Telus 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 . TELUS 2011 ANNUAL REPORT

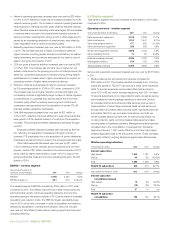

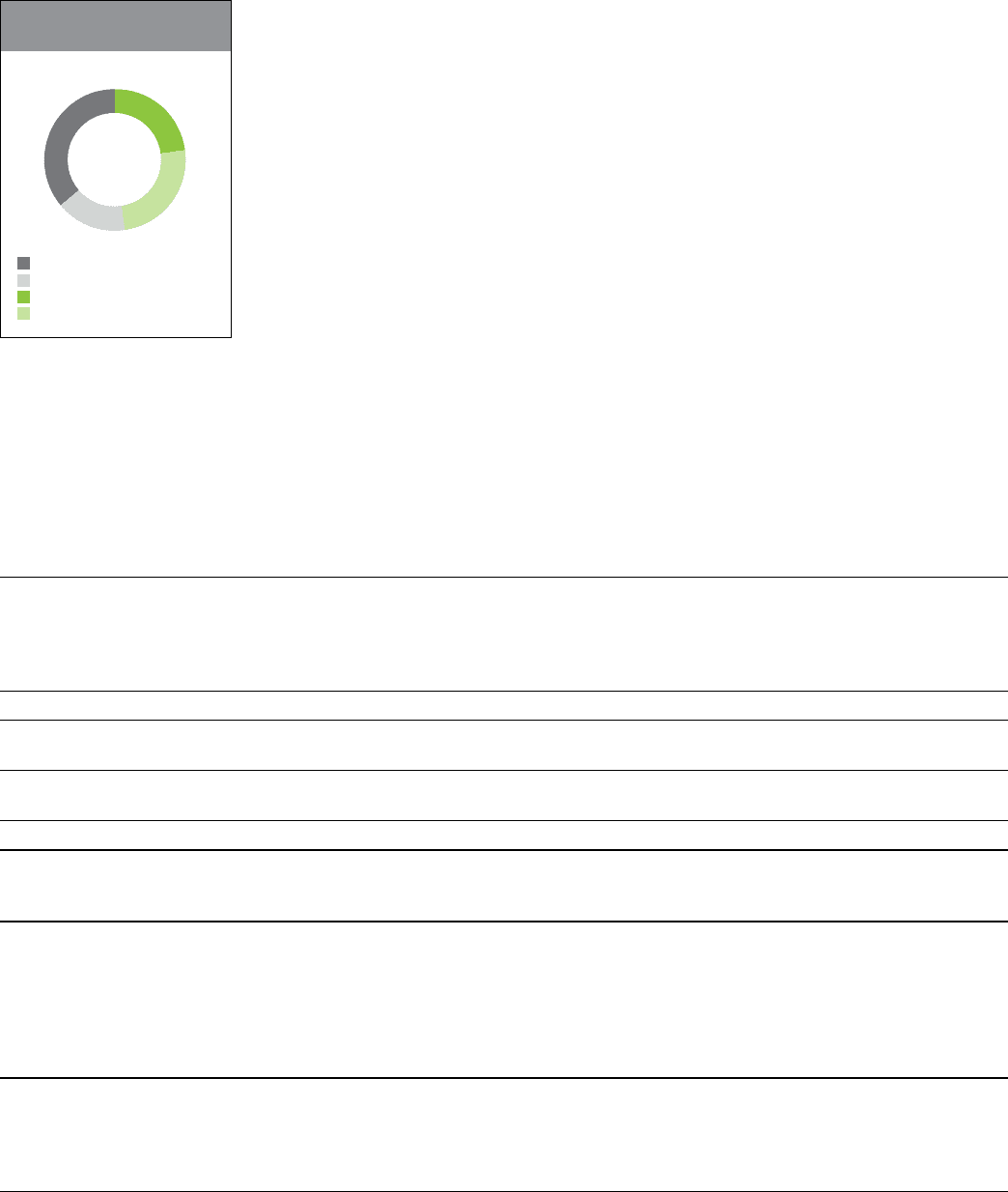

wireless voice and other

wireless data

wireline voice and other

wireline data

36%

16%

25%

2011 REVENUE MIX –

77% WIRELESS AND DATA

23%

Differences among the three

calendar years in the preceding

table include:

.Operating revenues –

Combined wireless revenue

and wireline data revenue

represents

approximately 77%

of consolidated

revenues

in 2011, as compared to 74%

in 2010 and 71% in 2009.

