Telus 2011 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150 . TELUS 2011 ANNUAL REPORT

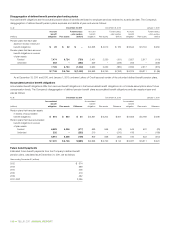

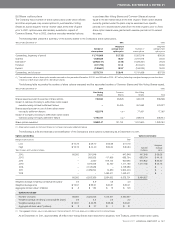

Pro forma disclosures

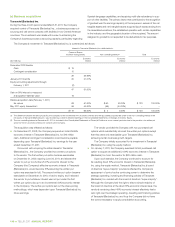

The following pro forma supplemental information represents certain results of operations as if the business acquisitions noted above had been

completed at the beginning of the fiscal years presented.

Years ended December 31 2 0 11 2010

(millions except per share amounts) As reported(1) Pro forma(2) As reported Pro forma(2)

(adjusted –

Note 25(c))

Operating revenues $ß10,397 $ß10,419 $ß9,792 $ß9,891

Net income $ß 1,215 $ß 1,208 $ß1,052 $ß1,045

Net income per Common Share and Non-Voting Share

– Basic $ß 3.76 $ß 3.73 $ß 3.27 $ß 3.26

– Diluted $ß 3.74 $ß 3.71 $ß 3.27 $ß 3.25

(1)

Operating revenues and net income for the year ended December 31, 2011, include $39 and $NIL, respectively, in respect of the acquisition of Transactel (Barbados) Inc. Operating revenues

and net income (loss) for the year ended December 31, 2011, include $11 and $(2), respectively, in respect of the acquisition of the TELUS-branded wireless dealership businesses.

(2) Pro forma amounts for the years ended December 31, 2011 and 2010, reflect Transactel (Barbados) Inc. and the TELUS-branded wireless dealership businesses. The pro forma

amounts for the year ended December 31, 2010, do not reflect a re-measurement gain on the 29.99% interest in Transactel (Barbados) Inc. that the Company held during that period.

Transactel (Barbados) Inc. was acquired on February 1, 2011, and the TELUS-branded wireless dealership businesses were acquired on various dates in 2011; their results have been

included in the Company’s Consolidated Statements of Income and Other Comprehensive Income effective the dates of acquisition.

The pro forma supplemental information is based on estimates

and assumptions which are believed to be reasonable. The pro forma

supplemental information is not necessarily indicative of the Company’s

consolidated financial results in future periods or the results that

actually would have been realized had the business acquisitions been

completed at the beginning of the periods presented. The pro forma

supplemental information includes incremental intangible asset

amortization, financing and other charges as a result of the acquisitions,

net of the related tax effects.

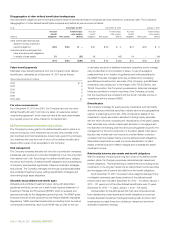

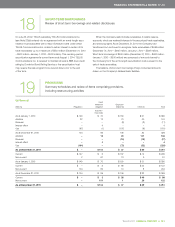

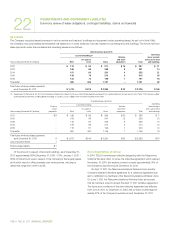

17 REAL ESTATE JOINT VENTURE

Summary review of real estate joint venture and related disclosures

(a) General

In the first quarter of 2011, the Company announced that it has partnered

in a residential condominium, retail and commercial real estate redevel-

opment project, TELUS Garden, in Vancouver, British Columbia, which

will result in the Company having a new national headquarter premises,

scheduled for completion in 2015. The new-build office tower is to be

built to the 2009 Leadership in Energy and Environmental Design (LEED)

Platinum standard and the residential condominium tower (also new-

build) is to be built to the LEED Gold standard.

The Company expects to account for its 50% interest in the real

estate joint venture using the equity method.

(b) Commitments

Operating lease

Subsequent to December 31, 2011, the Company entered into an oper-

ating lease for its new national headquarter premises with the real estate

joint venture at market rates. Operating lease payments for the initial term

of 15 years total $163 million, including occupancy costs of $63 million.

Construction credit facilities

Subsequent to December 31, 2011, the real estate joint venture received

financing commitments from two Canadian financial institutions in

connection with the TELUS Garden project. TELUS Corporation plans

to participate as a 50% lender in the construction credit facilities which,

once fully documented, will provide a combined total of $413 million

of liquidity to the real estate joint venture. The facilities contain custom-

ary representations, warranties and covenants and are secured by

demand debentures constituting first fixed and floating charge mortgages

over the two underlying real estate projects; the facilities bear interest

at bankers’ acceptance rate or prime rate, plus applicable margins.

As at February 23, 2012, no amounts had been advanced under

the facilities.