Telus 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 41

MANAGEMENT’S DISCUSSION & ANALYSIS: 1

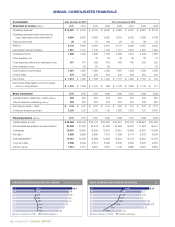

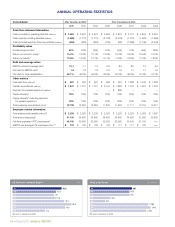

Operating highlights

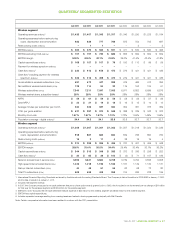

.Consolidated Operating revenues increased by $605 million in

2011 when compared to 2010, surpassing $10 billion for the first time

in 2011.

Service and equipment revenues increased by $583 million in 2011

when compared to 2010. Approximately 67% of the increase was

due to the growth in wireless network revenue, which increased by

8.5% driven by growth in the number of subscribers, growth in data

ARPU related to accelerated smartphone adoption, and increased

roaming revenues.

The remaining increase was due to: (i) growth

in wireline data reve

nues resulting from TV and high-speed Internet

subscriber growth and rate increases, increased equipment sales and

revenues from implemen tation of recent large enterprise customer

deals, as well as revenues from operations of Transactel (Barbados)

Inc. consolidated since February 1, 2011 (see Partnering, acquiring

and divesting in Section 2.2); and (ii) increased wireless equipment

revenues driven

by higher gross subscriber additions, increased

retention volumes, device upgrade revenues, a larger proportion of

higher-priced smart phones in the sales mix, as well as current year

tablet sales. Partly offsetting growth in wireline data revenue is the

continued decline in wireline legacy voice revenues as a result of

competition and substitution to data and wireless services. Partly

offsetting growth in wireless data revenue is the year-over-year

decline in wireless voice revenue due to lower usage as customers

move towards using more texting and data services and reducing

voice calls, as well as competitive pricing.

Other operating income, presented as a separate component

of revenues, increased by $22 million in 2011. The increase includes

a $17 million non-cash gain on Transactel (Barbados) Inc. in 2011;

the gain reflects a re-measurement at fair value when TELUS exer-

cised its purchased call option and asserted control. Transactel

operates call centres in Central America (see Partnering and acquiring

in Section 2.2). The increase also includes higher recoveries of

employee costs under eligible government-sponsored employment

programs, and a drawdown of the price cap deferral account for

provisioning of broadband Internet service to a number of qualifying

rural and remote communities, partly offset by lower portable

subsidy revenues.

Consolidated Operating revenues excluding the non-cash

Transactel gain increased by $588 million or 6.0% in 2011 when

compared to 2010.

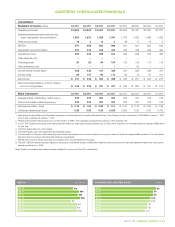

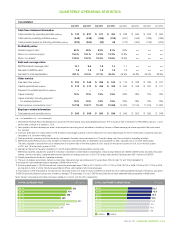

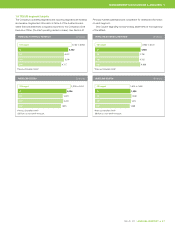

.Subscriber connections increased by 475,000 during 2011

(378,000 in 2010), as a result of 7.4% growth in wireless postpaid

subscribers, 62% growth in TELUS TV subscribers, and a 4.6%

increase in total Internet subscriptions, partly offset by a 6.9%

decrease in wireless prepaid subscribers and a 3.9% decrease in

total network access lines (NALs). Residential NAL losses in 2011

improved by 46,000 as a result of the positive effect of bundled

service offers including Optik TV and Optik High Speed Internet

services following their market launch in June 2010. Business NAL

losses improved by 35,000 in 2011 as additions of wholesale lines

partly offset the effects of increased competition in the small and

medium business market and the ongoing conversion of voice lines

to more efficient IP services. Wireline total subscriber connections

increased by 107,000 in 2011 – the first such wireline increase

since 2004.

The blended monthly wireless subscriber churn rate was 1.68%

in 2011, up from 1.57% in 2010 due to the loss of a federal govern-

ment wireless service contract to a low-priced bid from an incumbent

competitor (a loss of approximately 77,000 subscribers, which added

11 basis points of churn in 2011).

Wireless blended ARPU was $59.10 in 2011, up 2.5% from the

same period in 2010. The increase reflects the 38% growth in data

ARPU resulting from increased use of data services and a higher

penetration of smartphones, as well as increased roaming, partly

offset by lower voice pricing and declining minutes of use. Quarterly

blended ARPU has increased year over year for five consecutive

quarters: 1.0% (Q4 2011), 3.0% (Q3 2011), 2.5% (Q2 2011), 2.7%

(Q1 2011) and 1.9% (Q4 2010). Prior to the fourth quarter of 2010,

blended ARPU had been declining since mid-2007.

.Operating income increased by $59 million in 2011 when com-

pared to 2010. The increase in 2011 was mainly due to a $128 million

increase in EBITDA that was partly offset by higher amortization

expenses. Wireless EBITDA increased by $166 million, driven by 8.5%

growth in network revenue that was partly offset by higher costs of

sub scriber acquisition and retention. Wireline EBITDA decreased

by $38 million as growth in data services, lower restructuring costs

and the $17 million Transactel gain were more than offset by higher

content and support costs for the growing Optik TV service and

ongoing declines in higher margin legacy voice services.

TELUS’ adjusted EBITDA for 2011, which excludes the $17 million

Transactel gain, increased by $111 million when compared to 2010.

The adjusted EBITDA margin decreased by 1.1 percentage points

due to margin pressures in both segments.

.Income before income taxes increased by $204 million in 2011

due to lower Financing costs and increased Operating income.

Financing costs decreased by $145 million year over year primarily

due to lower effective interest rates resulting from $1.6 billion of

refinancing in the second quarter of 2011 and third quarter of 2010.

Income taxes increased by $41 million in 2011 mainly due to

higher pre-tax income, partly offset by a lower blended statutory

income tax rate.

.Net income increased by $163 million or over 15% in 2011 when

compared to 2010. Excluding items shown in the following table,

Net income increased by approximately $112 million or 10% in 2011.

Analysis of Net income

Years ended December 31 ($ millions) 2 0 11 2010 Change

Net income 1,215 1,052 163

Deduct after-tax Transactel gain (12) – (12)

Add back third quarter 2010 after-tax

loss on redemption of debt – 37 (37)

Add back third quarter 2010 after-tax

regulatory financing charge – 11 (11)

Deduct net favourable income

tax-related adjustments,

including any related interest

income (see Section 5.2) (21) (30) 9

Net income before above

items (approximate) 1,182 1,070 112