Telus 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138 . TELUS 2011 ANNUAL REPORT

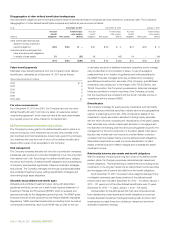

Other defined benefit pension plans

In addition to the foregoing plans, the Company has non-registered,

non-contributory supplementary defined benefit pension plans which

have the effect of maintaining the earned pension benefit once the

allowable maximums in the registered plans are attained. As is common

with non-registered plans of this nature, these plans are primarily

funded only as benefits are paid.

The Company has three contributory, non-indexed defined benefit

pension plans arising from a pre-merger acquisition which comprise less

than 1% of the Company’s total accrued benefit obligation; these plans

ceased accepting new participants in September 1989.

Other defined benefit plans

Other defined benefit plans, which are all non-contributory, are com-

prised of a disability income plan, a healthcare plan for retired employees

and a life insurance plan. The healthcare plan for retired employees

and the life insurance plan ceased accepting new participants effective

January 1, 1997. In connection with the collective agreement signed

in 2005, an external supplier commenced providing a new long-term

disability plan effective January 1, 2006. The existing disability income

plan will continue to provide payments to previously approved claimants

and qualified eligible employees.

Telecommunication Workers Pension Plan

Certain employees in British Columbia are covered by a negotiated-

cost, target-benefit union pension plan. Company contributions are

determined in accordance with provisions of negotiated labour contracts,

the current one of which is in effect until December 31, 2015, and are

generally based on employee gross earnings. The Company is

not required to guarantee the benefits or assure the solvency of the

plan and is not liable to the plan for other participating employers’

obligations. For the years ended December 31, 2011 and 2010, the

Company’s contributions comprised substantially all of the employer

con tributions to the union pension plan; similarly, substantially all

of the plan parti cipants were active and retired employee participants

of the Company.

British Columbia Public Service Pension Plan

Certain employees in British Columbia are covered by a public service

pension plan. Contributions are determined in accordance with provisions

of labour contracts negotiated by the Province of British Columbia and

are generally based on employee gross earnings.

Defined contribution pension plans

The Company offers two defined contribution pension plans, which are

contributory, and are the Company-sponsored pension plans available

to non-unionized and certain unionized employees. Generally, employees

annually can choose to contribute to the plans at a rate of between 3%

and 6% of their pensionable earnings. The Company will match 100% of

the contributions of the employees up to 5% of their pensionable earn-

ings and will match 80% of employee contributions greater than that.

Generally, membership in a defined contribution pension plan is voluntary

until an employee’s third-year service anniversary. In the event that annual

contributions exceed allowable maximums, excess amounts are in

certain cases contributed to a non-registered supplementary defined

contribution pension plan.

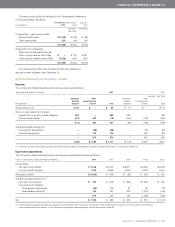

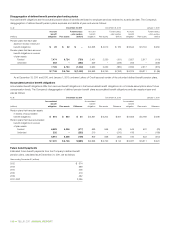

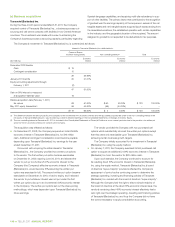

(a) Defined benefit plans – funded status overview

Information concerning the Company’s defined benefit plans, in aggregate, is as follows:

Pension benefit plans Other benefit plans

(millions) 2 0 11 2010 2 0 11 2010

Accrued benefit obligation:

Balance at beginning of year $ 6,958 $ß6,376 $ 75 $ 71

Current service cost 110 103 1 –

Interest cost 360 368 2 5

Actuarial loss (gain) arising from:

Demographic assumptions (26) (32) (2) 1

Financial assumptions 700 484 4 3

Benefits paid (354) (341) (5) (5)

Balance at end of year 7,748 6,958 75 75

Plan assets:

Fair value at beginning of year 6,765 6,316 29 30

Return on plan assets

Expected long-term rate of return on plan assets 474 454 1 1

Actual return on plan assets greater (less) than

expected long-term rate of return on plan assets (461) 169 – –

Contributions

Employer contributions (e) 297 137 1 3

Employees’ contributions 30 30 – –

Benefits paid (354) (341) (5) (5)

Fair value at end of year 6,751 6,765 26 29

Effect of asset ceiling limit

Beginning of year 5 5 – –

Effect of experience related underwriting agreement – – 2 –

End of year 5 5 2 –

Fair value of plan assets at end of year, net of asset ceiling limit 6,746 6,760 24 29

Funded status – plan surplus (deficit) $ß(1,002) $ß (198) $ß(51) $ß(46)