Telus 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

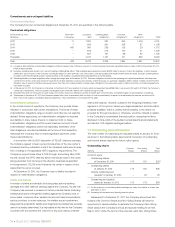

66 . TELUS 2011 ANNUAL REPORT

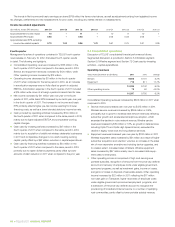

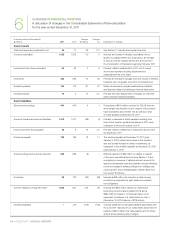

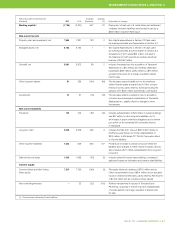

Financial position at December 31 Changes Changes

($ millions) 2 0 11 2010 ($ millions) (%) Explanation of changes

Current assets

Cash and temporary investments, net 46 17 29 171 See Section 7: Liquidity and capital resources

Accounts receivable 1,428 1,318 110 8 Includes an increase in wireless receivables due to

growth in postpaid ARPU and subscribers, an increase

in accrued vendor rebates earned and amounts from

the consolidation of Transactel beginning February 2011

Income and other taxes receivable 66 62 4 6 Primarily reflects instalments for 2011, net of current

income tax expense including adjustments for

reassessments for prior years

Inventories 353 283 70 25

Primarily an increase in average cost and volume of wireless

handsets due to a greater proportion of smartphones

Prepaid expenses 144 113 31 27 Mainly an increase in prepaid maintenance contracts

and deposits related to building an Internet data centre

Derivative assets 14 4 10 n/m Primarily fair value adjustments to hedges for restricted

share units and wireless handsets

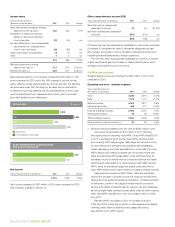

Current liabilities

Short-term borrowings 404 400 4 1 Comprised of $400 million received by TELUS from the

arm’s-length securitization trust in respect of securitized

trade receivables (see Section 7.6), as well as a draw

on bank facilities at December 31, 2011

Accounts payable and accrued liabilities 1,419 1,477 (58) (4) Primarily a decrease in trade payables resulting from

lower fourth quarter capital expenditures in 2011 when

compared to the fourth quarter of 2010

Income and other taxes payable 25 6 19 n/m Primarily reflects a difference in instalments and income

tax expense in 2011

Dividends payable 188 169 19 11 The dividend payable at December 31, 2011 (paid

January 3, 2012) reflects an increase in the dividend

rate and a small increase in shares outstanding, as

compared to the dividend payable at December 31, 2010

(paid January 4, 2011)

Advance billings and customer deposits 655 658 (3) – Reflects payment of $53 million of rebates in respect

of the price cap deferral account (see Section 7.1) and

recognition in revenues of deferral account amounts for

approved broadband build and disability access initiatives,

net of an increase in advance billings from wireless sub-

scriber growth, and a reclassification of $23 million from

non-current Provisions

Provisions 88 122 (34) (28) Includes a $48 million net reduction in restructuring

provisions as payments for past initiatives exceeded

new obligations

Current maturities of long-term debt 1,066 847 219 26 Includes the $300 million Series CC 4.5% Notes

becoming current (maturing March 2012) and a

$662 million increase in commercial paper, net of

repayment of matured U.S. dollar Notes on June 1

(December 31, 2010 balance of $736 million)

Derivative liabilities – 419 (419) (100) Includes settlement of derivative liabilities associated with

the June 2011 maturity of U.S. dollar Notes (December 31

balance of $404 million), fair value adjustments for share

options and unwinding option hedges

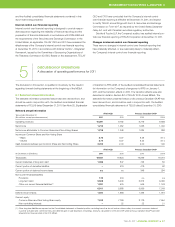

6CHANGES IN FINANCIAL POSITION

A discussion of changes in the Consolidated statements of financial position

for the year ended December 31, 2011