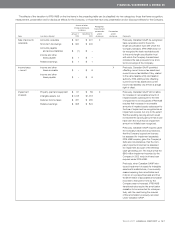

Telus 2011 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

172 . TELUS 2011 ANNUAL REPORT

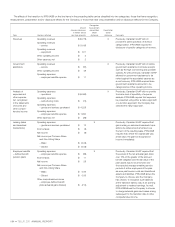

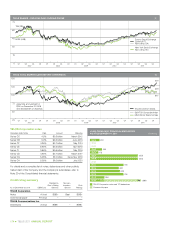

Stock exchanges and TELUS trading symbols

Toronto Stock Exchange (TSX)

Common shares T CUSIP: 87971M103

Non-voting shares T.A CUSIP: 87971M202

New York Stock Exchange (NYSE)

Non-voting shares TU CUSIP: 87971M202

Member of

. S&P/TSX Composite Index . S&P/TSX 60 Index

. S&P/TSX Telecom Index . MSCI World Telecom Index

. Jantzi Social Index . FTSE4Good Index

. Dow Jones Sustainability Index (DJSI) North American

Canada

United States and other

18%

82%

ESTIMATED SHARE

OWNERSHIP BY REGION1

Share facts

. Common and non-voting

shares receive the same

dividend

. Common and non-voting

shares have the same rights

and privileges, with the

exception of voting rights

. Shareholders have the

opportunity to vote to eliminate

the non-voting share class at

the May 9, 2012 annual and

special meeting. The proposal

to convert each non-voting

share into a common share on

a one-for-one basis requires

approval of two-thirds of the votes cast by each class, as well as court

and stock exchange approvals.

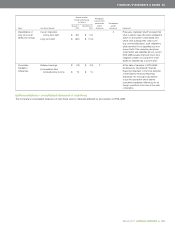

Registered shareholders1

2 0 11 2010

TELUS common 30,616 31,587

TELUS non-voting 27,281 28,012

1 The Canadian Depository for Securities (CDS) represents one registration and holds

securities for many institutions. At the end of 2011, it was estimated that TELUS

had more than 225,000 non-registered shareholders combined in the two classes

of shares.

Ownership at December 31, 2011

Number of

shares held % of total

TELUS employee share plan 7,977,416 2.5

Common shares widely held 167,069,968 51.4

Non-voting shares widely held 149,801,327 46.1

Total outstanding shares 324,848,711 100.0

TELUS estimates that approximately 80% of its shares are held by

institutional investors and 20% by retail investors.

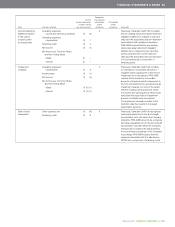

Dividend developments

In May 2011, the Company announced plans to continue with two

dividend increases per year to 2013, normally declared in May and

November, and expects the increase to be in the range of circa

10% annually. Dividend decisions will continue to be subject to the

Board’s assessment and determination of the Company’s financial

situation and outlook on a quarterly basis.

The January and April 2012 quarterly dividends are 58 cents or $2.32

on an annualized basis. In 2011, TELUS increased the dividend twice,

representing a 10.5% increase from the previous year. In February 2012,

the Company declared a three cent or 5.2% increase in the quarterly

dividend to 61 cents to be paid on July 3, 2012 to common and non-voting

shares. This is $2.44 on an annualized basis and represents a 10.9%

higher level than the dividend level a year earlier.

In the event the proposed share conversion of non-voting shares

to common shares on a one-for-one basis receives all requisite approvals

and is effective prior to the July dividend record date of June 8, 2012,

holders of record on such date who previously held non-voting shares

would hold common shares and would receive the same 61 cent

dividend as all other holders of common shares.

TELUS advises that, unless noted otherwise, all common and non-

voting share quarterly dividends paid since January 2006 are eligible

dividends as defined by subsection 89(1) of the Income Tax Act.

Under this legislation, Canadian residents may be entitled to enhanced

dividend tax credits that reduce the income tax otherwise payable.

The exception to the above is with respect to the dividends payable

on April 1, 2007, where $0.0025 of the $0.375 dividends paid to

both common and non-voting shares were not eligible dividends.

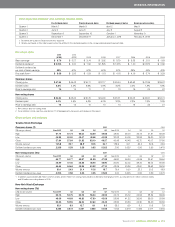

11

10

09

08

07

Fourth quarter dividends shown in declaration year.

715

584

521

642

601

TOTAL DIVIDENDS TO SHAREHOLDERS ($ millions)

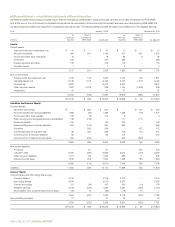

Dividend reinvestment and share purchase plan

Investors may take advantage of automatic dividend reinvestment

to acquire additional shares without fees. Under this feature, eligible

shareholders can have their dividends reinvested automatically into

additional non-voting shares acquired at market price.

Effective March 1, 2011, under the dividend reinvestment plan,

TELUS resumed open-market purchases of TELUS non-voting shares

with no discount on the purchase price of plan shares.

Under the share purchase feature, eligible shareholders can, on a

monthly basis, buy TELUS non-voting shares (maximum $20,000 per

calendar year and minimum $100 per transaction) at market price without

brokerage commissions or service charges. Effective March 1, 2011,

non-voting shares acquired with optional cash payments changed from

treasury issuance to open-market purchase.

In the event the proposed share conversion of non-voting shares to

common shares on a one-for-one basis receives all requisite approvals,

this dividend reinvestment and share purchase plan would be amended

so that purchases and issuances of non-voting shares would be

changed to common shares.

INVESTOR INFORMATION

1 Common and non-voting share owner-

ship as of December 31, 2011, based

on TELUS and transfer agent estimates.