Telus 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144 . TELUS 2011 ANNUAL REPORT

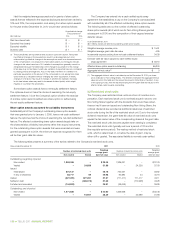

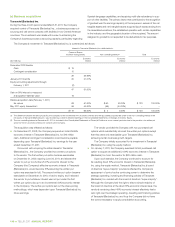

2011 sensitivity(1) of key assumptions (year ended, or as at, December 31, 2011) Pension benefit plans Other benefit plans

Change in Change in Change in Change in

(millions) obligation expense obligation expense

Impact of hypothetical 25 basis point decrease(2) in:

Discount rate $ß262 $ß – $ß 1 $ß –

Expected long-term rate of return on plan assets $ß17 $ß –

Rate of future increases in compensation $ß 27 $ß 4 $ß – $ß –

(1) The sensitivities in this table are not comparable to those disclosed by the Company in previous periods due to the convergence of Canadian GAAP for publicly accountable

enterprises with IFRS-IASB, as discussed further in Note 2 and Note 25.

(2) These sensitivities are hypothetical and should be used with caution. Favourable hypothetical changes in the assumptions result in decreased amounts, and unfavourable hypothetical

changes in the assumptions result in increased amounts, of the obligations and expenses. Changes in amounts based on a 25 basis point variation in assumptions generally cannot

be extrapolated because the relationship of the change in assumption to the change in amounts may not be linear. Also, in this table, the effect of a variation in a particular assumption

on the change in obligation or change in expense is calculated without changing any other assumption; in reality, changes in one factor may result in changes in another (for example,

increases in discount rates may result in increased expectations about the long-term rate of return on plan assets), which might magnify or counteract the sensitivities.

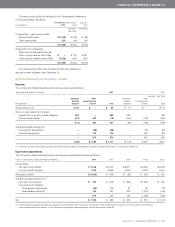

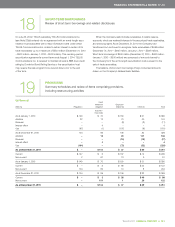

(g) Defined contribution plans

The Company’s total defined contribution pension plan costs recognized

were as follows:

Years ended December 31 (millions) 2 0 11 2010

Union pension plan and public service

pension plan contributions $ß27 $ß27

Other defined contribution pension plans 39 34

$ß66 $ß61

The Company expects that its 2012 union pension plan and public

service pension plan contributions will be approximately $27 million.