Telus 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 . TELUS 2011 ANNUAL REPORT

The discussion in this section is qualified in its entirety by the Caution regarding forward-looking statements at the beginning of the MD&A.

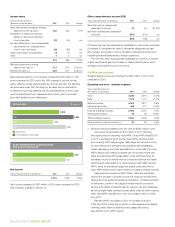

4.1 Principal markets addressed and competition

Wireless: National services for consumers and businesses

TELUS capability Competition overview

Licensed national wireless spectrum.

Total coverage of 99% of the Canadian population at December 31, 2011,

including network access agreements.

Digital LTE 4G network launched in 14 urban areas on February 10, 2012,

including reciprocal network access agreements with Bell Canada

.Manufacturer-rated peak data download speeds of up to 75 Mbps

(typical speeds of 12 to 25 Mbps expected)

.Roaming on HSPA+ network outside LTE urban coverage.

Digital 4G HSPA+ network launched in November 2009

.HSPA+ wireless network coverage of 33.8 million or more than 97%

of the Canadian population, facilitated by reciprocal network access

agreements with Bell Canada and SaskTel

.Dual-cell capability market-launched in March 2011 with manufacturer-

rated peak data download speeds of up to 42 Mbps (expected

average download speed of 7 to 14 Mbps with a compatible device,

while actual speed may vary by device being used, topography

and environmental conditions, network congestion, signal strength,

and other factors)

.International roaming to more than 200 countries

.Improved capability for international roaming revenue, previously

limited to roaming from CDMA and Mike service users, primarily

from the U.S.

.Enabled an optimal transition to LTE technology and services.

Mature networks:

.Digital PCS (CDMA) network, including a 3G high-speed evolution

data optimized (EVDO) Revision A overlay

.iDEN network Mike service, a Push to Talk service focused on the

commercial marketplace.

Interconnection with TELUS’ wireline networks.

Services and products offered:

.Data – Web browsing, social networking, messaging, TELUS mobile

TV®, video on demand, Rdio, downloadable music, and the latest

wireless mobile applications

.Digital voice – Postpaid, Pay & Talk® prepaid and Mike services,

including TELUS Push To Talk®

.Devices – Leading smartphones, mobile Internet keys, mobile Wi-Fi

devices and tablets.

Facilities-based national competitors Rogers Wireless and Bell Mobility,

and provincial telecommunications companies SaskTel and MTS Mobility.

Resellers of competitors’ wireless networks.

New entrants:

.Four new entrants offered services throughout 2011 and 2010

.One additional new entrant is expected to begin offering services

in 2012, while two others have not disclosed plans

.Other new entrants that acquired advanced wireless services (AWS)

spectrum in 2008 may enter the market in 2012 or later

.Shaw Communications chose to build metropolitan Wi-Fi networks

rather than build and launch conventional wireless services using

its AWS spectrum (see discussion of assumptions in Section 1.4)

.Potential for alliances and integrations among regional new entrants.

4CAPABILITIES

Factors that affect the capability to execute strategies, manage key

performance drivers and deliver results