Telus 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 . TELUS 2011 ANNUAL REPORT

The trends in Net income and basic earnings per share (EPS) reflect the items noted above, as well as adjustments arising from legislated income

tax changes, settlements and tax reassessments for prior years, including any related interest on reassessments.

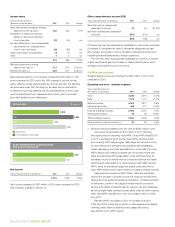

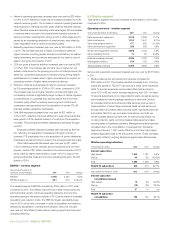

Income tax-related adjustments

($ in millions, except EPS amounts) 2011 Q4 2011 Q3 2011 Q2 2011 Q1 2010 Q4 2010 Q3 2010 Q2 2010 Q1

Approximate Net income impact 10 – 11 – 10 9 10 1

Approximate EPS impact 0.03 – 0.03 – 0.03 0.03 0.03 –

Approximate basic EPS excluding

income tax-related impacts 0.73 1.00 0.96 1.01 0.67 0.75 0.91 0.85

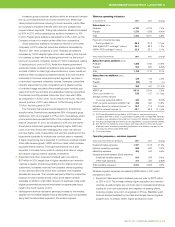

Fourth quarter

Management’s review of operations contained in TELUS’ fourth quarter

news release on February 10, 2012, discussed fourth quarter results

in detail. The following are highlights.

.Consolidated Operating revenues increased by $136 million in the

fourth quarter of 2011 when compared to the same period in 2010.

Service and equipment revenues increased by $120 million, while

Other operating income increased by $16 million.

.Operating income decreased by $3 million in the fourth quarter

of 2011 when compared to the same period in 2010, as an increase

in amortization expense was not fully offset by growth in adjusted

EBITDA. Amortization expense in the fourth quarter of 2011 included

a $19 million write-down of a foreign operation’s assets held for sale.

.Net income increased by $11 million year over year in the fourth

quar ter of 2011, while basic EPS increased by six cents year over year

in the fourth quarter of 2011. The increase in net income and basic

EPS primarily reflects higher pre-tax income resulting from lower

financing costs, as well as a lower blended statutory income tax rate.

.Cash provided by operating activities increased by $104 million in

the fourth quarter of 2011 when compared to the same period in 2010,

mainly due to higher adjusted EBITDA and comparative working

capital changes.

.Cash used by investing activities increased by $47 million in the

fourth quarter of 2011 when compared to the same period in 2010,

mainly due to acquisition of additional wireless dealership businesses

in 2011 and comparative changes in non-cash investing working

capital, partly offset by a $52 million reduction in capital expenditures.

.Cash used by financing activities increased by $34 million in the

fourth quarter of 2011 when compared to the same period in 2010,

primarily due to higher dividend payments partly offset by lower

amounts of debt reduction in 2011 when compared to the prior year.

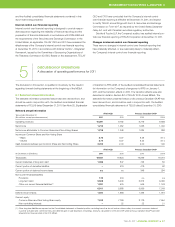

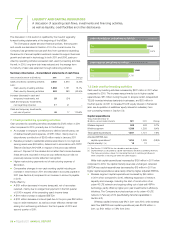

5.3 Consolidated operations

Discussion of TELUS’ consolidated financial performance follows.

Segmented discussion is provided in Section 5.4 Wireless segment,

Section 5.5 Wireline segment and Section 7.2 Cash used by investing

activities – capital expenditures.

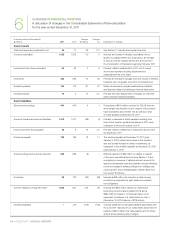

Operating revenues

Years ended December 31 ($ millions) 2 0 11 2010 Change

Service 9,606 9,131 5.2%

Equipment 719 611 17.7%

10,325 9,742 6.0%

Other operating income 72 50 44.0%

10,397 9,792 6.2%

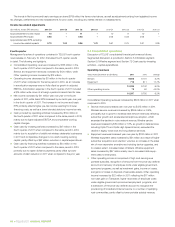

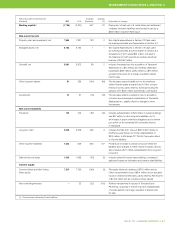

Consolidated Operating revenues increased by $605 million in 2011 when

compared to 2010.

.Service revenues increased year over year by $475 million in 2011.

Wireless service revenues increased by $395 million or 8.5%,

prin cipally due to growth in wireless data network revenues reflecting

subscriber growth and accelerated smartphone adoption, which

exceeded the decline in voice network revenue. Wireline service

reve nues increased by $80 million or 1.8%, as growth in data services,

including Optik TV and Optik High Speed Internet, exceeded the

decline in legacy voice local and long distance services.

.Equipment revenues increased year over year by $108 million in 2011.

Wireless equipment sales increased by $51 million as a result of higher

subscriber acquisition and retention volumes, an increase in the sales

mix of more expensive smartphones including device upgrades, and

to a lesser extent, increased sales of tablets. Wireline equipment

sales increased by $57 million mainly due to increased data equip-

ment sales to enterprises.

.Other operating income is comprised of high cost serving area

portable subsidies, recognition of amounts from the price cap deferral

account and recovery of employee costs under eligible government-

sponsored programs, as well as investment gains, income or losses,

and gains or losses on disposal of real estate assets. Other operating

income increased by $22 million in 2011 reflecting the $17 million

non-cash gain on Transactel, higher recoveries of employee costs

under eligible government-sponsored employment programs, and

a drawdown of the price cap deferral account to recognize the

provisioning of broad band Internet service to a number of qualifying

rural commu nities, partly offset by lower portable subsidy revenue.