Telus 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 . TELUS 2011 ANNUAL REPORT

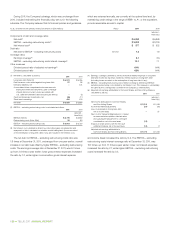

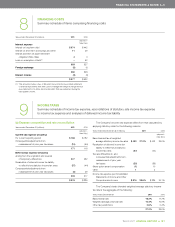

Net income and

comprehensive Capital

Years ended December 31 income expenditures

($ increase (decrease) in millions) 2 0 11 2010 2 0 11 2010

10% change in Cdn.$: U.S.$

exchange rate(1)

Canadian dollar appreciates $ 27 $ 20 $ß(23) $ß(17)

Canadian dollar depreciates $ß(27) $ß(20) $ 23 $ 17

(1)

These sensitivities are hypothetical and should be used with caution. Changes in net

income and comprehensive income generally cannot be extrapolated because the

relationship of the change in assumption to the change in net income and compre-

hen sive income may not be linear. In this table, the effect of a variation in the Canadian

dollar: U.S. dollar exchange rate on the amount of net income and comprehensive

income is calculated without changing any other analysis inputs; in reality, changes

in the Canadian dollar: U.S. dollar exchange rate may result in changes in another

factor (for example, increased strength of the Canadian dollar may result in more

favourable market interest rates), which might magnify or counteract the sensitivities.

The sensitivity analysis assumes that changes in exchange rates would be

realized by the Company; in reality, the competitive marketplace in which the Company

operates would impact this assumption. The sensitivity analysis is prepared based

on the simple average of the Canadian dollar: U.S. dollar exchange rate for the period.

In respect of U.S. dollar denominated inventory purchases, the current period’s

purchases have been included in the sensitivity analysis by assuming that all items

are sold in the period purchased. Similarly, this sensitivity analysis is based on the

assumption that all U.S. dollar denominated accounts receivable and accounts pay-

able arising in the period are collected and paid, respectively, in the period.

In respect of U.S. dollar denominated capital expenditures, the current period’s

expenditures have been included in the sensitivity analysis by assuming one-half

period’s straight-line depreciation and amortization in the year of acquisition and an

estimated useful life of ten years; no consideration has been made for U.S. dollar

denominated capital expenditures made in prior periods.

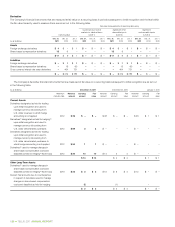

(e) Interest rate risk

Changes in market interest rates will cause fluctuations in the fair value

or future cash flows of temporary investments, short-term investments,

short-term obligations, long-term debt and/or cross currency interest

rate swap derivatives.

When the Company has temporary investments, they have short

maturities and fixed rates, thus their fair value will fluctuate with changes

in market interest rates; absent monetization prior to maturity, the related

future cash flows do not change due to changes in market interest rates.

If the balance of short-term investments includes debt instruments

and/or dividend-paying equity instruments, the Company could be

exposed to interest rate risks.

As short-term obligations arising from bilateral bank facilities, which

typically have variable interest rates, are rarely outstanding for periods

that exceed one calendar week, interest rate risk associated with this

item is not material.

Short-term borrowings arising from the sales of trade receivables to

an arm’s-length securitization trust are fixed-rate debt. Due to the short

maturities of these borrowings, interest rate risk associated with this item

is not material.

In respect of the Company’s currently outstanding long-term debt,

other than for commercial paper and amounts drawn on its credit

facilities (Note 20(b)), it is all fixed-rate debt. The fair value of fixed-rate

debt fluctuates with changes in market interest rates; absent early

redemption and/or foreign exchange rate fluctuations, the related future

cash flows do not change. Due to the short maturities of commercial

paper, its fair values are not materially affected by changes in market

interest rates but its cash flows representing interest payments may be

if the commercial paper is rolled over.

Amounts drawn on the Company’s short-term and long-term credit

facilities will be affected by changes in market interest rates in a manner

similar to commercial paper.

Similar to fixed-rate debt, the fair value of the Company’s cross

currency interest rate swap derivatives fluctuated with changes in market

interest rates as the interest rate swapped to was fixed; absent early

redemption, the related future cash flows would not have changed due

to changes in market interest rates.

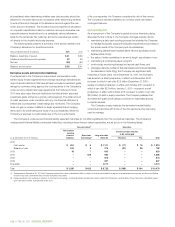

(f) Other price risk

Provisions

The Company is exposed to other price risk arising from a written put

option provided for a non-controlling interest, as discussed further in

Note 16(e).

Short-term investments

If the balance of the short-term investments line item on the statement

of financial position includes equity instruments, the Company would be

exposed to equity price risks.

Long-term investments

The Company is exposed to equity price risks arising from investments

classified as available-for-sale. Such investments are held for strategic

rather than trading purposes.

Share-based compensation derivatives

The Company is exposed to other price risk arising from cash-settled

share-based compensation (appreciating Common Share and Non-Voting

Share prices increase both the expense and the potential cash outflow).

Cash-settled equity swap agreements have been entered into that estab-

lish a cap on the Company’s cost associated with its net-cash settled

share options (Note 13(b)) and fix the Company’s cost associated with

its restricted stock units (Note 13(c)).

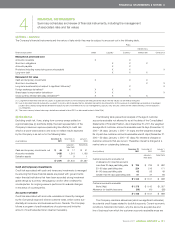

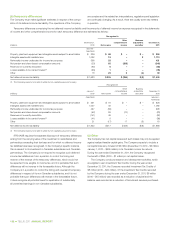

(g) Market risk

Net income and other comprehensive income for the years ended

December 31, 2011 and 2010, could have varied if the Canadian dollar:

U.S. dollar exchange rates, market interest rates and the Company’s

Common Share and Non-Voting Share prices varied by reasonably pos-

sible amounts from their actual statement of financial position date values.

The sensitivity analysis of the Company’s exposure to currency risk

at the reporting date has been determined based upon a hypothetical

change taking place at the statement of financial position date (as con-

trasted with applying the hypothetical change to all relevant transactions

during the reported periods – see (d)). The U.S. dollar denominated

balances and derivative financial instrument notional amounts as at the

statement of financial position dates have been used in the calculations.

The sensitivity analysis of the Company’s exposure to interest rate

risk at the reporting date has been determined based upon a hypothetical

change taking place at the beginning of the relevant fiscal year and

being held constant through to the statement of financial position date.

The relevant statement of financial position date principal and notional

amounts have been used in the calculations.

The sensitivity analysis of the Company’s exposure to other price

risk arising from share-based compensation at the reporting date has

been determined based upon a hypothetical change taking place at the

relevant statement of financial position date. The relevant statement of

financial position date notional number of shares, including those in the

cash-settled equity swap agreements, has been used in the calculations.