Telus 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 55

MANAGEMENT’S DISCUSSION & ANALYSIS: 4

Operational resources Operational risks and risk management

Technology, systems and properties

TELUS is a highly complex technology-dependent company with

a multitude of interconnected wireless and wireline telecommunications

networks, IT systems and processes.

Real properties (owned or leased) include administrative office space,

work centres and space for telecommunications equipment. A small

number of buildings are constructed on leasehold land and the majority

of radio towers are situated on lands or buildings held under leases

or licences for varying terms.

Network facilities are constructed under or along streets and highways,

pursuant to rights-of-way granted by the owners of land such as

municipalities and the Crown, or on freehold land owned by TELUS.

Intangible assets include wireless spectrum licensed from Industry

Canada, which is essential to providing wireless services.

TELUS International provides contact centre and business process

and IT outsourcing by utilizing sophisticated on-site facilities including

call centre solutions, and by utilizing international data networks and

reliable data centres with rigorous privacy and security standards. Global

rerouting and diversity are provided through facilities in North America,

Central America and Asia.

Technology risks (see Section 10.2):

.Wireless spectrum congestion is being experienced in urban markets,

requiring ongoing investments in technology and participation in

future spectrum auctions

.IP-based technology that is replacing legacy technology may not be

feasible or economical in many areas for some time and the Company

will need to support both systems. Convergence of wireless and

wireline voice, Internet and video to a common IP-based application

is very complex and could be accompanied by implementation errors

and system instability.

Process risks – See Section 10.5.

Taxation risks – See Section 10.7.

Health, safety and environment risks (see Section 10.8):

.Increasing adoption of wireless services and expanding wireless competi-

tion have resulted in more public scrutiny of, and opposition to, new radio

towers. Public concerns include aesthetics and perceived health risks

.Increasing stakeholder interest in environmental issues.

Risks associated with legal and regulatory compliance, defects in software

and failures in data and transaction processing, and intellectual property

and proprietary rights – See Section 10.9 Litigation and legal matters.

Human-caused and natural threats to TELUS infrastructure and

operations – See Section 10.10.

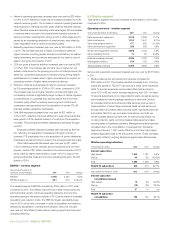

4.3 Liquidity and capital resources

Capital structure financial policies

The Company’s objectives when managing capital are: (i) to maintain a

flexible capital structure that optimizes the cost and availability of capital

at acceptable risk; and (ii) to manage capital in a manner that considers

the interests of equity and debt holders.

In the management and definition of capital, the Company includes

Common Share and Non-Voting Share equity (excluding accumulated

other comprehensive income), long-term debt (including any associated

hedging assets or liabilities, net of amounts recognized in accumulated

other comprehensive income), cash and temporary investments and

securitized trade receivables.

The Company manages its capital structure and makes adjustments

to it in light of changes in economic conditions and the risk character-

istics of the underlying assets. In order to maintain or adjust its capital

struc ture, the Company may adjust the amount of dividends paid to

holders of Common Shares and Non-Voting Shares, purchase shares for

cancellation pursuant to permitted normal course issuer bids, issue new

shares, issue new debt, issue new debt to replace existing debt with

different characteristics and/or increase or decrease the amount of trade

receivables sold to an arm’s-length securitization trust.

The Company monitors capital utilizing a number of measures,

including the net debt to EBITDA – excluding restructuring costs ratio

and the dividend payout ratio. See Section 7.4 Liquidity and capital

resource measures.

Subsequent to December 31, 2011, the Company announced that

holders of its Common Shares and Non-Voting Shares will have the

opportunity to decide whether to eliminate the Company’s Non-Voting

Share class at the Company’s annual and special meeting to be held

May 9, 2012. Under the terms of the proposal, each Non-Voting Share

would be converted into a Common Share on a one-for-one basis,

effected by way of a court-approved plan of arrangement and will be

subject to the approval of two-thirds of the votes cast by the holders

of Common Shares and two-thirds of the votes cast by the holders

of Non-Voting Shares, each voting separately as a class; there can be

no assurance that the proposal will receive voting approval. If this

plan of arrangement is not completed, the market price of Non-Voting

Shares and Common Shares may decline.

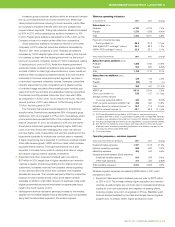

Financing and capital structure management plans

Report on 2011 financing and capital structure management plans

Pay dividends to the holders of TELUS Common Shares and Non-Voting Shares

The fourth quarter dividend of 58 cents per share was paid on January 3, 2012. On February 8, 2012, a first quarter dividend of 58 cents per share was

declared, payable on April 2, 2012, to shareholders of record at the close of business on March 9, 2012. The first quarter dividend reflects an increase

of 10.5% from the dividend one year earlier. On February 21, 2012, the Board of Directors declared a quarterly dividend of 61 cents per share on the issued

and outstanding Common Shares and Non-Voting Shares of the Company, payable on July 3, 2012, to shareholders of record at the close of business on

June 8, 2012. The 61 cents per share dividend declared for the second quarter of 2012 reflects an increase of six cents or 10.9% from the dividend one year

earlier. This is consistent with TELUS’ dividend growth model as discussed in 2012 financing and capital structure management plans following this table.

In the event that the proposed share conversion of Non-Voting Shares to Common Shares on a one-for-one basis (see Capital structure financial policies

above) receives all requisite approvals and is effective prior to the dividend record date of June 8, 2012, holders of record on such date who previously held

Non-Voting Shares would hold Common Shares and would therefore receive the same dividend as all other holders of Common Shares.