Telus 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 151

FINANCIAL STATEMENTS & NOTES: 17–19

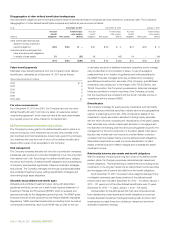

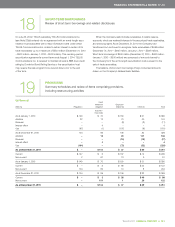

18 SHORT-TERM BORROWINGS

Review of short-term borrowings and related disclosures

On July 26, 2002, TELUS subsidiary TELUS Communications Inc.

(see Note 23(a)) entered into an agreement with an arm’s-length secu-

ritization trust associated with a major Schedule I bank under which

TELUS Communications Inc. is able to sell an interest in certain of its

trade receivables up to a maximum of $500 million (December 31, 2010

– $500 million; January 1, 2010 – $500 million). This revolving-period

securitization agreement’s current term ends August 1, 2014. TELUS

Communications Inc. is required to maintain at least a BBB (low) credit

rating by Dominion Bond Rating Service or the securitization trust

may require the sale program to be wound down prior to the end

of the term.

When the Company sells its trade receivables, it retains reserve

accounts, which are retained interests in the securitized trade receivables,

and servicing rights. As at December 31, 2011, the Company had

transferred, but continued to recognize, trade receivables of $456 million

(December 31, 2010 – $465 million; January 1, 2010 – $598 million).

Short-term borrowings of $400 million (December 31, 2010 – $400 million;

January 1, 2010 – $500 million) are comprised of amounts loaned to

the Company from the arm’s-length securitization trust pursuant to the

sale of trade receivables.

The balance of short-term borrowings (if any) comprised amounts

drawn on the Company’s bilateral bank facilities.

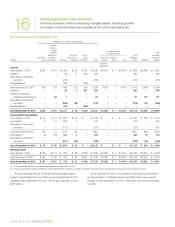

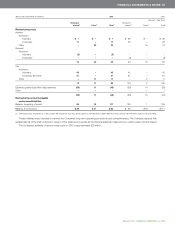

19 PROVISIONS

Summary schedules and review of items comprising provisions,

including restructuring activities

(a) General

Asset

retirement Employee

(millions) Regulatory obligation related (b) Other (b) Total

(adjusted –

Note 25(d))

As at January 1, 2010 $ß149 $ß 70 $ß150 $ß21 $ß390

Addition 22 12 70 20 124

Reversal – – (8) (3) (11)

Interest effect – 4 – – 4

Use (67) (1) (107) (6) (181)

As at December 31, 2010 104 85 105 32 326

Addition – 15 20 101 136

Reversal – – (15) (12) (27)

Interest effect – 4 – – 4

Use (104) – (73) (52) (229)

As at December 31, 2011 $ß – $ß104 $ß 37 $ß69 $ß210

Current $ß147 $ß 3 $ß137 $ß12 $ß299

Non-current 2 67 13 9 91

As at January 1, 2010 $ß149 $ß 70 $ß150 $ß21 $ß390

Current $ß – $ß 3 $ß 95 $ß24 $ß122

Non-current 104 82 10 8 204

As at December 31, 2010 $ß104 $ß 85 $ß105 $ß32 $ß326

Current $ß – $ß 3 $ß 36 $ß49 $ß 88

Non-current – 101 1 20 122

As at December 31, 2011 $ß – $ß104 $ß 37 $ß69 $ß210