Telus 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 113

FINANCIAL STATEMENTS & NOTES: 1

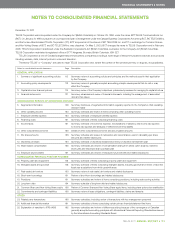

(c) Financial instruments – recognition and measurement*

In respect of the recognition and measurement of financial instruments, the Company has adopted the following policies:

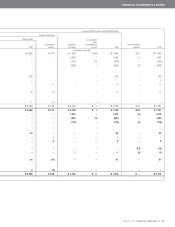

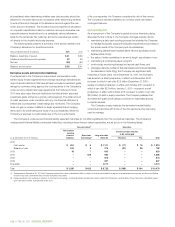

Accounting classification

Fair value Part of a cash

through net Loans and Available- Amortized flow hedging

Financial instrument income(1)(2) receivables for-sale(3) cost relationship(3)

Measured at amortized cost

Accounts receivable X

Short-term obligations X

Accounts payable X

Provisions X

Long-term debt X

Measured at fair value

Cash and temporary investments X

Short-term investments X

Long-term investments (not subject to significant influence)(4) X

Foreign exchange derivatives X X

Share-based compensation derivatives X X

Cross currency interest rate swap derivatives X

(1) Classification includes financial instruments held for trading. Certain qualifying financial instruments that are not required to be classified as held for trading may be classified as held

for trading if the Company so chooses.

(2) Unrealized changes in the fair values of financial instruments are included in net income.

(3) Unrealized changes in the fair values of financial instruments classified as available-for-sale, or the effective portion of unrealized changes in the fair values of financial instruments

held for hedging, are included in other comprehensive income.

(4) Long-term investments that are not subject to significant influence of the Company are classified as available-for-sale. In respect of investments in securities for which the fair values

can be reliably measured, the Company determines the classification on an instrument-by-instrument basis at time of initial recognition.

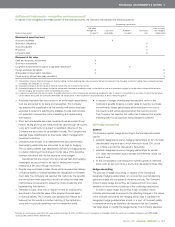

.Accounts receivable that may be sold to an arm’s-length securitization

trust are accounted for as loans and receivables. The Company

has selected this classification as the benefits that would have been

expected to arise from selecting the available-for-sale method were

not expected to exceed the costs of selecting and implementing

that method.

.Short-term marketable securities investments are accounted for as

held for trading and thus are measured at fair value through net income.

Long-term investments not subject to significant influence of the

Company are accounted for as available-for-sale. The Company has

selected these classifications as they better reflect management’s

investment intentions.

.Derivatives that are part of an established and documented cash

flow hedging relationship are accounted for as held for hedging.

The Company believes that classification as held for hedging results

in a better matching of the change in the fair value of the derivative

financial instrument with the risk exposure being hedged.

Derivatives that are not part of a documented cash flow hedging

relationship are accounted for as held for trading and thus are

measured at fair value through net income.

.Regular-way purchases or sales (those which require actual delivery

of financial assets or financial liabilities) are recognized on the settle-

ment date. The Company has selected this method as the benefits

that would have been expected to arise from using the trade date

method were not expected to exceed the costs of selecting and

implementing that method.

.Transaction costs, other than in respect of held for trading items,

are added to the initial fair value of the acquired financial asset

or financial liability. The Company has selected this method as it

believes that this results in a better matching of the transaction

costs with the periods benefiting from the transaction costs.

.In respect of hedges of anticipated transactions, which in the

Company’s specific instance currently relate to inventory purchase

commitments, hedge gains/losses will be included in the cost of

the inventory and will be expensed when the inventory is sold.

The Company has selected this method as it believes that a better

matching with the risk exposure being hedged is achieved.

(d) Hedge accounting

General

The Company applies hedge accounting to the financial instruments

used to:

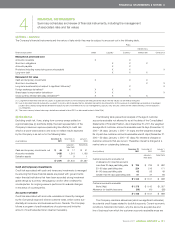

.establish designated currency hedging relationships for its U.S. dollar

denominated long-term debt, which matured in fiscal 2011, as set

out in Note 4 and further discussed in Note 20(b);

.establish designated currency hedging relationships for certain

U.S. dollar denominated future purchase commitments, as set out

in Note 4; and

.fix the compensation cost arising from specific grants of restricted

stock units, as set out in Note 4 and further discussed in Note 13(c).

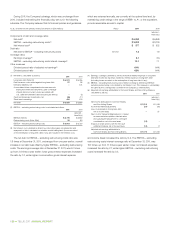

Hedge accounting

The purpose of hedge accounting, in respect of the Company’s

designated hedging relationships, is to ensure that counterbalancing

gains and losses are recognized in the same periods. The Company

chose to apply hedge accounting, as it believes this is more repre-

sentative of the economic substance of the underlying transactions.

In order to apply hedge accounting, a high correlation (which

indicates effectiveness) is required in the offsetting changes in the values

of the financial instruments (the hedging items) used to establish the

designated hedging relationships and all, or a part, of the asset, liability

or transaction having an identified risk exposure that the Company

has taken steps to modify (the hedged items). The Company assesses

*Denotes accounting policy affected in the years ended December 31, 2011 and 2010, by the convergence of Canadian GAAP for publicly accountable enterprises with IFRS-IASB,

as discussed further in Note 2 and Note 25.