Telus 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.114 . TELUS 2011 ANNUAL REPORT

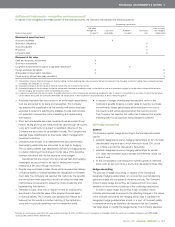

the anticipated effectiveness of designated hedging relationships at

inception and actual effectiveness for each reporting period thereafter.

A designated hedging relationship is considered effective by the

Company if the following critical terms match between the hedging item

and the hedged item: the notional amount of the hedging item and

the principal of the hedged item; maturity dates; payment dates;

and interest rate index (if, and as, applicable). As set out in Note 4(i),

any ineffectiveness, such as would result from a difference between

the notional amount of the hedging item and the principal of the hedged

item, or from a previously effective designated hedging relationship

becoming ineffective, is reflected in the Consolidated Statements of

Income and Other Comprehensive Income as Financing costs if in respect

of long-term debt, as Goods and services purchased if in respect of

U.S. dollar denominated future purchase commitments or as Employee

benefits expense if in respect of share-based compensation.

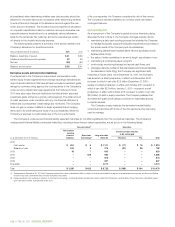

Hedging assets and liabilities

In the application of hedge accounting, an amount (the hedge value) is

recorded on the Consolidated Statements of Financial Position in respect

of the fair value of the hedging items. The net difference, if any, between

the amounts recognized in the determination of net income and the

amount necessary to reflect the fair value of the designated cash flow

hedging items on the Consolidated Statements of Financial Position is

effectively recognized as a component of other comprehensive income,

as set out in Note 10.

In the application of hedge accounting to U.S. dollar denominated

long-term debt that matured in fiscal 2011, the amount recognized in

the determination of net income was the amount that counterbalanced

the difference between the Canadian dollar equivalent of the value of

the hedged items at the rate of exchange at the statement of financial

position date and the Canadian dollar equivalent of the value of the

hedged items at the rate of exchange in the hedging items.

In the application of hedge accounting to the compensation cost

arising from share-based compensation, the amount recognized in the

determination of net income is the amount that counterbalances the

difference between the quoted market price of the Company’s Non-Voting

Shares at the statement of financial position date and the price of the

Company’s Non-Voting Shares in the hedging items.

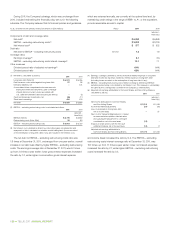

(e) Revenue recognition

General

The Company earns the majority of its revenue (wireless network, data

(including television, Internet, data and information technology managed

services), voice local and voice long distance) from access to, and usage

of, the Company’s telecommunications infrastructure. The majority of

the balance of the Company’s revenue (other and wireless equipment)

arises from providing services and products facilitating access to, and

usage of, the Company’s telecommunications infrastructure.

The Company offers complete and integrated solutions to meet its

customers’ needs. These solutions may involve the delivery of multiple

services and products occurring at different points in time and/or

over different periods of time. As appropriate, these multiple element

arrangements are separated into their component accounting units,

consideration is measured and allocated amongst the accounting units

based upon their relative fair values (derived using Company-specific

objective evidence) and then the Company’s relevant revenue recognition

policies are applied to the accounting units. A limitation cap restricts

the consideration allocated to services or products currently transferred

in multiple element arrangements to an amount that is not contingent

upon the delivery of additional items or meeting other specified perfor-

mance conditions. The Company’s view is that the limitation cap results

in a faithful depiction of the transfer of services and products as it reflects

the telecommunications industry’s generally accepted understanding

of the transfer of services and products as well as reflecting the related

cash flows.

Multiple contracts with a single customer are normally accounted

for as separate arrangements. In instances where multiple contracts are

entered into with a customer in a short period of time, they are reviewed

as a group to ensure that, as with multiple element arrangements,

relative fair values are appropriate.

Lease accounting is applied to an accounting unit if it conveys the

right to use a specific asset to a customer but does not convey the risks

and/or benefits of ownership.

The Company’s revenues are recorded net of any value-added,

sales and/or use taxes billed to the customer concurrent with a revenue-

producing transaction.

When the Company receives no identifiable, separable benefit for

consideration given to a customer (e.g. discounts and rebates), the con-

sideration is recorded as a reduction of revenue rather than as an expense.

Voice local, voice long distance, data and wireless network

The Company recognizes revenues on the accrual basis and includes

an estimate of revenues earned but unbilled. Wireline and wireless service

revenues are recognized based upon access to, and usage of, the

Company’s telecommunications infrastructure and upon contract fees.

Advance billings are recorded when billing occurs prior to rendering

the associated service; such advance billings are recognized as

revenue in the period in which the services are provided. Similarly,

and as appropriate, upfront customer activation and connection fees

are deferred and recognized over the average expected term of the

customer relationship.

The Company follows the liability method of accounting for its quality

of service rate rebate amounts that arise from the jurisdiction of the

Canadian Radio-television and Telecommunications Commission (CRTC).

The CRTC has established a portable subsidy mechanism to

subsidize local exchange carriers, such as the Company, that provide

residential basic telephone service to high cost serving areas. The CRTC

has determined the per network access line/per band portable subsidy

rate for all local exchange carriers. The Company recognizes the portable

subsidy on an accrual basis by applying the subsidy rate to the number

of residential network access lines it has in high cost serving areas, as

further discussed in Note 6. Differences, if any, between interim and final

subsidy rates set by the CRTC are accounted for as a change in estimate

in the period in which the CRTC finalizes the subsidy rate.

Other and wireless equipment

The Company recognizes product revenues, including wireless handsets

sold to re-sellers and customer premises equipment, when the products

are delivered and accepted by the end-user customers. Revenues from

operating leases of equipment are recognized on a systematic and

rational basis (normally a straight-line basis) over the term of the lease.

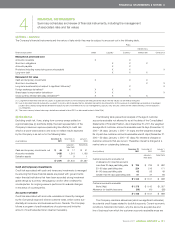

Non-high cost serving area deferral account

On May 30, 2002, and on July 31, 2002, the CRTC issued Decision

2002-34 and Decision 2002-43, respectively, pronouncements that

affected regulated services in the Company’s Wireline segment. In

an effort to foster competition for residential basic service in non-high

cost serving areas, the concept of a deferral account mechanism was

introduced by the CRTC, as an alternative to mandating price reductions.