Telus 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 133

FINANCIAL STATEMENTS & NOTES: 10–11

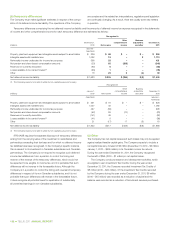

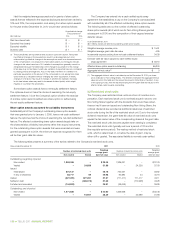

As at December 31, 2011, the Company’s estimate of the net amount

of existing gains (losses) arising from the unrealized fair value of deriva-

tives designated as cash flow hedges which are reported in accumulated

other comprehensive income and are expected to be reclassified to net

income in the next twelve months, excluding tax effects, is $3 million.

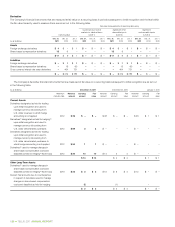

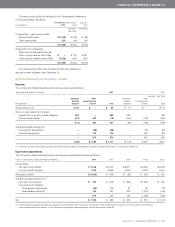

10 OTHER COMPREHENSIVE INCOME

Details of other comprehensive income and accumulated amounts

Years ended December 31 2 0 11 2010

(adjusted – Note 25)

Other comprehensive Accumulated Other comprehensive Accumulated

income (loss) income (loss) income (loss) income (loss)

Amount Income Beginning End of Amount Income Beginning End of

(millions) arising taxes Net of period period arising taxes Net of period period

Items that may subsequently

be reclassified to income

Change in unrealized fair value of

derivatives designated as cash

flow hedges (Note 4(i))

Gains (losses) arising in

current period $ß 15 $ 5 $ 10 $ 15 $ 11 $ 4

(Gains) losses arising in prior

periods and transferred to net

income in the current period (7) (3) (4) 59 9 50

8 2 6 $ 1 $ß 7 74 20 54 $ß(53) $ 1

Cumulative foreign currency

translation adjustment 4 – 4 – 4 – – – – –

12 2 10 1 11 74 20 54 (53) 1

Item never subsequently

reclassified to income

Cumulative employee defined

benefit plan actuarial

gains (losses)(1) (1,139) (288) (851) (214) (1,065) (287) (73) (214) – (214)

$ß(1,127) $ß(286) $ß(841) $ß(213) $ß(1,054) $ß(213) $ß(53) $ß(160) $ß(53) $ß(213)

(1) Cumulative employee defined benefit plan actuarial gains (losses) are only those amounts arising on or after January 1, 2010 (see Note 25); excluding the tax effects thereon,

the cumulative net gain (loss) charged to other comprehensive income at December 31, 2011, was $(1,426) (2010 – $(287)).

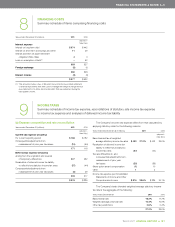

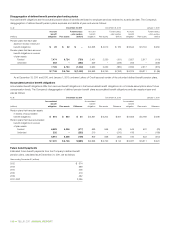

11 PER SHARE AMOUNTS

Summary schedule and review of numerators and denominators used in calculating

per share amounts and related disclosures

Basic net income per Common Share and Non-Voting Share is calculated

by dividing net income attributable to Common Shares and Non-Voting

Shares by the total weighted average Common Shares and Non-Voting

Shares outstanding during the period. Diluted net income per Common

Share and Non-Voting Share is calculated to give effect to share option

awards and restricted stock units.

The following table presents the reconciliations of the denominators

of the basic and diluted per share computations. Net income attributable

to Common Shares and Non-Voting Shares equalled diluted income

attributable to Common Shares and Non-Voting Shares for all periods

presented.

Years ended December 31 (millions) 2 0 11 2010

Basic total weighted average Common Shares

and Non-Voting Shares outstanding 324 320

Effect of dilutive securities

Share option awards 2 1

Diluted total weighted average Common Shares

and Non-Voting Shares outstanding 326 321

For the year ended December 31, 2011, certain outstanding share

option awards, in the amount of 1 million (2010 – 5 million), were not

included

in the computation of diluted income per Common Share and

Non-Voting

Share because the share option awards’ exercise prices

were greater than the average market price of the Common Shares and

Non-Voting Shares during the reported periods.