Telus 2011 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

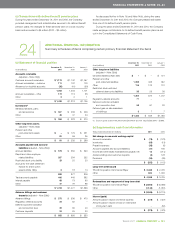

162 . TELUS 2011 ANNUAL REPORT

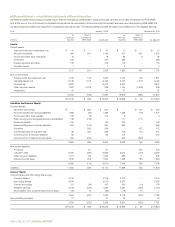

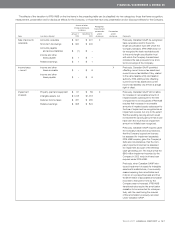

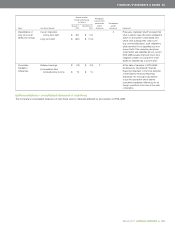

25 EXPLANATION OF TRANSITION TO IFRS-IASB

Summary schedules and review of differences arising because of the convergence of

Canadian generally accepted accounting principles with International Financial Reporting

Standards as issued by the International Accounting Standards Board

(a) General

The Company’s date of transition to IFRS-IASB is January 1, 2010, and

its date of adoption is January 1, 2011. The Company’s December 31, 2010,

annual consolidated financial statements were the latest presented using

previous non-IFRS-IASB compliant GAAP.

(b) Exemption elections

International Financial Reporting Standard 1, First-time Adoption of

International Financial Reporting Standards, sets out the procedures

that the Company must follow when it adopts IFRS-IASB for the first

time as the basis for preparing its consolidated financial statements.

The Company is required to establish its IFRS-IASB accounting policies

as at December 31, 2011, and, in general, apply these retrospectively

to determine the IFRS-IASB opening statement of financial position at its

date of transition, January 1, 2010. This standard provides a number

of optional exemptions to this general principle. These are set out below,

together with a description in each case of the exemption taken by

the Company.

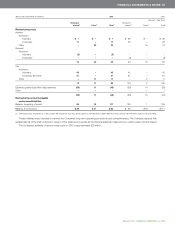

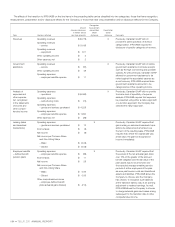

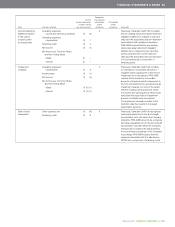

Exemption

Exemption

taken?

Comments

Business combinations Yes As would impact the Company, and as adopted by the Company, pre-2011 Canadian GAAP in respect

of business combinations, consolidation and non-controlling interests was aligned with IFRS-IASB

effective January 1, 2009; business combinations prior to that date would be measured differently.

Share-based payment transactions Yes The Company has chosen to apply the relevant IFRS-IASB standard (International Financial Reporting

Standard 2, Share-based Payment) only to share option awards made subsequent to 2001 and to

modification of outstanding share option awards subsequent to 2001 (which results in no difference

from past application of pre-2011 Canadian GAAP).

Fair value or revaluation as

deemed cost

No The Company has chosen to measure its property, plant and equipment and intangible assets at

historical cost (see Note 1(r)).

Leases No As would impact the Company, and as adopted by the Company, pre-2011 Canadian GAAP in respect

of leases is aligned with IFRS-IASB.

Employee benefits Ye s The Company has chosen to recognize cumulative unamortized actuarial gains and losses, past

service costs and transitional obligations and assets at the transition date as an adjustment to retained

earnings on the same date.

Cumulative translation differences Yes The Company has chosen to apply the relevant IFRS-IASB standard (International Accounting

Standard 21, The Effects of Changes in Foreign Exchange Rates) prospectively effective the date of

transition to IFRS-IASB due to immateriality and will deem cumulative foreign currency translation

differences to be zero as of the same date.

Assets and liabilities of subsidiaries,

associates and joint ventures

No As a consolidated entity, the Company first-time adopted IFRS-IASB concurrently.

Compound financial instruments No As would impact the Company, and as adopted by the Company, pre-2011 Canadian GAAP in respect

of compound financial instruments is aligned with IFRS-IASB.

Designation of previously

recognized financial instruments

No The Company did not re-designate any of its previously recognized financial instruments.

Fair value measurement of financial

assets or financial liabilities at initial

recognition

No As would impact the Company, and as adopted by the Company, pre-2011 Canadian GAAP in respect

of the fair value measurement of financial assets and financial liabilities is aligned with IFRS-IASB.

Decommissioning liabilities

included in the cost of property,

plant and equipment

Yes The Company has chosen to apply the relevant IFRS-IASB standard (IFRIC Interpretation 1, Changes

in Existing Decommissioning, Restoration and Similar Liabilities) prospectively effective the date of

transition to IFRS-IASB due to immateriality.

Borrowing costs Ye s The Company has chosen to apply the relevant IFRS-IASB standard (International Accounting

Standard 23, Borrowing Costs) prospectively effective the date of transition to IFRS-IASB due to

immateriality.