Telus 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

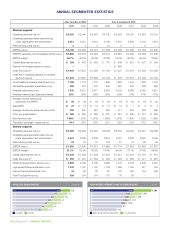

46 . TELUS 2011 ANNUAL REPORT

Consolidated 2012 targets

See Caution regarding forward-looking statements at the beginning

of the MD&A.

10

09

08

07

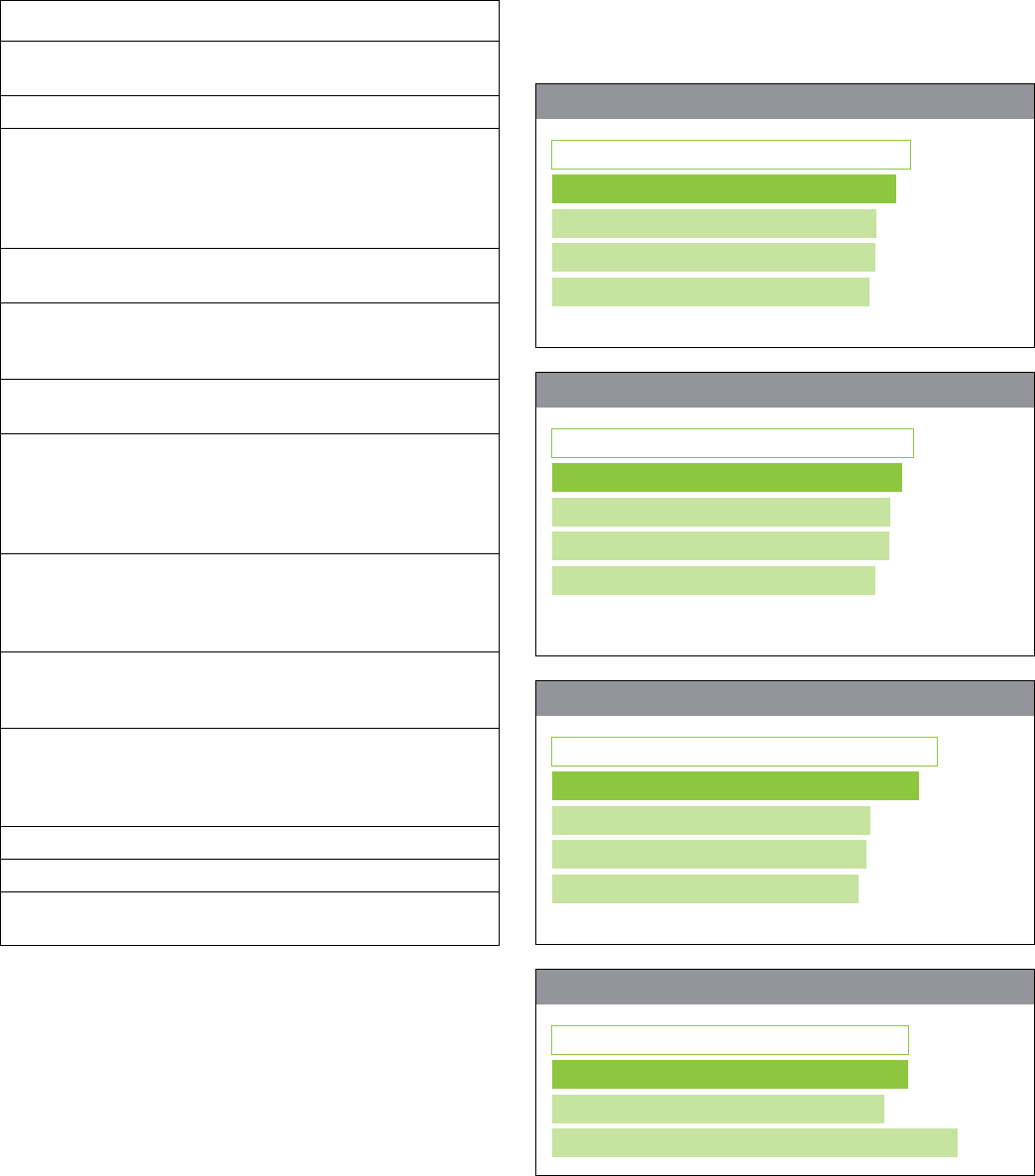

CONSOLIDATED REVENUE ($ millions)

12 target 10,700 to 11, 000

9,779

9,606

10,397

9,792

11

10

10*

09*

*Previous Canadian GAAP

10

09

08

07

CONSOLIDATED EBITDA ($ millions)

12 target 3,800 to 4,000

3,643

3,491

3,778

3,650

11

10

10*

09*

*Previous Canadian GAAP

EBITDA is a non-GAAP measure.

10

09

08

07

BASIC EARNINGS PER SHARE ($)

12 target 3.75 to 4.15

3.23

3.14

3.76

3.27

11

10

10*

09*

*Previous Canadian GAAP

10

09

08

07

CONSOLIDATED CAPITAL EXPENDITURES ($ millions)

12 target approx. 1,850

2,103

1,847

1,721

11

10

09

09*

Assumptions for 2012 targets

Ongoing intense wireless and wireline competition in both business

and consumer markets

Continued downward re-pricing of legacy services

Wireless industry penetration of the Canadian population to increase

between 4.0 and 4.5 percentage points, with wireless industry

subscriber growth to remain robust due to a combination of increased

competition and accelerated adoption of smartphones, tablets

and data applications

TELUS wireless domestic voice ARPU erosion offset by increased data

and international roaming ARPU growth

Wireless acquisition and retention expenses to increase due to

increased loading of more expensive smartphones, including upgrades,

and to support a larger subscriber base

Ongoing investments for deployment of LTE wireless technology

in urban markets

Wireline data revenue growth greater than legacy service revenue

declines due to continued wireline broadband expansion and upgrades

supporting Optik TV and Optik High Speed Internet subscriber sales.

Legacy service revenue declines reflect continued erosion in network

access lines and long distance revenue

A preliminary pension accounting discount rate was confirmed at

4.5% (75 basis points lower than 2011) and the preliminary expected

long-term return was estimated at 6.5% and subsequently set at

6.75% (25 basis points lower than 2011)

A discretionary pension contribution of $100 million was made in

January 2012 (a similar discretionary contribution of $200 million was

made in January 2011)

Approximately $25 million in restructuring costs to support operating

and capital efficiency initiatives, supplemented by value-for-money

initiatives to improve efficiency and effectiveness that do not involve

restructuring charges

Financing costs of approximately $350 million ($377 million in 2011)

Statutory income tax rate of approximately 25 to 26% (27.2% in 2011)

Cash income taxes of approximately $150 to $200 million

($150 million in 2011).