Telus 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 . TELUS 2011 ANNUAL REPORT

The discussion in this section is qualified in its entirety by the Caution

regarding forward-looking statements at the beginning of the MD&A.

1.1 Preparation of the MD&A

The Company’s disclosure controls and procedures are designed to

provide reasonable assurance that all relevant information is gathered

and reported to senior management on a timely basis, so that appro-

priate decisions can be made regarding public disclosure. Management

determines whether or not information is material based on whether it

believes a reasonable investor’s decision to buy, sell or hold securities

in the Company would likely be influenced or changed if the information

were omitted or misstated. The MD&A and the Audited consolidated

financial statements were reviewed by TELUS’ Audit Committee and

approved by TELUS’ Board of Directors.

Management has issued guidance on and reports on certain

non-GAAP measures to evaluate performance of the Company and

its segments. Non-GAAP measures are also used to determine

compliance with debt covenants and to manage the capital structure.

Because non-GAAP measures do not generally have a standardized

meaning, securities regulations require such measures to be clearly

defined, qualified and reconciled with their nearest GAAP measure

(see Section 11). The term EBITDA (earnings before interest, taxes,

depreciation and amortization) used in this document means standard-

ized EBITDA as defined by the Canadian Performance Reporting Board

of the Canadian Institute of Chartered Accountants (CICA). Adjusted

EBITDA used in this document deducts from standardized EBITDA

items of an unusual nature that do not reflect ongoing telecommunica-

tions operations. See Section 11.1 for the definition, calculation and

reconciliation of EBITDA.

1.2 Canadian economy and telecommunications industry

Economic environment

The Bank of Canada maintained its target for the overnight borrowing

rate at 1% in its January 2012 bank rate announcement. The Bank’s

January 2012 Monetary Policy Report estimated economic growth of

2.4% for Canada in 2011. It also projected growth of 2.0% in 2012 and

2.8% in 2013, with the economy returning to full capacity by the third

quarter of 2013.

Statistics Canada’s Labour Force Survey reported the December 2011

national unemployment rate had increased to 7.5% from 7.1% in Sep-

tember 2011, but was down slightly from 7.6% in December 2010 (see

Section 10.11 Economic growth and fluctuations). In January 2012,

the national unemployment rate edged up to 7.6%.

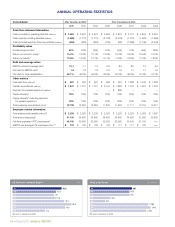

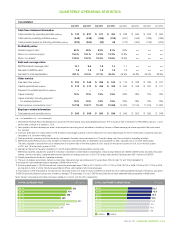

Telecommunications industry

The Company estimates that growth in Canadian telecommunications

industry revenue (including TV revenue and excluding media revenue;

see Competition overview in Section 4.1) was approximately 3% in 2011,

driven by continued growth in the wireless sector.

Canadian wireless industry revenue and EBITDA growth for 2011

are estimated at approximately 4.5% and 2%, respectively. Increased

competitive intensity from established national competitors and new

entrants, as well as new smartphones and tablets, attracted more

than 1.6 million new industry subscribers in 2011, or an approximate

4.3 percentage point increase in penetration to just over 77% of

the population. The wireless penetration rate in Canada is expected

to increase further in 2012 by between 4.0 and 4.5 percentage points.

The Canadian wireline sector is expected to continue to face

pressure on legacy voice services from strong competitive intensity

and technological substitution to growing data and wireless services.

Growth opportunities remain in wireline data, including Internet,

and IP-based TV and entertainment services.

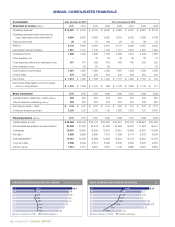

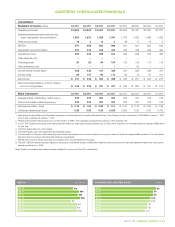

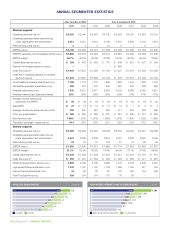

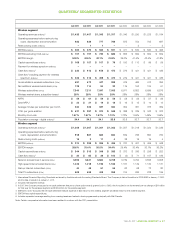

1.3 Consolidated highlights

Years ended December 31

($ millions, unless noted otherwise) 2 0 11 2010 Change

Consolidated statements of income

Operating revenues 10,397 9,792 6.2%

Operating income 1,968 1,909 3.1%

Income before income taxes 1,591 1,387 14.7%

Net income 1,215 1,052 15.5%

Basic earnings per share(1) (EPS) ($) 3.76 3.27 15.0%

Diluted EPS(1) ($) 3.74 3.27 14.4%

Cash dividends declared per share(1) ($) 2.205 2.00 10.3%

Average shares(1) outstanding

– basic (millions) 324 320 1.3%

Consolidated statements

of cash flows

Cash provided by operating activities 2,550 2,670 (4.5)%

Cash used by investing activities 1,968 1,731 13.7%

– Capital expenditures 1,847 1,721 7.3%

Cash used by financing activities 553 963 (42.6)%

Other highlights

Subscriber connections(2) (thousands) 12,728 12,253 3.9%

EBITDA(3) 3,778 3,650 3.5%

Adjusted EBITDA(3)(4) 3,761 3,650 3.0%

Adjusted EBITDA margin(5) (%) 36.2 37.3 (1.1) pts.

Free cash flow(3) 997 939 6.2%

Net debt to EBITDA – excluding

restructuring costs(3) (times) 1.8 1.8 –

Notations used in MD&A: n/a – Not applicable; n/m – Not meaningful;

pts. – Percentage points.

(1) Includes Common Shares and Non-Voting Shares.

(2) The sum of wireless subscribers, network access lines (NALs), Internet access

subscribers and TELUS TV subscribers (Optik TVTM subscribers and TELUS

Satellite TV® subscribers), measured at the end of the respective periods based

on information in billing and other systems.

(3) Non-GAAP measures. See Section 11.1 EBITDA, Section 11.2 Free cash flow and

Section 11.4 Definitions of liquidity and capital resource measures.

(4) Adjusted EBITDA for 2011 excludes a $17 million gain on purchase of control

of Transactel (Barbados) Inc.

(5) Adjusted EBITDA margin is adjusted EBITDA divided by (Operating revenues

excluding the 2011 gain on Transactel).

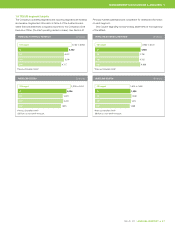

1INTRODUCTION

A summary of TELUS’ consolidated results for 2011, performance against 2011 targets,

and presentation of targets for 2012