Legacy wireline voice revenues

continue to be eroded by

competi

tion and technological

substitution.

.Net income – Includes income

tax-related adjustments resulting

from legislated income tax changes, settlements and tax reassess-

ments for prior years, including any related interest. These adjustments

positively impacted Net income by $21 million (six cents per share) in

2011, by $30 million (nine cents per share) in 2010 and by $165 million

(52 cents per share) in 2009.

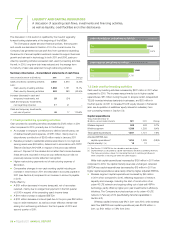

.Long-term debt – The increase in current maturities of long-term debt

in 2011 includes $300 million of Notes coming due in March 2012

and an increase in commercial paper, net of repayment of matured

U.S. dollar Notes in June 2011. The increase in the non-current

portion of long-term debt in 2011 reflects the $600 million Note issue

in May 2011 to help fund repayment of U.S. dollar Notes, net of the

$300 million Notes that became current.

.Current portion of derivative liabilities – The decrease in 2011

reflects settlement of cross currency interest rate swap agreements

associated with repayment of U.S. dollar Notes in June 2011

(see Section 7.3 Cash used by financing activities).

.Other non-current financial liabilities – The increase in 2011

is primarily due to an increase in pension and other post-retirement

liabilities, as a result of a lower defined benefit pension plan discount

rate and lower pension plan investment returns, partly offset by

funding. At December 31, 2009, other non-current financial liabilities

included a $721 million derivative liability associated with U.S. dollar

denominated debt. The remaining $404 million derivative liability

associated with the U.S. dollar debt was current at December 31,

2010, and settled in mid-2011.

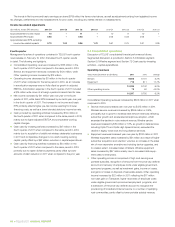

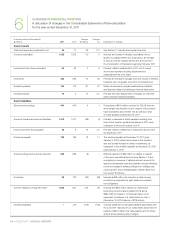

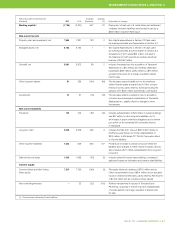

5.2 Summary of quarterly results and fourth quarter recap

($ in millions, except

per share amounts) 2011 Q4 2011 Q3 2011 Q2 2011 Q1 2010 Q4 2010 Q3 2010 Q2 2010 Q1

Operating revenues 2,690 2,622 2,554 2,531 2,554 2,461 2,400 2,377

Operating expenses

Goods and services purchased

1,316 1,178 1,134 1,098 1,235 1,036 997 968

Employee benefits expense 500 476 470 447 478 484 478 466

Depreciation and amortization 481 443 442 444 445 433 409 454

2,297 2,097 2,046 1,989 2,158 1,953 1,884 1,888

Operating income 393 525 508 542 396 508 516 489

Financing costs 87 92 94 104 105 185 117 115

Income before income taxes 306 433 414 438 291 323 399 374

Income taxes 69 107 90 110 65 72 97 101

Net income 237 326 324 328 226 251 302 273

Net income attributable to

Common Shares and

Non-Voting Shares 246 325 321 327 225 250 301 272

Net Income per Common Share

and Non-Voting Share

– Basic 0.76 1.00 0.99 1.01 0.70 0.78 0.94 0.85

– Diluted 0.75 1.00 0.98 1.00 0.70 0.78 0.94 0.85

Cash dividends declared

per Common Share

and Non-Voting Share 0.58 0.55 0.55 0.525 0.525 0.50 0.50 0.475

Additional information

EBITDA(1) 874 968 950 986 841 941 925 943

Restructuring costs

included in EBITDA

and Operating income 16 3 12 4 38 17 19 6

(1) A non-GAAP measure (see Section 11.1 EBITDA). Equivalent to Operating income before depreciation and amortization expenses.