Telus 2011 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 163

FINANCIAL STATEMENTS & NOTES: 25

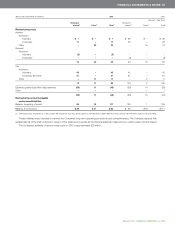

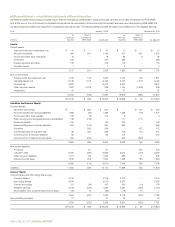

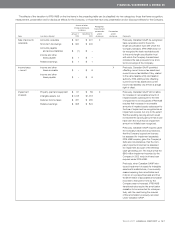

(c) Reconciliations – consolidated statement of income and other comprehensive income

Generally accepted accounting principles require that the Company’s comprehensive income previously reported at the end of the most recently

completed annual period be reconciled to those amounts that would have been reported applying IFRS-IASB; the corresponding reconciliation

is required for comparative periods as well. The following table provides the comprehensive reconciliations for the requisite period.

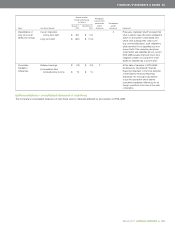

As Effect of

Year ended December 31, 2010 previously transition to

(millions except per share amounts) reported IFRS-IASB As adjusted

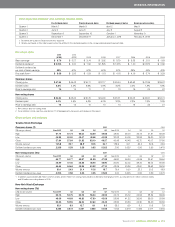

Operating Revenues $ß9,779 $ß(9,779) $ –

Service – 9,131 9,131

Equipment – 611 611

9,779 (37) 9,742

Other operating income – 50 50

9,779 13 9,792

Operating Expenses

Operations 6,062 (6,062) –

Restructuring costs 74 (74) –

Goods and services purchased – 4,236 4,236

Employee benefits expense – 1,906 1,906

Depreciation 1,333 6 1,339

Amortization of intangible assets 402 – 402

7,871 12 7,883

Operating Income 1,908 1 1,909

Other expense, net 32 (32) –

Financing costs 510 12 522

Income Before Income Taxes 1,366 21 1,387

Income taxes 328 7 335

Net Income 1,038 14 1,052

Other Comprehensive Income

Items that may subsequently be reclassified to income

Change in unrealized fair value of derivatives designated as cash flow hedges 54 – 54

Foreign currency translation arising from translating financial statements of foreign operations – – –

54 – 54

Item never subsequently reclassified to income

Employee defined benefit plans actuarial gains (losses) – (214) (214)

54 (214) (160)

Total Comprehensive Income $ß1,092 $ (200) $ 892

Net Income Attributable to:

Common Shares and Non-Voting Shares $ß1,034 $ß 14 $ß1,048

Non-controlling interests 4 – 4

$ß1,038 $ß 14 $ß1,052

Total Comprehensive Income Attributable to:

Common Shares and Non-Voting Shares $ß1,088 $ (200) $ 888

Non-controlling interests 4 – 4

$ß1,092 $ (200) $ 892

Net Income per Common Share and Non-Voting Share

Basic $ß 3.23 $ 0.04 $ß 3.27

Diluted $ß 3.22 $ 0.05 $ß 3.27