Telus 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 119

FINANCIAL STATEMENTS & NOTES: 2 – 3

expense concepts of “interest cost” and “return on plan assets”

will be replaced with the concept of “net interest”. Net interest for

each plan is the product of the plan’s surplus (deficit) multiplied

by the discount rate. Unchanged is that the amended standard

does not prescribe where in the results of operations the net interest

amount is to be presented, but the Company expects that it will

present such amount as a component of financing costs upon

application of the amended standard.

As the Company’s current view, consistent with long-term historical

experience, is that the expected long-term rate of return on plan

assets would exceed the discount rate (a result of targeting a sig-

nificant percentage of the defined benefit plan assets to be invested

in equity securities), the relative effect of the amended stan dard is

expected to be a decrease in net income and associated per share

amounts. The variance, if any, between the actual rate of return on

defined benefit plan assets and the discount rate, as well as related

effects from the limit on defined benefit assets, if any, would be

included in other comprehensive income as a re-measurement. The

amended standard is not expected to affect the Company’s statement

of financial position or the statement of cash flows.

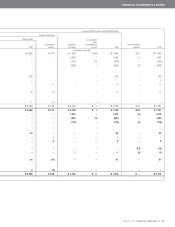

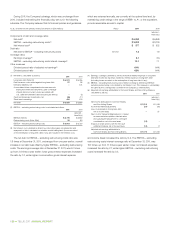

The amended standard affects the Company’s Consolidated Statements of Income and Other Comprehensive Income as follows:

Years ended December 31 (millions except per share amounts) 2 0 11 2010

As currently Amended As currently Amended

reported IAS 19 effects Pro forma reported IAS 19 effects Pro forma

Operating expenses

Employee benefits expense $ß1,893 $ß 113 $ß2,006 $ß1,906 $ß 82 $ß1,988

Financing costs $ 377 6 $ 383 $ 522 5 $ 527

Income taxes $ 376 (30) $ 346 $

335 (22) $ 313

Net income (89) (65)

Other comprehensive income

Item never subsequently reclassified to income

Defined benefit plans re-measurements $ß (851) 89 $ß (762) $ß (214) 65 $ß (149)

Comprehensive income $ß – $ß –

Net income per Common Share and Non-Voting Share

Basic $ß 3.76 $ß(0.28) $ß 3.48 $ß 3.27 $ß(0.20) $ß 3.07

Diluted $ß 3.74 $ß(0.28) $ß 3.46 $ß 3.27 $ß(0.20) $ß 3.07

The Company currently plans to initially apply the amended standard for periods beginning on or after January 1, 2013.

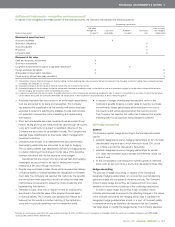

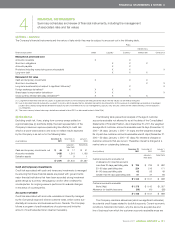

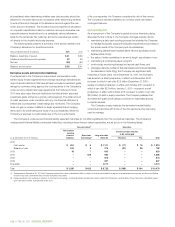

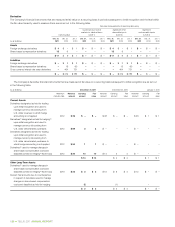

3CAPITAL STRUCTURE FINANCIAL POLICIES

Summary review of the Company’s objectives, policies and processes

for managing its capital structure

The Company’s objectives when managing capital are: (i) to maintain a

flexible capital structure that optimizes the cost and availability of capital

at acceptable risk; and (ii) to manage capital in a manner that considers

the interests of equity and debt holders.

In the management and definition of capital, the Company includes

Common Share and Non-Voting Share equity (excluding accumulated

other comprehensive income), long-term debt (including any associated

hedging assets or liabilities, net of amounts recognized in accumulated

other comprehensive income), cash and temporary investments and

securitized accounts receivable.

The Company manages its capital structure and makes adjustments

to it in the light of changes in economic conditions and the risk charac-

teristics of the underlying assets. In order to maintain or adjust its capital

structure, the Company may adjust the amount of dividends paid to

holders of Common Shares and Non-Voting Shares, purchase shares for

cancellation pursuant to permitted normal course issuer bids, issue new

shares, issue new debt, issue new debt to replace existing debt with

different characteristics and/or increase or decrease the amount of trade

receivables sold to an arm’s-length securitization trust.

The Company monitors capital utilizing a number of measures,

including: net debt to earnings before interest, taxes, depreciation and

amortization – excluding restructuring costs (EBITDA – excluding

restructuring costs); and dividend payout ratios.

Net debt to EBITDA – excluding restructuring costs is calculated

as net debt at the end of the period divided by twelve-month trailing

EBITDA – excluding restructuring costs. This measure, historically, is

substantially the same as the leverage ratio covenant in the Company’s

credit facilities. Net debt and EBITDA – excluding restructuring costs

are measures that do not have any standardized meanings prescribed

by IFRS-IASB and are therefore unlikely to be comparable to similar

measures presented by other issuers; the calculations of these measures

are as set out in the following schedule. Net debt is one component

of a ratio used to determine compliance with debt covenants.

The reported dividend payout ratio is calculated as the quarterly

dividend declared per Common Share and Non-Voting Share, as recorded

in the financial statements, multiplied by four and divided by the sum

of basic earnings per share for the most recent four quarters for interim

reporting periods (divided by annual basic earnings per share for fiscal

years); the reported dividend payout ratio of adjusted net earnings

differs in that it excludes: income tax-related adjustments; the loss on

redemption of long-term debt; and the ongoing impacts of share options

with the net-cash settlement feature.