Telus 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 129

FINANCIAL STATEMENTS & NOTES: 5

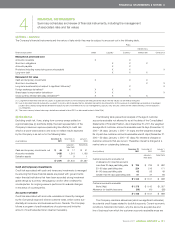

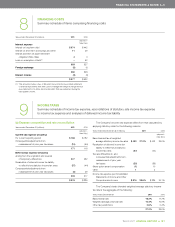

5SEGMENTED INFORMATION

Summary disclosure of segmented information regularly reported to the Company’s

chief operating decision-maker

similarities in technology, the technical expertise required to deliver

the services and products, customer characteristics, the distribution

channels used and regulatory treatment. Intersegment sales are

recorded at the exchange value, which is the amount agreed to by

the parties.

The Company does not have material revenues attributed, or capital

assets and goodwill located, outside of Canada.

The Company’s operating segments and reportable segments are

Wireless and Wireline. The Wireless segment includes digital personal

communications services, equipment sales and wireless Internet

services. The Wireline segment includes voice local, voice long distance,

data (which includes: television; Internet, enhanced data and hosting

services; and managed and legacy data services) and other telecom-

munications services excluding wireless. Segmentation is based on

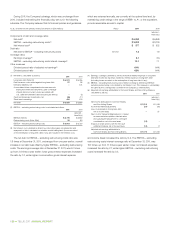

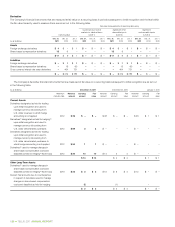

The following segmented information is regularly reported to the Company’s Chief Executive Officer (the Company’s chief operating decision-maker).

Wireless Wireline Eliminations Consolidated

Years ended December 31 (millions) 2 0 11 2010 2 0 11 2010 2 0 11 2010 2 0 11 2010

(adjusted –

Note 25(c))

Operating revenues

External revenue $ß5,462 $ß5,012 $ß4,935 $ß4,780 $ – $ – $ß10,397 $ß9,792

Intersegment revenue 38 33 164 155 (202) (188) – –

$ß5,500 $ß5,045 $ß5,099 $ß4,935 $ß(202) $ß(188) $ß10,397 $ß9,792

EBITDA(1) $ß2,186 $ß2,020 $ß1,592 $ß1,630 $ – $ – $ß 3,778 $ß3,650

CAPEX(2) $ 508 $ 463 $ß1,339 $ß1,258 $ – $ – $ß 1,847 $ß1,721

EBITDA less CAPEX $ß1,678 $ß1,557 $ 253 $ 372 $ – $ – $ß 1,931 $ß1,929

Operating revenues (above) $ß10,397 $ß9,792

Goods and services purchased 4,726 4,236

Employee benefits expense 1,893 1,906

EBITDA (above) 3,778 3,650

Depreciation 1,331 1,339

Amortization 479 402

Operating income $ß 1,968 $ß1,909

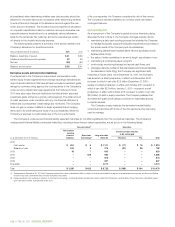

(1) Earnings before interest, taxes, depreciation and amortization (EBITDA) does not have any standardized meaning prescribed by IFRS-IASB and is therefore unlikely to be comparable

to similar measures presented by other issuers; EBITDA is defined by the Company as operating revenues less goods and services purchased and employee benefits expense.

TELUS has issued guidance on, and reports, EBITDA because it is a key measure that management uses to evaluate performance of its business and is also utilized in measuring

compliance with certain debt covenants.

(2) Total capital expenditures (CAPEX).