Telus 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 . TELUS 2011 ANNUAL REPORT

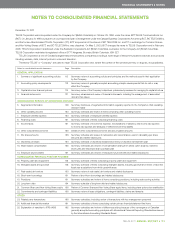

1SUMMARY OF SIGNIFICANT ACCOUNTING PRINCIPLES

Summary review of accounting policies and principles and the methods used

in their application by the Company

The accompanying consolidated financial statements are expressed in

Canadian dollars. The generally accepted accounting principles (GAAP)

used by TELUS are International Financial Reporting Standards as issued

by the International Accounting Standards Board and these consolidated

financial statements comply with International Financial Reporting

Standards as issued by the International Accounting Standards Board

(IFRS-IASB) and Canadian generally accepted accounting principles.

The consolidated financial statements of TELUS for the years ended

December 31, 2011 and 2010, were authorized by TELUS’s Board of

Directors for issue on February 23, 2012.

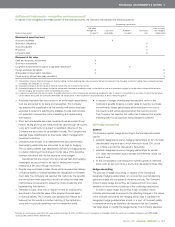

(a) Consolidation

The consolidated financial statements include the accounts of the

Company and all of the Company’s subsidiaries, of which the princi-

pal one is TELUS Communications Inc. Currently, through the TELUS

Communications Company partnership and the TELE-MOBILE

COMPANY partnership, TELUS Communications Inc. includes sub-

stantially all of the Company’s Wireline segment’s operations and

substantially all of the Wireless segment’s operations. With the exception

of non-controlling interests in an immaterial subsidiary held for sale,

all of the Company’s subsidiaries are wholly owned.

The financing arrangements of the Company and all of its subsidiaries

do not impose restrictions on inter-corporate dividends.

On a continuing basis, TELUS reviews its corporate organization

and effects changes as appropriate so as to enhance its value.

This process can, and does, affect which of the Company’s subsidiaries

are considered principal subsidiaries at any particular point in time.

(b) Use of estimates and judgements

The preparation of financial statements in conformity with generally

accepted accounting principles requires management to make

estimates, assumptions and judgements that affect: the reported

amounts of assets and liabilities at the date of the financial statements;

the disclosure of contingent assets and liabilities at the date of the

financial statements; and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ from

those estimates.

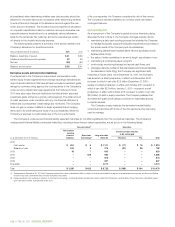

Estimates

Examples of significant estimates and assumptions include:

.the allowance for doubtful accounts;

.the allowance for inventory obsolescence;

.the estimated useful lives of assets;

.the recoverability of tangible assets;

.the recoverability of intangible assets with indefinite lives;

.the recoverability of goodwill;

.the recoverability of long-term investments;

.the amount and composition of income tax assets and income tax

liabilities, including the amount of unrecognized tax benefits; and

.certain actuarial and economic assumptions used in determining

defined benefit pension costs, accrued pension benefit obligations

and pension plan assets.

Judgements

Examples of significant judgements, apart from those involving

estimation, include:

.The Company’s choice to depreciate and amortize its property, plant,

equipment and intangible assets subject to amortization on a straight-

line basis as it believes that this method reflects the consumption

of resources related to the economic lifespan of those assets better

than an accelerated method and is more representative of the

economic substance of the underlying use of those assets.

.The Company’s view that its spectrum licences granted by Industry

Canada will likely be renewed by Industry Canada; that the Company

intends to renew them; and that the Company believes it has the

financial and operational ability to renew them and, thus, they are

deemed to have an indefinite life, as discussed further in Note 16(c).