Telus 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 123

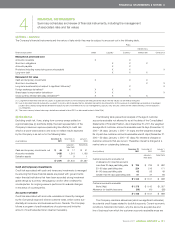

FINANCIAL STATEMENTS & NOTES: 4

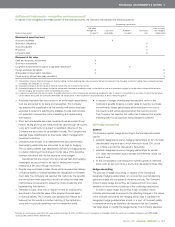

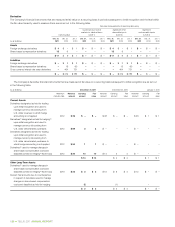

Non-derivative Derivative

Non-interest

Long-term debt Other financial liabilities

As at bearing All except Currency swaps amounts Currency swaps amounts

December 31, 2010 financial Short-term finance Finance to be exchanged(2) to be exchanged

(millions) liabilities borrowings(1) leases(1)(2) leases (Receive) Pay Other (Receive) Pay Total

(adjusted –

Note 25(d))

2 011

First quarter $ß1,173 $ß 1 $ 161 $ß 3 $ß – $ – $ß13 $ß(116) $ß118 $ß 1,353

Balance of year 229 5 1,012 5 (766) 1,183 – (190) 191 1,669

2012 1 403 597 – – – – – – 1,001

2013 – – 583 – – – – – – 583

2014 – – 958 – – – – – – 958

2015 – – 851 – – – – – – 851

Thereafter 1 – 4,266 – – – – – – 4,267

Total $ß1,404 $ß409 $ß8,428 $ß 8 $ (766) $ß1,183 $ß13 $ß(306) $ß309 $ß10,682

Total $ß8,853

(1) Interest payment cash outflows in respect of short-term borrowings, commercial paper and amounts drawn under the Company’s credit facilities (if any) have been calculated based

upon the rates in effect as at December 31, 2010.

(2) The amounts included in undiscounted non-derivative long-term debt in respect of the U.S. dollar denominated long-term debt, and the corresponding amounts included in the long-term

debt currency swaps receive column, have been determined based upon the rates in effect as at December 31, 2010. The U.S. dollar denominated long-term debt contractual maturity

amounts, in effect, are reflected in the long-term debt currency swaps pay column as gross cash flows are exchanged pursuant to the cross currency interest rate swap agreements.

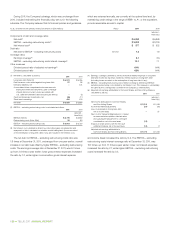

Non-derivative Derivative

Non-interest

Long-term debt Other financial liabilities

As at bearing All except Currency swaps amounts Currency swaps amounts

January 1, 2010 financial Short-term finance Finance to be exchanged(2) to be exchanged

(millions) liabilities borrowings(1) leases(1)(2) leases (Receive) Pay Other (Receive) Pay Total

(Note 25(d))

2010

First quarter $ß1,023 $ß 1 $ 502 $ß 1 $ß – $ – $ß51 $ß (75) $ß 77 $ß 1,580

Balance of year 309 3 418 1 (113) 175 9 (95) 95 802

2011 – 4 1,726 1 (1,473) 2,152 – – – 2,410

2012 – 502 546 – – – – – – 1,048

2013 – – 532 – – – – – – 532

2014 – – 907 – – – – – – 907

Thereafter 1 – 3,813 – – – – – – 3,814

Total $ß1,333 $ß510 $ß8,444 $ß 3 $ß(1,586) $ß2,327 $ß60 $ß(170) $ß172 $ß11,093

Total $ß9,188

(1) Interest payment cash outflows in respect of short-term borrowings, commercial paper and amounts drawn under the Company’s credit facilities (if any) have been calculated based

upon the rates in effect as at January 1, 2010.

(2)

The amounts included in undiscounted non-derivative long-term debt in respect of the U.S. dollar denominated long-term debt, and the corresponding amounts included in the long-term

debt currency swaps receive column, have been determined based upon the rates in effect as at January 1, 2010. The U.S. dollar denominated long-term debt contractual maturity

amounts, in effect, are reflected in the long-term debt currency swaps pay column as gross cash flows are exchanged pursuant to the cross currency interest rate swap agreements.

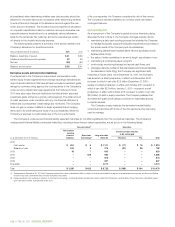

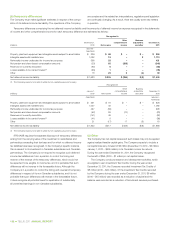

(d) Currency risk

The Company’s functional currency is the Canadian dollar, but it regularly

transacts in U.S. dollars due to certain routine revenues and operating

costs being denominated in U.S. dollars, as well as sourcing some

inventory purchases and capital asset acquisitions internationally. The

U.S. dollar is the only foreign currency to which the Company has a

significant exposure.

The Company’s foreign exchange risk management includes the

use of foreign currency forward contracts and currency options to fix the

exchange rates on short-term U.S. dollar denominated transactions and

commitments. Hedge accounting is applied to these short-term foreign

currency forward contracts and currency options only on a limited basis.

As discussed further in Note 20(b), the Company was also exposed

to currency risks in that the fair value or future cash flows of its U.S.

dollar denominated long-term debt would fluctuate because of changes

in foreign exchange rates. Currency hedging relationships were

established for the related semi-annual interest payments and principal

payment at maturity.

Net income and other comprehensive income for the years ended

December 31, 2011 and 2010, could have varied if Canadian dollar:

U.S. dollar exchange rates varied from the actual transaction date rates.

The following Canadian dollar: U.S. dollar exchange rate sensitivity

analysis is based upon a hypothetical change having occurred through-

out the reporting period (other than no change is reflected as at the

statement of financial position date – see (g)) and having been applied to

all relevant Consolidated Statement of Income and Other Comprehensive

Income transactions. The income tax expenses, which are reflected

net in the sensitivity analysis, reflect the applicable weighted average

statutory income tax rates for the reporting periods.