Telus 2011 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166 . TELUS 2011 ANNUAL REPORT

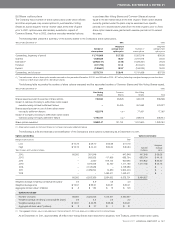

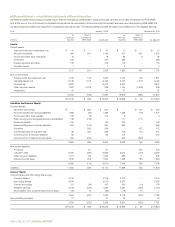

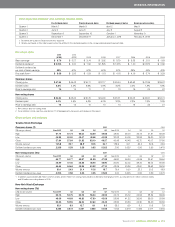

(d) Reconciliations – consolidated statements of financial position

Generally accepted accounting principles require that the Company’s shareholders’ equity previously reported at the date of transition to IFRS-IASB

and at the end of the most recently completed annual period be reconciled to those amounts that would have been reported applying IFRS-IASB; the

corresponding reconciliation is required for comparative periods as well. The following table provides the equity reconciliations for the requisite periods.

As at January 1, 2010 December 31, 2010

As Effect of As Effect of

previously transition to previously transition to

(millions) reported IFRS-IASB As adjusted reported IFRS-IASB As adjusted

Assets

Current assets

Cash and temporary investments, net $ 41 $ – $ 41 $ 17 $ – $ 17

Accounts receivable 694 501 1,195 917 401 1,318

Income and other taxes receivable 16 – 16 56 6 62

Inventories 270 – 270 283 – 283

Prepaid expenses and other 105 – 105 113 – 113

Derivative assets 1 – 1 4 – 4

1,127 501 1,628 1,390 407 1,797

Non-current assets

Property, plant and equipment, net 7,729 103 7,832 7,722 109 7,831

Intangible assets, net 5,148 1,018 6,166 5,134 1,018 6,152

Goodwill, net 3,572 – 3,572 3,572 – 3,572

Other long-term assets 1,602 (1,316) 286 1,744 (1,509) 235

Investments 41 – 41 37 – 37

18,092 (195) 17,897 18,209 (382) 17,827

$ß19,219 $ 306 $ß19,525 $ß19,599 $ 25 $ß19,624

Liabilities and Owners’ Equity

Current liabilities

Short-term borrowings $ – $ 500 $ 500 $ – $ 400 $ 400

Accounts payable and accrued liabilities 1,385 (49) 1,336 1,495 (18) 1,477

Income and other taxes payable 182 (8) 174 6 – 6

Restructuring accounts payable and accrued liabilities

135 (135) – 111 (111) –

Dividends payable 150 – 150 169 – 169

Advance billings and customer deposits 674 (144) 530 658 – 658

Provisions – 299 299 – 122 122

Current maturities of long-term debt 82 467 549 743 104 847

Current portion of derivative liabilities 62 – 62 419 – 419

Current portion of deferred income taxes 294 (294) – 348 (348) –

2,964 636 3,600 3,949 149 4,098

Non-current liabilities

Provisions – 91 91 – 204 204

Long-term debt 6,090 (467) 5,623 5,313 (104) 5,209

Other long-term liabilities 1,271 63 1,334 638 11 649

Deferred income taxes 1,319 203 1,522 1,498 185 1,683

8,680 (110) 8,570 7,449 296 7,745

Liabilities 11,644 526 12,170 11,398 445 11,843

Owners’ Equity

Common Share and Non-Voting Share equity

Common Shares 2,216 – 2,216 2,219 – 2,219

Non-Voting Shares 3,070 – 3,070 3,237 – 3,237

Contributed surplus 181 (14) 167 190 (14) 176

Retained earnings 2,159 (225) 1,934 2,551 (425) 2,126

Accumulated other comprehensive income (loss) (72) 19 (53) (18) 19 1

7,554 (220) 7,334 8,179 (420) 7,759

Non-controlling interests 21 – 21 22 – 22

7,575 (220) 7,355 8,201 (420) 7,781

$ß19,219 $ 306 $ß19,525 $ß19,599 $ 25 $ß19,624