Telus 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 . TELUS 2011 ANNUAL REPORT

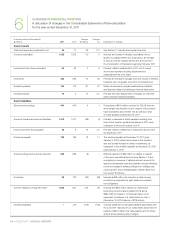

.The Company’s critical accounting estimates affect line items on the Consolidated statements of income and other comprehensive income, and line

items on the Consolidated statements of financial position, as follows:

Consolidated statements of income and other comprehensive income

Other

comprehensive

Operating expenses

income (Item never

Goods and Employee Amortization subsequently

Operating services benefits of intangible reclassified

Consolidated statements of financial position revenues purchased expense Depreciation assets to income)

Accounts receivable X

Inventories X

Property, plant and equipment, net X

Intangible assets, net, and Goodwill, net(1) X

Investments X

Employee defined benefit pension plans X X(2) X

(2) X

(1) Accounting estimate, as applicable to intangible assets with indefinite lives and goodwill, primarily affects the Company’s wireless cash-generating unit.

(2) Accounting estimate impact due to internal labour capitalization rates.

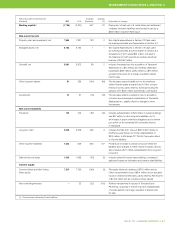

Accounts receivable

General

.The Company considers the business area that gave rise to

the accounts receivable, performs statistical analysis of portfolio

delinquency trends and performs specific account identification

when determining its allow ance for doubtful accounts.

.Assumptions underlying the allowance for doubtful accounts

include portfolio delinquency trends and specific account assess-

ments made when performing specific account identification.

.These accounting estimates are in respect of the Accounts

receivable line item on the Company’s Consolidated statements

of financial position comprising approximately 7% of Total assets

at December 31, 2011 (7% at December 31, 2010, and 6% at

January 1, 2010). If the future were to adversely differ from manage-

ment’s best estimates of the fair value of the residual cash flows and

the allowance for doubtful accounts, the Company could experience

a doubtful account expense in the future. Such a doubtful account

expense does not result in a cash outflow.

The allowance for doubtful accounts

.The estimate of the Company’s allowance for doubtful accounts

could materially change from period to period due to the allowance

being a function of the balance and composition of accounts

receivable, which can vary on a month-to-month basis. The variance

in the balance of accounts receivable can arise from a variance in

the amount and composition of operating revenues and from variances

in accounts receivable collection performance.

Inventories

The allowance for inventory obsolescence

.The Company determines its allowance for inventory obsolescence

based upon expected inventory turnover, inventory aging, and

current and future expectations with respect to product offerings.

.Assumptions underlying the allowance for inventory obsolescence

include future sales trends and offerings and the expected inventory

requirements and inventory composition necessary to support

these future sales offerings. The estimate of the Company’s allow-

ance for inventory obsolescence could materially change from

period to period due to changes in product offerings and consumer

acceptance of those products.

.This accounting estimate is in respect of the Inventories line item on

the Company’s Consolidated statements of financial position, which

comprises approximately 2% of Total assets at December 31, 2011

(1% at December 31, 2010 and January 1, 2010). If the allowance for

inventory obsolescence were inadequate, the Company could expe-

rience a charge to Goods and services purchased expense in the

future. Such an inventory obsolescence charge does not result in a

cash outflow.

Property, plant and equipment, net; Intangible assets, net;

and Goodwill, net

General

.The Property, plant and equipment, net, line item on the Company’s

Consolidated statements of financial position represents approximately

40% of Total assets at December 31, 2011 (40% at December 31,

2010 and January 1, 2010).

.The Intangible assets, net, line item represents approximately 31%

of Total assets at December 31, 2011 (31% at December 31, 2010

and 32% at January 1, 2010). Included in Intangible assets, wireless

spectrum licences represent approximately 24% of Total assets at

December 31, 2011 (25% at December 31, 2010 and January 1, 2010).

.The Goodwill, net, line item represents approximately 18% of Total

assets at December 31, 2011 (18% at December 31, 2010 and

January 1, 2010).

.If TELUS’ estimated useful lives of assets were incorrect, it could

experience increased or decreased charges for amortization of intangi-

ble assets or depreciation in the future. If the future were to adversely

differ from management’s best estimate of key economic assumptions

and associated cash flows were to materially decrease, the Company

could potentially experience future material impairment charges

in respect of its property, plant and equipment assets, its intangible

assets or its goodwill. If intangible assets with indefinite lives were

determined to have finite lives at some point in the future, the Company

could experience increased charges for amortization of intangible

assets. Such charges do not result in a cash outflow and of them-

selves would not affect the Company’s immediate liquidity.