Telus 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 61

MANAGEMENT’S DISCUSSION & ANALYSIS: 5

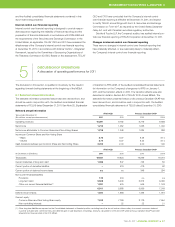

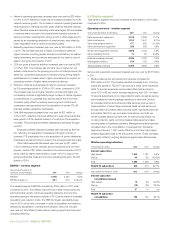

Operating expenses

Years ended December 31 ($ millions) 2 0 11 2010 Change

Goods and services purchased 4,726 4,236 11.6%

Employee benefits expense 1,893 1,906 (0.7)%

Depreciation 1,331 1,339 (0.6)%

Amortization of intangible assets 479 402 19.2%

8,429 7,883 6.9%

Consolidated operating expenses increased by $546 million in 2011 when

compared to 2010.

.Goods and services purchased increased year over year by $490 mil-

lion in 2011, reflecting higher wireless costs of acquisition and retention

and increased content and support costs for expanding and managing

wireline Optik TV services.

.Employee benefits expense decreased year over year by $13 million

in 2011. The decrease mainly reflects lower employee-related

restructuring costs, a higher defined benefit pension plan recovery,

lower share-based compensation expenses mainly due to employees

choosing to settle their options other than through a net-cash

settlement feature, and higher capitalization of labour, partly offset

by increased wage and salary expenses. Wage and salary expenses

increased by $85 million due to the following: inclusion of Transactel

operations since February 2011 and TELUS-branded wireless

dealership businesses acquired in 2011, hiring to support the growing

wireless and TV subscriber bases, bargaining unit wage increases

effective since July 2011, and management salary and compensation

increases effective April 2011.

.Depreciation expense decreased year over year by $8 million in 2011.

Lower depreciation expenses were largely due to an increase in

fully depreciated assets and lower depreciation for TV set-top boxes

caused by lengthening their expected service lives in the second

quarter of 2010, largely offset by growth in wireless HSPA+ and other

capital assets and acquired Transactel assets.

.Amortization of intangible assets increased year over year by

$77 million in 2011. The increase was principally due to ongoing

capital investments in network and administrative software assets,

a $19 million write-down of a foreign operation’s assets held for

sale at the end of 2011, amortization resulting from the acquisition

of Transactel and certain wireless dealership businesses in 2011,

and prior year recognition of $5 million of investment tax credits in

the second quarter of 2010.

