Telus 2011 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 161

FINANCIAL STATEMENTS & NOTES: 23 – 24

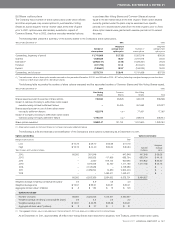

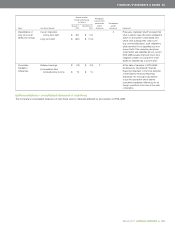

(c) Transactions with defined benefit pension plans

During the years ended December 31, 2011 and 2010, the Company

provided management and administrative services to its defined benefit

pension plans; the charges for these services were on a cost recovery

basis and amounted to $5 million (2010 – $6 million).

As discussed further in Note 1(i) and Note 14(b), during the years

ended December 31, 2011 and 2010, the Company leased real estate

from one of its defined benefit pension plans.

During the years ended December 31, 2011 and 2010, the Company

made employer contributions to its defined benefit pension plans as set

out in the Consolidated Statements of Cash Flows.

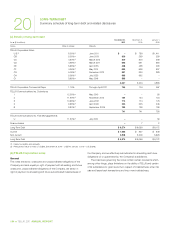

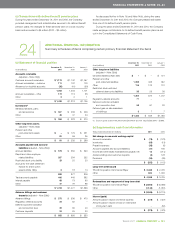

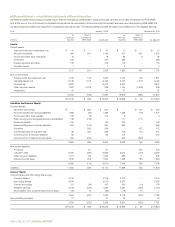

24 ADDITIONAL FINANCIAL INFORMATION

Summary schedules of items comprising certain primary financial statement line items

(a) Statement of financial position

December 31, December 31, January 1,

As at (millions) 2 0 11 2010 2010

Accounts receivable

(adjusted – Note 25(d))

Customer accounts receivable $ß1,178 $ß1,142 $ß1,057

Accrued receivables – customer 111 102 103

Allowance for doubtful accounts (36) (41) (59)

1,253 1,203 1,101

Accrued receivables – other 172 113 93

Other 3 2 1

$ß1,428 $ß1,318 $ß1,195

Inventories(1)

Wireless handsets, parts

and accessories $ 307 $ 236 $ 226

Other 46 47 44

$ 353 $ 283 $ 270

Other long-term assets

(adjusted – Note 25(d))

Pension and other

post-retirement assets $ – $ 179 $ 251

Other 81 56 35

$ 81 $ 235 $ 286

Accounts payable and accrued

liabilities (adjusted – Note 25(d))

Accrued liabilities $ 579 $ 555 $ 520

Payroll and other employee

related liabilities 287 284 252

Restricted stock units liability 29 20 20

Accrual for net-cash settlement

feature for share option

awards (Note 13(b)) 3 18 14

898 877 806

Trade accounts payable 406 448 382

Interest payable 68 73 60

Other 47 79 88

$ß1,419 $ß1,477 $ß1,336

Advance billings and customer

deposits (adjusted – Note 25(d))

Advance billings $ 575 $ 536 $ 470

Regulatory deferral accounts 24 62 –

Deferred customer activation

and connection fees 32 35 40

Customer deposits 24 25 20

$ 655 $ 658 $ 530

December 31, December 31, January 1,

As at (millions) 2 0 11 2010 2010

Other long-term liabilities

(adjusted – Note 25(d))

Derivative liabilities (Note 4(h)) $ – $ – $ 721

Pension and other

post-retirement liabilities 1,053 423 357

Other 116 123 131

Restricted stock units and

deferred share units liabilities 35 29 38

1,204 575 1,247

Regulatory deferral accounts 77 – –

Deferred customer activation

and connection fees 59 67 80

Deferred gain on sale-leaseback

of buildings 3 7 7

$ 1,343 $ 649 $ß1,334

(1) Cost of goods sold for the year ended December 31, 2011 was $1,522 (2010 – $1,189).

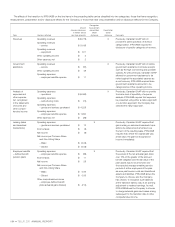

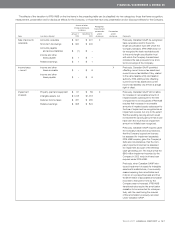

(b) Supplementary cash flow information

Years ended December 31 (millions) 2 0 11 2010

Net change in non-cash working capital

Accounts receivable $ (79) $ (123)

Inventories (69) (13)

Prepaid expenses (36) (8)

Accounts payable and accrued liabilities (47) 160

Income and other taxes receivable and payable, net

13 (214)

Advance billings and customer deposits (3) 128

Provisions (34) (49)

$ (255) $ (119)

Long-term debt issued

TELUS Corporation Commercial Paper $ 3,468 $ 2,725

Other 600 1,000

$ 4,068 $ 3,725

Redemptions and repayment of long-term debt

TELUS Corporation Commercial Paper $ß(2,806) $ß(3,088)

Other (1,140) (1,031)

$ß(3,946) $ß(4,119)

Interest (paid)

Amount (paid) in respect of interest expense $ (378) $ (427)

Amount (paid) in respect of loss on redemption

of long-term debt – (52)

$ (378) $ (479)