Telus 2011 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 . TELUS 2011 ANNUAL REPORT

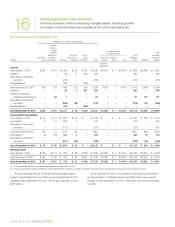

Had the weighted average assumptions for grants of share option

awards that are reflected in the expense disclosures above been varied by

10% and 20%, the compensation cost arising from share option awards

for the year ended December 31, 2011, would have varied as follows:

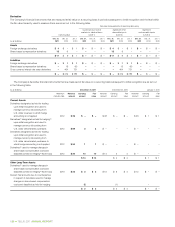

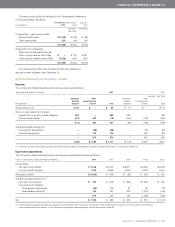

Hypothetical change

in assumptions(1)

($ in millions) 10% 20%

Risk free interest rate $ß – $ß –

Expected lives (years) $ß – $ß –

Expected volatility $ß 1 $ß 2

Dividend yield $ß 1 $ß 1

(1) These sensitivities are hypothetical and should be used with caution. Favourable

hypothetical changes in the assumptions result in a decreased amount, and

unfavourable hypothetical changes in the assumptions result in an increased amount,

of the compensation cost arising from share option awards. As the figures indicate,

changes in fair value based on a 10% variation in assumptions generally cannot be

extrapolated because the relationship of the change in assumption to the change

in fair value may not be linear; in particular, variations in expected lives are constrained

by vesting periods and legal lives. Also, in this table, the effect of a variation in a

particular assumption on the amount of the compensation cost arising from share

option awards is calculated without changing any other assumption; in reality,

changes in one factor may result in changes in another (for example, increases

in risk free interest rates may result in increased dividend yields), which might

magnify or counteract the sensitivities.

Some share option awards have a net-equity settlement feature.

The optionee does not have the choice of exercising the net-equity

settle ment feature; it is at the Company’s option whether the exercise

of a share option award is settled as a share option or settled using

the net-equity settlement feature.

Share option awards accounted for as liability instruments

Substantially all of the Company’s outstanding share option awards

that were granted prior to January 1, 2005, have a net-cash settlement

feature; the optionee has the choice of exercising the net-cash settlement

feature. The affected outstanding share option awards largely take on

the characteristics of liability instruments rather than equity instruments.

For the outstanding share option awards that were amended and were

granted subsequent to 2001, the minimum expense recognized for them

will be their grant-date fair values.

The Company has entered into a cash-settled equity swap

agreement that establishes a cap on the Company’s cost associated

with substantially all of the affected outstanding share option awards.

The following table sets out the number of affected outstanding

share option awards (all of which are for Non-Voting Shares granted

subsequent to 2001) and the composition of their capped exercise-

date fair values.

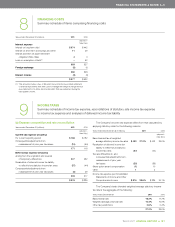

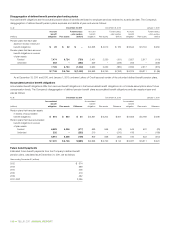

As at December 31, 2011

($ in millions except per affected outstanding share option award)

Weighted average exercise price $ 15.91

Weighted average grant-date fair value 4.85

Incremental expense arising from net-cash settlement feature 34.39

Exercise-date fair value capped by cash-settled equity

swap agreement $ 55.15

Affected share option awards outstanding 66,300

Aggregate intrinsic value(1) $ß 3

(1) The aggregate intrinsic value is calculated upon the December 31, 2011, per share

price of $54.64 for Non-Voting Shares. The difference between the aggregate intrinsic

value amount in this table and the amount disclosed in Note 24(a) is the effect, if any,

of recognizing no less than the expense arising from the grant-date fair values for the

affected share option awards outstanding.

(c) Restricted stock units

The Company uses restricted stock units as a form of incentive com-

pensation. Each restricted stock unit is nominally equal in value to one

Non-Voting Share together with the dividends that would have arisen

thereon had it been an issued and outstanding Non-Voting Share; the

notional dividends are recorded as additional issuances of restricted

stock units during the life of the restricted stock unit. Due to the notional

dividend mechanism, the grant-date fair value of restricted stock units

equals the fair market value of the corresponding shares at the grant date.

The restricted stock units become payable when vesting is completed.

The restricted stock units typically vest over a period of 33 months

(the requisite service period). The vesting method of restricted stock

units, which is determined on or before the date of grant, may be

either cliff or graded. The associated liability is normally cash-settled.

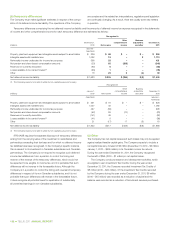

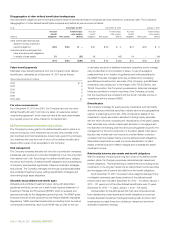

The following table presents a summary of the activity related to the Company’s restricted stock units.

Years ended December 31 2 0 11 2010

Weighted

Weighted

Number of restricted stock units average grant- Number of restricted stock units average grant-

Non-vested Vested date fair value Non-vested Vested date fair value

Outstanding, beginning of period

Non-vested 1,359,066 – $ß32.46 1,385,091 – $ß37.76

Vested – 24,689 31.86 – 24,226 37.03

Issued

Initial award 801,137 – 46.75 754,057 – 33.82

In lieu of dividends 83,717 59 49.98 90,384 44 40.18

Vested (627,281) 627,281 31.57 (771,417) 771,417 43.11

Settled in cash – (636,078) 31.62 – (770,998) 43.28

Forfeited and cancelled (144,803) – 35.91 (99,049) – 36.89

Outstanding, end of period

Non-vested 1,471,836 – $ß40.60 1,359,066 – $ß32.46

Vested – 15,951 38.39 – 24,689 31.86