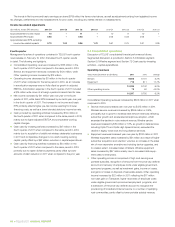

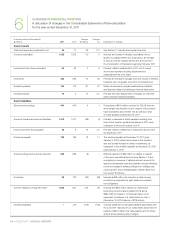

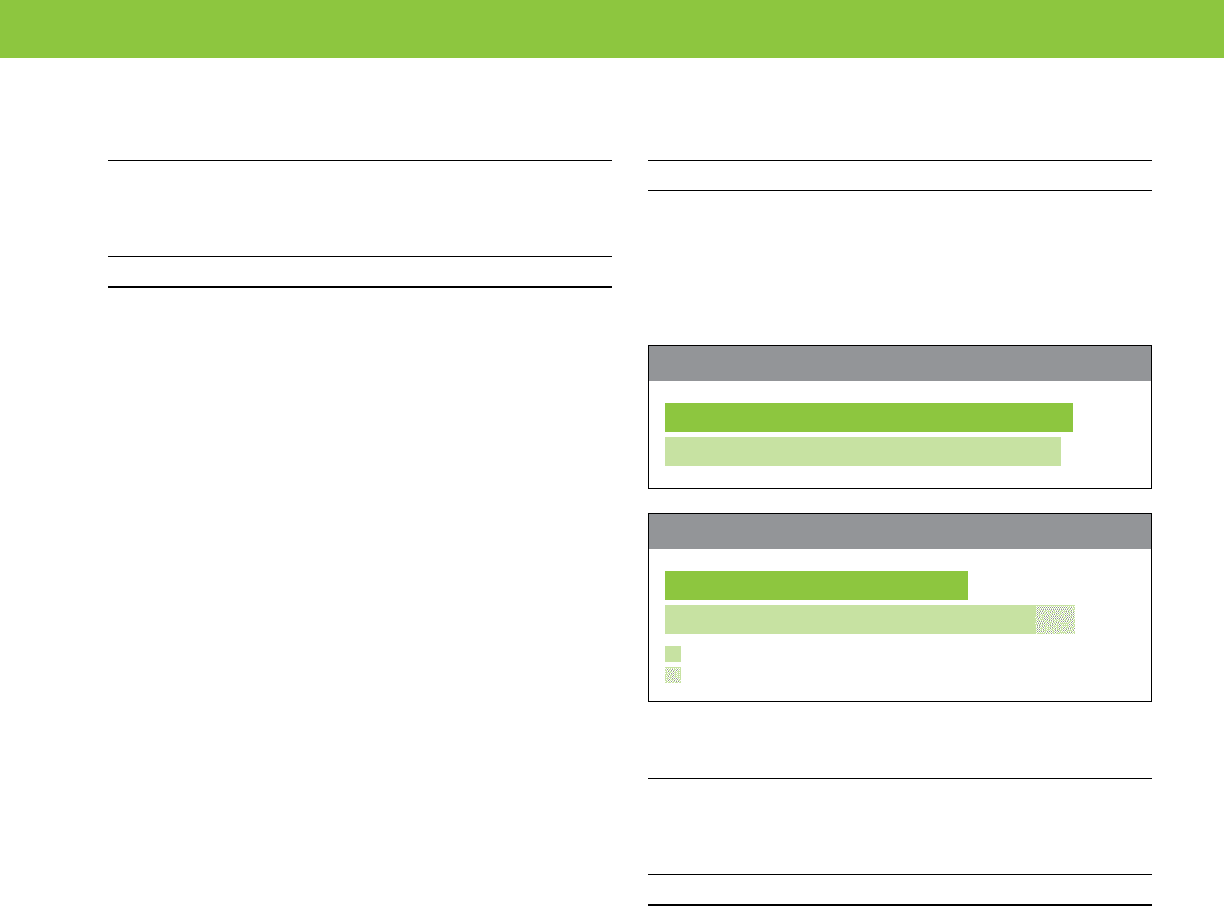

Operating income

Years ended December 31 ($ millions) 2 0 11 2010 Change

1,968 1,909 3.1%

Operating income increased by $59 million in 2011 when compared

to 2010, largely due to increased EBITDA. Wireless EBITDA increased

by $166 million (see Section 5.4), but was partly offset by a $38 million

reduction in wireline EBITDA (see Section 5.5), and a $69 million increase

in total depreciation and amortization expenses.

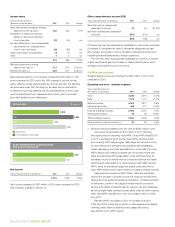

10

09

OPERATING INCOME ($ millions)

11 1,968

1, 909

10

10

09

08

Excluding loss on redemption of debt

Loss on redemption of debt

INTEREST EXPENSE ($ millions)

11 389

527

52475

10

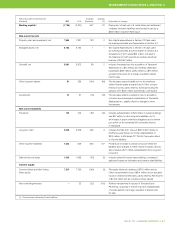

Financing costs

Years ended December 31 ($ millions) 2 0 11 2010 Change

Interest expense, excluding loss

on redemption of debt 389 475 (18.1)%

Loss on redemption of debt – 52 n/m

Interest income and foreign exchange (12) (5) 140.0%

377 522 (27.8)%

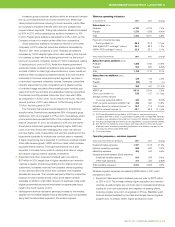

Financing costs decreased by $145 million in 2011 when compared to

2010, due in part to the September 2010 loss recorded for early partial

redemption of U.S. dollar Notes and settlement of related cross currency

interest rate swap agreements. Interest expense excluding the loss

on debt redemption decreased by $86 million, mainly due to a lower

effective interest rate on long-term debt resulting from financing activities

in the second quarter of 2011 and third quarter of 2010, as well as a

$15 million charge in the third quarter of 2010 that arose from the CRTC’s

determinations on the regulatory deferral account.

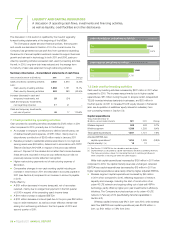

The lower effective interest rate in 2011 resulted from: (i) the Septem-

ber 2010 early partial redemption of 8% U.S. dollar Notes and unwinding

of associated cross currency interest rate swap agreements, funded by a

July 2010, 5.05% debt issue; and (ii) maturity of the remaining U.S. dollar

Notes on June 1, 2011, and settlement of the remaining cross currency

interest rate swap agreements, funded by a May 2011, 3.65% debt issue

and low-rate commercial paper issues.