Telus 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

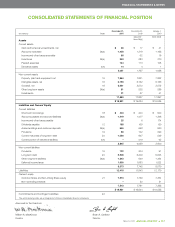

TELUS 2011 ANNUAL REPORT . 107

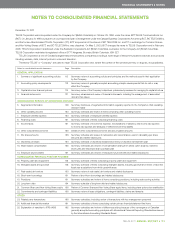

FINANCIAL STATEMENTS & NOTES

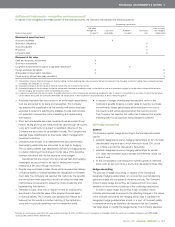

December 31, December 31, January 1,

(en millions) Note 2 0 11 2010 2010

(adjusted – (Note 25(d))

Note 25(d))

Assets

Current assets

Cash and temporary investments, net $ 46 $ 17 $ 41

Accounts receivable 24(a) 1,428 1,318 1,195

Income and other taxes receivable 66 62 16

Inventories 24(a) 353 283 270

Prepaid expenses 144 113 105

Derivative assets 4(h) 14 4 1

2,051 1,797 1,628

Non-current assets

Property, plant and equipment, net 15 7,964 7,831 7,832

Intangible assets, net 16 6,153 6,152 6,166

Goodwill, net 16 3,661 3,572 3,572

Other long-term assets 24(a) 81 235 286

Investments 21 37 41

17,880 17,827 17,897

$ß19,931 $ß19,624 $ß19,525

Liabilities and Owners’ Equity

Current liabilities

Short-term borrowings 18 $ 404 $ 400 $ 500

Accounts payable and accrued liabilities 24(a) 1,419 1,477 1,336

Income and other taxes payable 25 6 174

Dividends payable 12 188 169 150

Advance billings and customer deposits 24(a) 655 658 530

Provisions 19 88 122 299

Current maturities of long-term debt 20 1,066 847 549

Current portion of derivative liabilities 4(h) – 419 62

3,845 4,098 3,600

Non-current liabilities

Provisions 19 122 204 91

Long-term debt 20 5,508 5,209 5,623

Other long-term liabilities 24(a) 1,343 649 1,334

Deferred income taxes 1,600 1,683 1,522

8,573 7,745 8,570

Liabilities 12,418 11,843 12,170

Owners’ equity

Common Share and Non-Voting Share equity 21 7,513 7,759 7,334

Non-controlling interests – 22 21

7,513 7,781 7,355

$ß19,931 $ß19,624 $ß19,525

Commitments and Contingent Liabilities 22

The accompanying notes are an integral part of these consolidated financial statements.

Approved by the Directors:

William A. MacKinnon Brian A. Canfield

Director Director

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION