Telus 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 . TELUS 2011 ANNUAL REPORT

.Basic earnings per share (EPS) increased by 49 cents or 15%

in 2011. Excluding items shown in the following table, basic EPS

increased by approximately 33 cents or 10% in 2011.

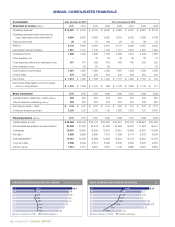

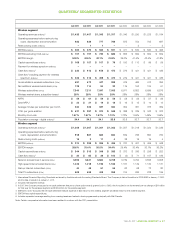

Analysis of basic EPS

Years ended December 31 ($) 2 0 11 2010 Change

Basic EPS 3.76 3.27 0.49

Deduct after-tax Transactel gain (0.04) – (0.04)

Add back third quarter 2010 after-tax

loss on redemption of debt per share – 0.12 (0.12)

Add back third quarter 2010 after-tax

regulatory financing charge per share – 0.03 (0.03)

Deduct net favourable income

tax-related adjustments per share

(see Section 5.2) (0.06) (0.09) 0.03

EPS before above items (approximate) 3.66 3.33 0.33

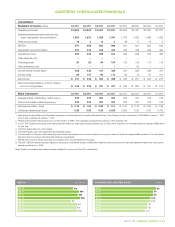

.Cash dividends declared per Common Share and Non-Voting Share

in 2011 totalled $2.205, an increase of 20.5 cents or 10.3% when com-

pared to 2010. On February 8, 2012, the Board of Directors declared

a quarterly dividend of 58 cents per share on the issued and out-

standing Common Shares and Non-Voting Shares of the Company,

payable on April 2, 2012, to shareholders of record at the close of

business on March 9, 2012. The 58 cent per share dividend declared

for the first quarter of 2012 reflects an increase of 5.5 cents or 10.5%

from the dividend one year earlier.

In addition, on February 21, 2012, the Board of Directors declared

a quarterly dividend of 61 cents per share on the issued and out-

standing Common Shares and Non-Voting Shares of the Company,

payable on July 3, 2012, to shareholders of record at the close of

business on June 8, 2012. The 61 cents per share dividend declared

for the second quarter of 2012 reflects an increase of six cents

or 10.9% from the dividend one year earlier. This is consistent with

TELUS’ dividend growth model (see 2012 financing and capital

struc ture management plans in Section 4.3). In the event that the

proposed share conversion of Non-Voting Shares to Common

Shares on a one-for-one basis (see Capital structure financial policies

in Section 4.3) receives all requisite approvals and is effective prior

to the dividend record date of June 8, 2012, holders of record

on such date who previously held Non-Voting Shares would hold

Common Shares and would therefore receive the same dividend

as all other holders of Common Shares.

Liquidity and capital resource highlights

.TELUS had unutilized credit facilities of $1.28 billion at December 31,

2011, as well as $100 million availability under the Company’s trade

receiv ables securitization program, consistent with its objective of

generally main taining more than $1 billion of unutilized liquidity. On

November 3, 2011, TELUS entered into a $2 billion bank credit facility

expiring in 2016 with a syndicate of financial institutions. This new

facility replaced the Company’s pre-existing committed credit facility

that would have expired in May 2012.

.Net debt to EBITDA – excluding restructuring costs was 1.8 times

at December 31, 2011, unchanged from December 31, 2010, as an

increase in net debt since the beginning of the year was offset by

improved EBITDA before restructuring costs. The ratio remains within

the Company’s long-term target policy range of 1.5 to 2.0 times.

.Cash provided by operating activities decreased by $120 million

in 2011 when compared to 2010, mainly due to the discretionary

$200 million contribution to defined benefit pension plans in January

2011, as well as price cap deferral account rebate payments in 2011

in accor dance with CRTC Telecom Decision 2010-639, partly offset

by lower income tax payments, higher adjusted EBITDA and lower

interest paid.

.Cash used by investing activities increased by $237 million in

2011 mainly due to a $126 million increase in capital expenditures

(see Building national capabilities in Section 2.2) and acquisitions.

Invest ments of $81 million were made in 2011 to purchase certain

independent TELUS-branded wireless dealerships, and $20 million was

invested to increase TELUS’ equity interest in Transactel (Barbados) Inc.

(see Partnering, acquiring and divesting in Section 2.2).

.Cash used by financing activities decreased by $410 million in 2011

when compared to 2010, primarily due to debt reduction activities

in 2010, partially offset by increased dividend payments in 2011.

Dividend payments increased due to a higher dividend rate and the

change in practice to purchasing shares for reinvested dividends

on the market rather than issuing shares from treasury.

In the second quarter of 2011, the Company successfully closed

a $600 million public offering of 3.65% five-year Notes. Proceeds

from the issue, as well as cash provided by commercial paper issues,

were used to fund the repayment of matured 8% U.S. dollar Notes

and accrued interest, and settle associated cross currency interest

rate swap agreements. The U.S. dollar Notes had an effective interest

rate of 8.5%. In addition, financing activities for 2011 included the

$51 million acquisition of an additional equity interest in Transactel

made in the second quarter, which, being a cash flow that is a

change in investment in a controlled entity that does not also result

in a change in control, is presented as a financing activity in the

Consolidated statement of cash flows when the entity concept of

consolidation theory required by IFRS is applied.

.Free cash flow increased by $58 million in 2011 when compared

to 2010, mainly due to higher EBITDA and lower interest and

income tax payments, partly offset by higher capital expenditures

and increased contributions to defined benefit plans, including

a discretionary $200 million contribution in January 2011.

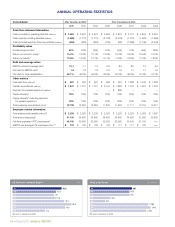

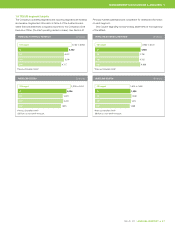

1.4 Performance scorecard (key performance measures)

TELUS achieved or exceeded three of its four original consolidated

targets and all four of its original 2011 segment targets, announced

on December 14, 2010. The consolidated target for capital expenditure

levels was not met due to an acceleration of the Company’s timeline

to com mence building its urban LTE wireless network, success-based

expenditures resulting from very strong Optik TV subscriber loadings,

and accelerated software purchases at year-end. Targets for consoli-

dated, wireless and wireline revenues were exceeded due to strong

growth in data revenues, driven by successful efforts to win and retain

wireless postpaid subscribers and expand the wireline TV and Internet

subscriber bases, as well as price increases for TV and Internet.

Achievement of the original consolidated EBITDA and earnings targets

resulted from higher than targeted revenues offset by increased costs

to acquire and retain wireless subscribers and increased programming

and support costs for TELUS TV.

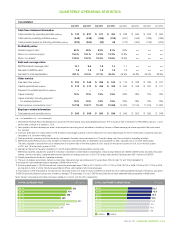

The Company updated annual guidance on August 5, 2011,

increasing expected 2011 revenues and capital expenditures and reaf-

firming target ranges for EBITDA and basic EPS (see footnote 1 of the

following Scorecard table). The August guidance was reaffirmed in

the third quarter MD&A released on November 4, 2011, and in the 2012