Telus 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 69

MANAGEMENT’S DISCUSSION & ANALYSIS: 7

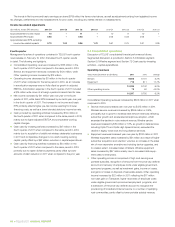

.Wireline segment capital expenditures increased by $81 million

in 2011 when compared to 2010. The increase in expenditures was

mainly due to investments in Optik TV growth and service capabil-

ities, new Internet data centres and gigabit passive optical network

(GPON) technology, partly offset by lower expenditures for imple-

menting large enterprise deals and lower expenditures for broadband

network expansion due to the substantial completion of the VDSL2

technology overlay in 2011.

Wireline capital intensity was 26% in 2011, up from 25% in 2010,

while wireline cash flow (adjusted EBITDA less capital expenditures)

was $236 million in 2011, down $136 million or 37% from 2010.

7.3 Cash used by financing activities

Cash used by financing activities decreased by $410 million in 2011

when compared to 2010.

.Cash proceeds received from Common Shares and Non-Voting

Shares issued for the exercise of options was $24 million in 2011

as compared to $15 million in 2010.

.Cash dividends paid to holders of Common Shares and Non-Voting

Shares were $642 million in 2011, or an increase of $169 million from

2010. For dividends declared after March 1, 2011, the Company

switched to purchasing shares on the open market with no discount,

rather than issuing shares from treasury at a 3% discount, which

results in increased cash outflows. The increase also results from

a higher dividend rate of circa 10% and a slightly higher number

of shares outstanding in 2011.

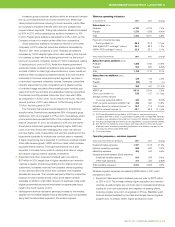

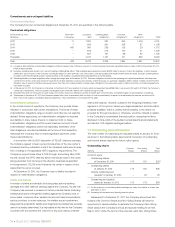

.Commercial paper, short-term borrowings and bank facilities

The Company often shifts among short-term financing sources to

take advantage of interest cost differentials. The Company’s commer-

cial paper program provides low-cost funds and is fully backed up

by the five-year committed credit facility.

Commercial paper outstanding at December 31, 2011, was

$766 million as compared to $104 million at the end of 2010. Commer-

cial paper decreased by $216 million during the second half of 2011

after increasing by $878 million in the first half of 2011 to help fund:

(i) the June 1 repayment of matured U.S. dollar Notes and settle

related cross currency interest rate swap agreements; (ii) a discre-

tionary contribution of $200 million to defined benefit pension plans

in January; (iii) acquisition of certain independent TELUS-branded

wireless dealerships in the first quarter; and (iv) increases in TELUS’

economic interest in Transactel (Barbados) Inc. For comparison,

commercial paper in 2010 decreased by $420 million in the second

half of the year after increasing by $57 million in the first half of

the year.

Short-term borrowings are comprised primarily of amounts

advanced to the Company from an arm’s-length securitization trust

pursuant to transfer of receivables securitization transactions (see

Section 7.6 Sale of trade receivables). Proceeds from securitized trade

receivables were $400 million at December 31, 2011, unchanged since

the first quarter of 2010 when proceeds were reduced by $100 million.

Draws on bank facilities were $4 million at December 31, 2011, and

$nil at December 31, 2010.

No amounts were drawn against the Company’s five-year credit

facilities in 2011 or 2010. See Section 7.5.

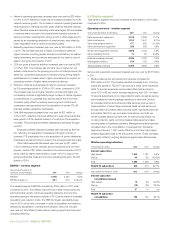

.Long-term debt issue in May 2011; maturity of U.S. dollar Notes

in June 2011

On May 25, 2011, the Company successfully closed a $600 million

public offering of 3.65% Series CI five-year Notes. Net proceeds

of the offering, combined with commercial paper issues, were applied

to repayment of the June 1 maturity of U.S.$741 million, 8% Notes

and accrued interest, as well as to the settlement of associated cross

currency interest rate swap agreements. The Series CI Notes are

redeemable at the option of the Company, in whole at any time, or in

part from time to time, and contain certain change of control provisions.

.Long-term debt issue in July 2010; early partial redemption of U.S.

dollar Notes in September 2010

In the third quarter of 2010, TELUS successfully closed a $1 billion

public offering of 5.05%, Series CH, 10-year Notes. The Company

used the net proceeds to fund the early partial redemption of

U.S.$607 million publicly held 8% U.S. dollar Notes, as well as pay-

ments to terminate cross currency interest rate swap agreements

associated with the redeemed Notes. The early redemption resulted

in a third quarter 2010, pre-tax charge of $52 million, or approximately

$37 million after tax (12 cents per share).

.Acquisition of additional equity interest in subsidiary from

non-controlling interest

The effects of TELUS exercising its second purchased call option

in respect of Transactel (Barbados) Inc. included that the Company

recorded a second quarter 2011, post-acquisition equity transaction

with the vendor for the incremental 44% economic interest for

$51 million cash. Cash flows that are changes in invest ments in con-

trolled entities, and which do not also result in a change in control,

are presented as financing activities in the Consolidated statement

of cash flows when the entity concept of consolidation theory

required by IFRS is applied.

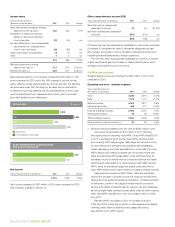

10

09

INCREASE (DECREASE) IN DEBT

AND SHORT-TERM BORROWINGS ($ millions)

11 126

(494)

10

10

09

DIVIDENDS DECLARED ($ millions)

11 715

642

10