Telus 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 67

MANAGEMENT’S DISCUSSION & ANALYSIS: 6

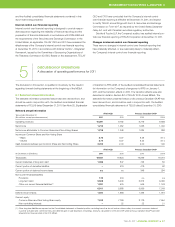

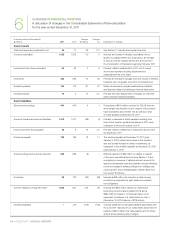

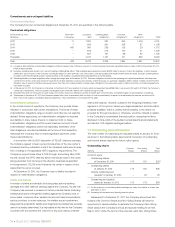

Financial position at December 31 Changes Changes

($ millions) 2 0 11 2010 ($ millions) (%) Explanation of changes

Working capital(1) (1,794) (2,301) 507 22 Repayment of matured U.S. dollar Notes and settlement

of related derivative liabilities were funded in part by a

$600 million long-term Note issue

Non-current assets

Property, plant and equipment, net 7,964 7,831 133 2 See Capital expenditures in Section 7.2 Cash used

by investing activities and Depreciation in Section 5.3

Intangible assets, net 6,153 6,152 1 – See Capital expenditures in Section 7.2 Cash used

by investing activities and Amortization in Section 5.3.

Acquisitions in 2011 added $61 million. Included in

the balances for both periods are wireless spectrum

licences of $4,867 million

Goodwill, net 3,661 3,572 89 2 Includes increases from the acquisition of Transactel

(Barbados) Inc. ($72 million) and wireless dealership

businesses ($38 million), partly offset by a $19 million

goodwill write-down for a foreign operation’s assets

held for sale

Other long-term assets 81 235 (154) (66) The decrease was principally due to the employee

defined benefit plans actuarial loss (in Other compre-

hensive income), partly offset by funding including the

January 2011, $200 million discretionary contribution

Investments 21 37 (16) (43) The decrease reflects a reduction due to acquisition

of control and subsequent consolidation of Transactel

(Barbados) Inc., slightly offset by changes in minor

investments

Non-current liabilities

Provisions 122 204 (82) (40)

Includes reclassification of $23 million to Advance billings

and $77 million to other long-term liabilities, net of

an increase in asset retirement obligations and a written

put option on the remaining 5% ownership interest

in Transactel

Long-term debt 5,508 5,209 299 6 Includes the May 2011 issue of $600 million Series CI

3.65% five-year Notes, net of the reclassification of

$300 million, 4.5% Series CC TELUS Corporation Bond

to Current liabilities

Other long-term liabilities 1,343 649 694 107 Primarily an increase in pension and post-retirement

liabilities (see changes in Other long-term assets, above).

Also includes a $77 million reclassification from long-term

provisions

Deferred income taxes 1,600 1,683 (83) (5) Includes deferred income taxes relating to unrealized

gains and losses on derivatives and pension plan liabilities

Owners’ equity

Common Share and Non-Voting

7,513 7,759 (246) (3) Principally dividends declared of $715 million and an

Share equity

Other comprehensive loss of $841 million due to actuarial

losses in defined benefit plans, partly offset by Net income

of $1,219 million and an increase in share capital

Non-controlling interests – 22 (22) (100) Reflects transactions in respect of Transactel (see

Partnering, acquiring in Section 2.2) and reclassification

of certain assets of a foreign operation to assets held

for sale

(1) Current assets subtracting Current liabilities.