Telus 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 139

FINANCIAL STATEMENTS & NOTES: 14

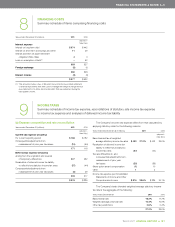

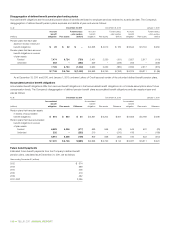

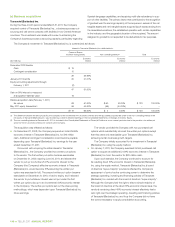

The plan surplus (deficit) is reflected in the Consolidated Statements

of Financial Position as follows:

December 31, December 31, January 1,

As at (millions) 2 0 11 2010 2010

(adjusted – (Note 25(d))

Note 25(d))

Funded status – plan surplus (deficit)

Pension benefit plans $ß(1,002) $ß(198) $ß (65)

Other benefit plans (51) (46) (41)

$ß(1,053) $ß(244) $ß(106)

Presented in the Consolidated

Statements of Financial Position as:

Other long-term assets (Note 24(a)) $ß – $ 179 $ 251

Other long-term liabilities (Note 24(a)) (1,053) (423) (357)

$ß(1,053) $ß(244) $ß(106)

The measurement date used to determine the plan assets and

accrued benefit obligation was December 31.

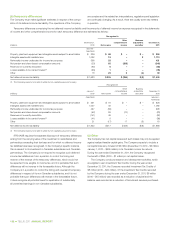

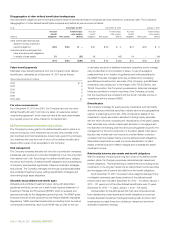

(b) Defined benefit pension plans – details

Expense

The Company’s defined benefit pension plan expense was as follows:

Years ended December 31 (millions) 2 0 11 2010

(adjusted – Note 25(c))

Employee Other Employee Other

benefits comprehensive benefits comprehensive

Recognized in expense income Total expense income Total

Current service cost $ 80 $ – $ 80 $ 73 $ß – $ß 73

Return on plan assets net of interest

Interest cost on accrued benefit obligation 360 – 360 368 – 368

Return on plan assets(1) (474) 461 (13) (454) (169) (623)

(114) 461 347 (86) (169) (255)

Actuarial loss (gain) arising from:

Demographic assumptions – (26) (26) – (32) (32)

Financial assumptions – 700 700 – 484 484

– 674 674 – 452 452

$ß(34) $ß1,135 $ß1,101 $ß (13) $ß283 $ß270

(1) The return on plan assets included in employee benefits expense reflects management’s expected long-term rate of return, as discussed further in (f).

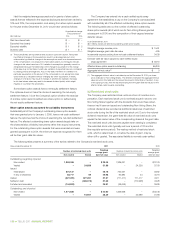

Experience adjustments

The Company’s defined benefit pension plan experience adjustments were as follows:

As at, or for the years ended, December 31 (millions) 2 0 11 2010 2009 2008 2007

Funded status

Fair value of plan assets $ 6,746 $ß6,760 $ß6,311 $ß5,649 $ß6,908

Accrued benefit obligation 7,748 6,958 6,376 5,243 6,347

Plan surplus (deficit) $ß(1,002) $ß (198) $ß (65) $ 406 $ 561

Actuarial loss (gain) arising from:(1)

Fair value of plan assets $ß 461 $ß (169) $ß (364) $ß1,596 $ 236

Accrued benefit obligation

Demographic assumptions (26) (32) 61 96 38

Financial assumptions (f) 700 484 930 (1,376) (446)

674 452 991 (1,280) (408)

Net $ 1,135 $ 283 $ 627 $ 316 $ß (172)

(1) The actuarial losses (gains) experienced subsequent to December 31, 2009, have been recognized in other comprehensive income, as set out in Note 1(n) and Note 10;

those experienced prior to January 1, 2010, have been recognized in retained earnings, as discussed further in Note 25.