues for interest charges

on current tax liabilities that have not been funded, which would include

interest and penalties arising from uncertain tax positions. The Company

includes such charges in the Consolidated Statements of Income and

Other Comprehensive Income as a component of Financing costs.

The Company’s research and development activities may be eligible

to earn Investment Tax Credits; the determination of eligibility is a

complex matter. The Company only recognizes Investment Tax Credits

when there is reasonable assurance that the ultimate determination

of the eligibility of the Company’s research and development activities

will result in the Investment Tax Credits being received. When there

is reasonable assurance that the Investment Tax Credits will be received,

they are accounted for using the cost reduction method whereby such

credits are deducted from the expenditures or assets to which they

relate, as set out in Note 9.

(m) Share-based compensation

For share option awards granted after 2001, a fair value is determined

for share option awards at the date of grant and that fair value is recog-

nized in the financial statements. Proceeds arising from the exercise of

share option awards are credited to share capital, as are the recognized

grant-date fair values of the exercised share option awards.

Share option awards which have a net-equity settlement feature, as

set out in Note 13(b), and which do not also have a net-cash settlement

feature, are accounted for as equity instruments. The Company has

selected the equity instrument fair value method of accounting for the

net-equity settlement feature as it is consistent with the accounting

treatment afforded to the associated share option awards.

*Denotes accounting policy affected in the years ended December 31, 2011 and 2010, by the convergence of Canadian GAAP for publicly accountable enterprises with IFRS-IASB,

as discussed further in Note 2 and Note 25.