Telus 2011 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 157

FINANCIAL STATEMENTS & NOTES: 21

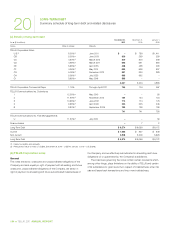

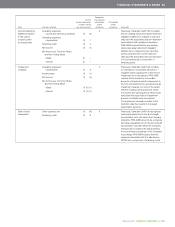

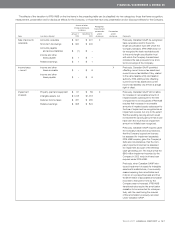

(b) Share option plans

The Company has a number of share option plans under which officers

and other employees may receive options to purchase Non-Voting

Shares at a price equal to the fair market value at the time of grant;

prior to 2001, options were also similarly awarded in respect of

Common Shares. Prior to 2002, directors were also awarded options

to purchase Non-Voting Shares and Common Shares at a price

equal to the fair market value at the time of grant. Share option awards

currently granted under the plans may be exercised over specific

periods not to exceed seven years from the time of grant; prior to 2003,

share option awards were granted with exercise periods not to exceed

ten years.

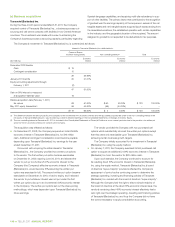

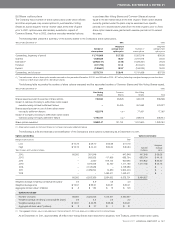

The following table presents a summary of the activity related to the Company’s share option plans.

Years ended December 31 2 0 11 2010

Weighted Weighted

Number of average share Number of average share

share options option price share options option price

Outstanding, beginning of period 11,741,666 $ß37.83 11,057,916 $ß38.08

Granted 1,522,639 46.67 2,787,876 33.00

Exercised(1) (2,963,147) 37.56 (1,329,351) 29.23

Forfeited (617,796) 37.41 (614,941) 39.55

Expired (109,661) 32.57 (159,834) 35.80

Outstanding, end of period 9,573,701 $ß39.41 11,741,666 $ß37.83

(1) The total intrinsic value of share option awards exercised for the year ended December 31, 2011, was $35 million (2010 – $17 million) (reflecting a weighted average price at the dates

of exercise of $49.48 per share (2010 – $41.88 per share)).

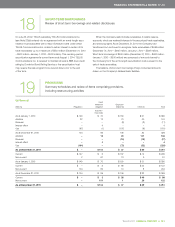

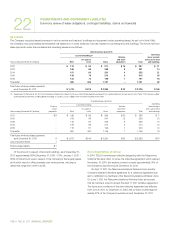

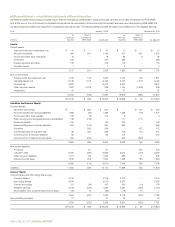

The following table reconciles the number of share options exercised and the associated number of Common Shares and Non-Voting Shares issued.

Years ended December 31 2 0 11 2010

Non-Voting Common Non-Voting

Shares Shares Shares Total

Shares issued pursuant to exercise of share options 745,340 96,526 440,073 536,599

Impact of optionee choosing to settle share option award

exercises using net-cash settlement feature – 25,225 451,652 476,877

Shares issued pursuant to use of share option award

net-equity settlement feature 422,076 n.a.(1) 77,061 77,061

Impact of Company choosing to settle share option award

exercises using net-equity settlement feature 1,795,731 n.a.(1) 238,814 238,814

Share options exercised 2,963,147 121,751 1,207,600 1,329,351

(1) Share option awards for Common Shares do not have a net-equity settlement feature.

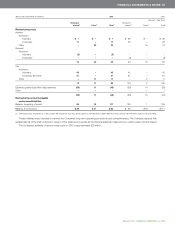

The following is a life and exercise price stratification of the Company’s share options outstanding as at December 31, 2011.

Options outstanding Options exercisable

Range of option prices Total

Low $ß10.75 $ß29.70 $ß44.66 $ß10.75 Weighted

High $ß16.15 $ß44.20 $ß64.64 $ß64.64 Number average

Year of expiry and number of shares of shares price

2012 66,300 381,546 – 447,846 447,846 $ß36.03

2013 – 565,825 117,969 683,794 683,794 $ß44.18

2014 – 2,550 918,142 920,692 915,822 $ß56.50

2015 – 1,375,005 42,160 1,417,165 1,417,165 $ß43.76

2016 – 2,108,589 – 2,108,589 – $ –

2017 – 2,489,824 12,380 2,502,204 – $ –

2018 – – 1,493,411 1,493,411 – $ –

66,300 6,923,339 2,584,062 9,573,701 3,464,627

Weighted average remaining contractual life (years) 0.9 3.9 4.5 4.0

Weighted average price $ß15.91 $ß35.57 $ß50.31 $ß39.41

Aggregate intrinsic value(1) (millions) $ 3 $ 132 $ 13 $ 148

Options exercisable

Number of shares 66,300 2,324,926 1,073,401 3,464,627

Weighted average remaining contractual life (years) 0.9 2.2 2.2 2.2

Weighted average price $ß15.91 $ß42.85 $ß55.36 $ß46.21

Aggregate intrinsic value(1) (millions) $ 3 $ 27 $ 1 $ 31

(1) The aggregate intrinsic value is calculated upon the December 31, 2011, per share price of $54.64 for Non-Voting Shares.

As at December 31, 2011, approximately 28 million Non-Voting Shares were reserved for issuance, from Treasury, under the share option plans.