Telus 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 81

MANAGEMENT’S DISCUSSION & ANALYSIS: 9

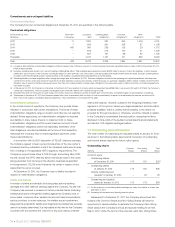

Cable-TV companies continue to increase the speed of their Internet

services and intensify customer acquisition offers. Canada’s four major

cable-TV companies have over 5.6 million Internet subscribers, up from

approximately 5.4 million in 2010, while telecommunications companies

have 4.4 million Internet subscribers, up from approximately 4.3 million

in 2010. Although the high-speed Internet market is maturing with over

76% penetration in TELUS’ incumbent region in Western Canada and

almost 75% penetration across Canada, subscriber growth is expected

to continue over the next several years.

The growing popularity of watching TV anywhere is expected to

continue as customers demand the ability to view content on multiple

screens, including computers, smartphones and tablets, as well as

on TVs. In early 2012, TELUS launched Optik on the go, allowing TELUS

customers to watch certain on-demand movies and shows anywhere,

anytime on a laptop, tablet or smartphone. In addition, OTT content pro-

viders like Netflix for movies and Hulu for TV shows and movies, as well

as Apple and Google, are competing for share of viewership. However,

it is not clear if this com petition replaces, or simply complements, existing

TV services. Wireline service providers are monitoring developments in

the OTT space and evolving their content strategy and approach to the

market to compete with these non-traditional offerings.

To help alleviate the competitive challenges in the legacy wireline

services, TELUS’ Future Friendly Home® strategy has successfully

increased revenues, while enhancing retention and loyalty through mul-

tiple service offerings. In mid-2010, the Company launched new TELUS

brands Optik TV (IP TV based on the Microsoft Mediaroom platform)

and Optik High Speed Internet in urban Alberta and British Columbia

markets, and later in Eastern Quebec. Optik offers an enhanced TV

experience with premium and differentiated services such as PVR

Anywhere (enabling customers to record and play back shows on up

to six TVs in the home), Remote Recording (enabling customers to

use their smartphone, tablet or Internet-connected computer to schedule

their PVR recordings when away from home) and other features such

as Facebook TV.

TELUS Satellite TV service in Alberta and B.C. complements the

Company’s Optik TV service, enabling TELUS to serve households that

are outside of the urban/suburban Optik TV network footprint, and

leverages TELUS’ strong distribution and mass marketing capabilities.

This expands the addressable market for TELUS TV to more than 90%

of households in the two provinces.

In 2011, TELUS added 196,000 new TV subscribers and increased

its TV subscriber base by 62% to 509,000. TELUS’ primary Western

cable-TV competitor increased the speeds of its Internet services and

launched a new residential media hub/gateway in 2011, with some

similar features such as whole-home PVR. In addition, in late 2011 and

early 2012 this competitor continued intense promotional activity and

incentives, lowered bundled prices and mass advertised to win back

customers and protect its shrinking cable-TV subscriber base.

TELUS’ new IP-based services are supported by its wireline broad-

band network, which has been upgraded significantly from 2009 to 2011

to meet the evolving bandwidth needs of customers. In 2011, TELUS

expanded its broadband network in communities in Alberta, B.C. and

Eastern Quebec. By early 2012, coverage with ADSL2+ or VDSL2 tech-

nology reached nearly 2.3 million homes. ADSL2+ allows broadband

download speeds of up to 15 Mbps, and the VDSL2 technology overlay

allows download speeds of up to 30 Mbps (enabling delivery of three

simultaneous HD signals into the home).

Combined with wireline local and long distance, wireless and high-

speed Internet and entertainment services, TELUS is increasingly offering

bundled products to achieve competitive differentiation with an inte-

grated set of services that provides customers more freedom, flexibility

and choice. Cable-TV companies are continuing to roll out higher-speed

Internet services, Internet telephony and digital cable-TV services to

support growth. In 2011, TELUS’ TV and high-speed Internet net subscriber

additions more than offset NAL losses for the first time in seven years,

as its broadband investments and bundled offers including its premium

Optik TV service, allowed the Company to improve its position relative

to its main cable-TV competitor.

The Canadian broadcasting industry has become more vertically

integrated, with most of TELUS’ competitors owning broadcast content.

In 2011, after public hearings, the CRTC set clear safeguards to ensure

competition (see Section 10.3 Regulatory matters – Broadcasting

distribution undertakings). TELUS’ differentiated approach, consistent

with the Company’s content strategy, is to aggregate, integrate and

make accessible the best content and applications to customers, through

whichever device they choose. TELUS believes that it is not necessary

to own content to make it accessible on an economically attractive basis.

In the business market, the convergence of IT and telecommuni-

cations, facilitated by the ubiquity of IP, continues to shape competitive

investments. Telecommunications companies like TELUS are providing

network-centric managed applications, while IT service providers are

bundling network connectivity with their software as service offerings.

In addition, manufacturers continue to bring all-IP and converged (IP plus

legacy) equipment to market, enabling ongoing migration to IP-based

solutions. The development of IP-based platforms providing combined

IP voice, data and video solutions creates cost efficiencies that com-

pensate, in part, for reduced margins resulting from the migration from

legacy to IP-based services. New opportunities exist for integrated

solutions that have greater business impact than traditional telecommu-

nications services. In 2012, TELUS expects to continue Customers

First initiatives, extending the TELUS future friendly promise to large

organizations across Canada and collaborating with customers to

deliver the right solutions to businesses with complex technology needs.

TELUS has launched an expanded series of solutions targeting

specific high-value segments as well as small and medium businesses

(SMB). The SMB market is one of the fastest-growing markets in Canada.

TELUS is investing in a range of affordable solutions for this segment,

including everything from email to web applications. In the small business

market, TELUS has countered increased cable-TV competition by

offering an integrated small business bundle called TELUS Business

One, which includes connectivity (voice, Internet and email services),

security, hosting, audio and video conferencing, and other IP-based

tools.

In 2011, TELUS introduced Future Friendly Office service bundles

integrating wire less and wireline with two flexible packages, including

anytime device upgrades and changes to services, 24/7 technical

support, and one bill (see Section 2.2 Providing integrated solutions).

The Company also opened nine TELUS Business Stores and more

than 40 SMB zones within corporate stores.

TELUS continues to believe that its consistent strategic focus on

providing a full suite of valuable and reliable telecommunications services;

delivering differentiated, premium national business solutions in data and

IP; exposure to growth services such as wireless, data and IP, including

Optik TV and Optik High Speed Internet; and the ongoing investment

to enhance its wireless and broadband networks, position the Company

well for revenue and EBITDA growth.