Telus 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 79

MANAGEMENT’S DISCUSSION & ANALYSIS: 9

The discussion in this section is qualified in its entirety by the Caution

regarding forward-looking statements at the beginning of the MD&A.

9.1 Telecommunications industry

Canada’s economic growth slowed to an estimated 2.4% in 2011 from

3.2% in 2010. The Bank of Canada reported in its January 2012 Monetary

Policy

Report that it expects Canada’s economic growth to be 2.0%

in 2012 and 2.8% in 2013. Western Canadian provincial economies are

projected to grow at the fastest rates, due to strong global demand

for commodities.

In 2011, revenues in the Canadian telecommunications industry

(including TV and excluding media) grew by an estimated 3% to just

over $51 billion, with wireless and data services continuing to be

growth engines for the sector. Offsetting this growth was continued

wireline indus try weakness in legacy voice service revenues. Bell

Canada (excluding media) and its affiliated companies represented

about 34% of the total industry revenue.

As one of the largest telecommunications companies in Canada,

TELUS generated $10.4 billion in revenues in 2011, or approximately 20%

of the total industry revenue. TELUS’ annual revenue increased by 6.2%,

with wireless revenues and wireline data revenue representing 77% of

total revenues (74% in 2010). The Company has targeted consolidated

revenue growth of 3 to 6% in 2012.

9.2 Wireless

The Canadian wireless industry experienced continued growth in 2011

with estimated year-over-year revenue and EBITDA increases of approx-

imately 4.5% and 2%, respectively (5% and 3%, respectively, in 2010).

The Canadian wireless market continues to grow at a healthy pace

with an estimate of more than 1.6 million new subscribers in 2011 com-

pared to 1.7 million in 2010. This reflects an increase in the penetration

rate in 2011 of approximately 4.3 per centage points to just over 77% of

the population, compared to an increase of approximately 4.4 percentage

points in 2010. The wireless penetration rate in Canada is expected

to increase further in 2012 by between 4.0 and 4.5 percentage points.

At 77% penetration, the wireless market in Canada continues to

support good growth, which is indicated by the generally comparable

market in the U.S. that has a penetration rate of approximately 101%.

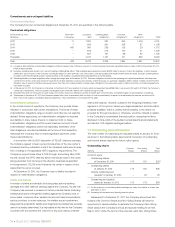

Estimated wireless industry growth factors

2010 2011 2012

Market penetration

of population – Canada 73% 77% 81 to 82%

Market penetration

of population – U.S. 97% 101% 105 to 106%

Data usage (percentage

of ARPU) – Canada 25% 30% 35%

Data usage (percentage

of ARPU) – U.S. 34% 39% 44%

Sources: TELUS estimates and company reports.

Wireless penetration rates in many countries in Western Europe have

significantly surpassed 100%. These rates are not exactly comparable

to Canada for several reasons, including:

.Canada’s wireline local service rates are among the lowest of

Organization for Economic Co-operation and Development countries,

and are priced as flat-rate monthly charges that include all local calls

to wireless phones, while Europe has a calling party pays regime

for wireline local calls

.The tendency in Europe for individuals to have multiple wireless

subscriptions on a single handset, in order to arbitrage roaming

charges among different carriers, also inflates subscription numbers

and understates average revenue per user

.Canada has a much lower population density, as shown in the

following table, which affects the economic efficiency and speed

of providing coverage by next generation technologies to 99%

of the population.

Historically, these factors have reduced the demand for wireless

substitution in Canada as compared to Europe. Yet despite these market

and geographic differences, TELUS provides 4G HSPA+ wireless cover-

age to more than 97% of Canada’s population and launched even faster

LTE services in 14 urban centres in February 2012.

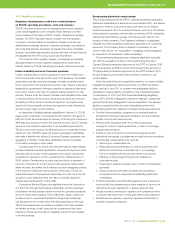

Wireless comparison

Canada U.S. Europe

Total land area (square km) 9 million 9 million 10 million

Subscriptions per square km

of network deployed(1) 12 37 131

Population estimates, 2011 34.7 million 313 million 731 million

(1) Nordicity report – June 2011.

A key driver of wireless revenue growth continues to be the increased

adoption and usage of data services such as messaging, social net-

working, web browsing, application usage, gaming and video-streaming.

In 2011, wireless data in Canada represented an estimated 30% of

industry ARPU. This compares to approximately 39% in the U.S., 31% in

Europe and 52% in Asia-Pacific, suggesting a significant ongoing growth

opportunity in Canada. The higher proportion of data usage in Asia is

due in part to a very low rate of penetration of wireline Internet to house-

holds in many Asian countries. The higher proportion of data usage in

the U.S. is due in part to the introduction of the iPhone by Apple two years

earlier than in Canada.

This data growth is being driven by the increasing availability, model

range and popularity of iPhone, Android and BlackBerry smartphones, as

well as increased adoption of tablets and mobile Internet keys. Increasing

sales of more expensive smartphones are impacting industry margins.

With a multi-year sales agreement, there is usually a large upfront device

subsidy provided to the customer that initially results in a negative return,

but also provides higher ARPU and lower churn rates, which result in

higher average lifetime revenue and value. Tablet devices oper ating on

mobile networks or Wi-Fi are expected to be a growth seg ment in 2012.

Customers increasingly want mobile connectivity to the Internet, and

are increasingly using enhanced portable computing services.

9GENERAL OUTLOOK

Expectations for the telecommunications industry in 2012