Telus 2011 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154 . TELUS 2011 ANNUAL REPORT

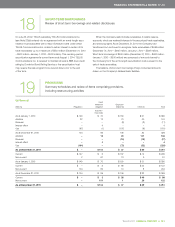

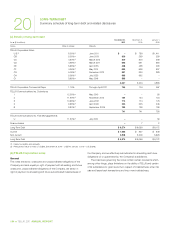

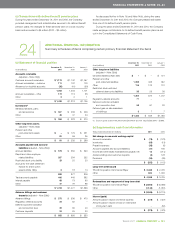

20 LONG-TERM DEBT

Summary schedule of long-term debt and related disclosures

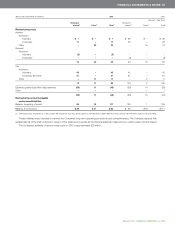

(a) Details of long-term debt

December 31, December 31, January 1,

As at ($ in millions) 2 0 11 2010 2010

Series Rate of interest Maturity

TELUS Corporation Notes

U.S.(2) 8.00%(1) June 2011 $ – $ 736 $ß1,411

CB 5.00%(1) June 2013 300 299 299

CC 4.50%(1) March 2012 300 300 299

CD 4.95%(1) March 2017 692 691 690

CE 5.95%(1) April 2015 498 498 498

CF 4.95%(1) May 2014 698 698 697

CG 5.05%(1) December 2019 991 990 989

CH 5.05%(1) July 2020 993 992 –

CI 3.65%(1) May 2016 595 – –

5,067 5,204 4,883

TELUS Corporation Commercial Paper 1.16% Through April 2012 766 104 467

TELUS Communications Inc. Debentures

1 12.00%(1) May 2010 – – 50

2 11.90%(1) November 2015 124 124 124

3 10.65%(1) June 2021 174 174 173

5 9.65%(1) April 2022 245 245 245

B 8.80%(1) September 2025 198 198 198

741 741 790

TELUS Communications Inc. First Mortgage Bonds

U 11.50%(1) July 2010 – – 30

Finance leases – 7 2

Long-Term Debt $ß6,574 $ß6,056 $ß6,172

Current $ß1,066 $ 847 $ 549

Non-current 5,508 5,209 5,623

Long-Term Debt $ß6,574 $ß6,056 $ß6,172

(1) Interest is payable semi-annually.

(2) Principal face value of notes is U.S.$NIL (December 31, 2010 – U.S.$741; January 1, 2010 – U.S.$1,348).

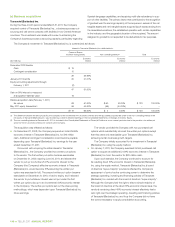

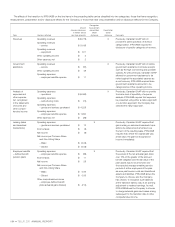

(b) TELUS Corporation notes

General

The notes are senior, unsecured and unsubordinated obligations of the

Company and rank equally in right of payment with all existing and future

unsecured, unsubordinated obligations of the Company, are senior in

right of payment to all existing and future subordinated indebtedness of

the Company, and are effectively subordinated to all existing and future

obligations of, or guaranteed by, the Company’s subsidiaries.

The indentures governing the notes contain certain covenants which,

among other things, place limitations on the ability of TELUS and certain

of its subsidiaries to: grant security in respect of indebtedness, enter into

sale and lease-back transactions and incur new indebtedness.